Hut 8 Mining Corp (NASDAQ:HUT) is experiencing a notable rise on Friday, driven by a recovery in cryptocurrency markets. This uptick comes after a challenging period where cryptocurrency-exposed stocks faced significant losses.

The rebound in Bitcoin (CRYPTO: BTC), which rose by 7% to the $68,000-level after a sharp decline, has contributed to the positive momentum seen in Hut 8’s stock. This recovery was part of a broader trend where crypto-related stocks surged following a tough trading session earlier in the week.

Here’s what investors need to know.

- Hut 8 stock is surging to new heights today. What’s fueling HUT momentum?

Bitcoin Rebound Lifts Crypto Stocks

Earlier this week, the cryptocurrency market experienced a severe downturn, impacting stocks with significant exposure to digital currencies. This downturn was particularly evident on Thursday, when many stocks suffered double-digit losses.

However, the market began to stabilize, and by Friday, a recovery was underway. The rebound in Bitcoin was a key factor in this turnaround, as it helped restore investor confidence in the sector.

- Bitcoin’s recovery of 7% to the $68,000-level played a crucial role in lifting stocks like Hut 8.

- Other crypto-exposed stocks also saw gains as the market rebounded from earlier losses.

In addition to the recovery in Bitcoin, the broader market dynamics have also influenced Hut 8’s performance. Earlier this week, several big stocks experienced declines, which contributed to the volatility seen across the market.

Despite these challenges, Hut 8 shares have managed to capitalize on the positive sentiment Friday surrounding the cryptocurrency rebound.

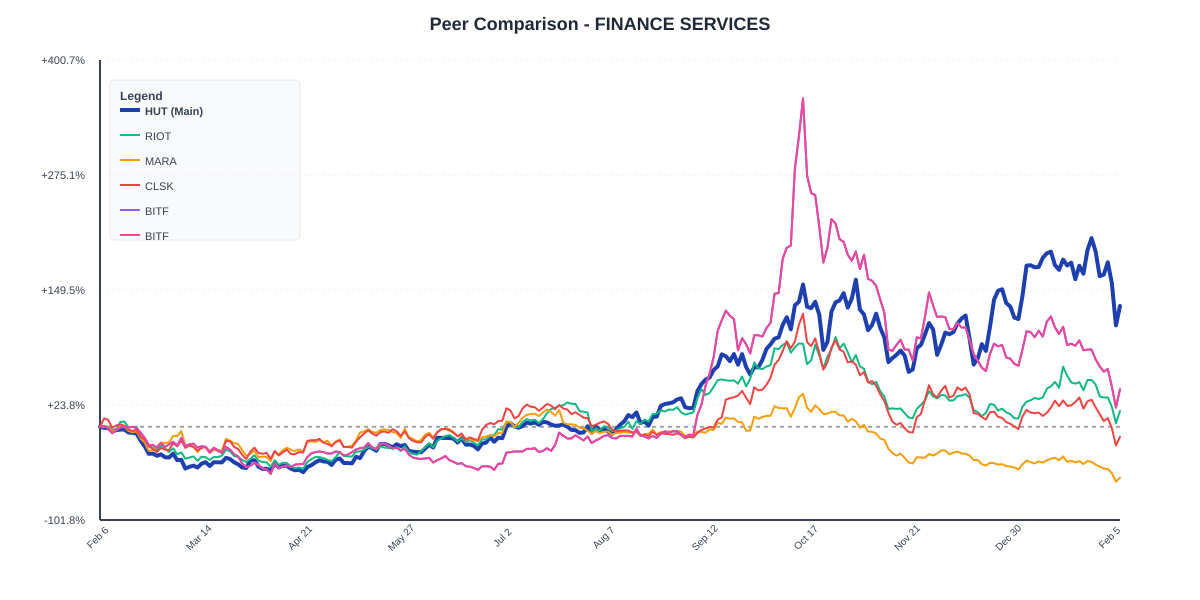

Hut 8 Mining’s performance is not just a testament to its own corporate strategy and execution but also an indicator of the challenges and divergences within the finance services sector.

With an average peer performance of just +6.65%, Hut 8’s advance of +131.99% over the past year underscores both its dominant position and the wider performance gap it has established with its sector peers.

Specifically, when comparing Hut 8 to its competitors, it is clear that its year-over-year growth is unmatched. Riot Platforms, Inc. (NASDAQ:RIOT) showed a modest gain of +17.31%, while Bitfarms Ltd. (NASDAQ:BITF) recorded a more substantial rise of +41.13%.

At the other end of the spectrum, MARA Holdings, Inc. (NASDAQ:MARA) experienced a significant decline of -55.48%, and CleanSpark Inc (NASDAQ:CLSK) also saw a decrease of -10.84%. This range of performances further exemplifies Hut 8’s exceptional year and its lead over both the average and individual peer performances.

HUT Shares Surge Friday

HUT Price Action: Hut 8 shares were up 8.86% at $48.42 at the time of publication on Friday, according to Benzinga Pro data.

Image: Shutterstock