ServiceNow (NOW) just reported fourth quarter and full year 2025 results, with revenue of US$3.57b for the quarter and US$13.28b for the year, alongside higher net income versus 2024.

See our latest analysis for ServiceNow.

Despite the strong AI-focused earnings update and new customer partnerships, sentiment around software stocks tied to AI risk has been very weak. ServiceNow’s 30-day share price return of 31.03% and year-to-date share price return of 30.40% are firmly negative, while the 1-year total shareholder return of 49.85% contrasts with a positive 10.76% total shareholder return over three years.

If the recent selloff has you looking beyond a single name, this could be a good moment to scan 33 AI infrastructure stocks for other AI infrastructure players shaping how enterprise software is built and delivered.

ServiceNow is now trading well below many analyst targets and its own recent highs, even after reporting higher revenue and net income. Is this sharp reset creating an opening, or is the market already correctly pricing in AI risks?

Most Popular Narrative: 54.6% Undervalued

ServiceNow's most followed narrative puts fair value at about $225.84 per share, compared with the last close of $102.63, setting up a wide valuation gap for investors to weigh.

ServiceNow's focus on AI platform and business transformation is gaining momentum, which is expected to drive future revenue growth as demand for AI-driven solutions increases. The acquisition of companies like Moveworks and Logik.ai can enhance ServiceNow’s offerings, potentially improving net margins by driving efficiencies and offering more integrated solutions.

Curious what kind of revenue runway and margin profile could justify that gap to fair value, and how rich a future earnings multiple this narrative leans on? The full story connects aggressive growth assumptions with a premium valuation framework that goes well beyond simple P/E math.

Result: Fair Value of $225.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change fast if large AI acquisitions are hard to integrate or if U.S. federal contract budgets tighten more than investors expect.

Find out about the key risks to this ServiceNow narrative.

Another View: Market Multiple Sends a Different Signal

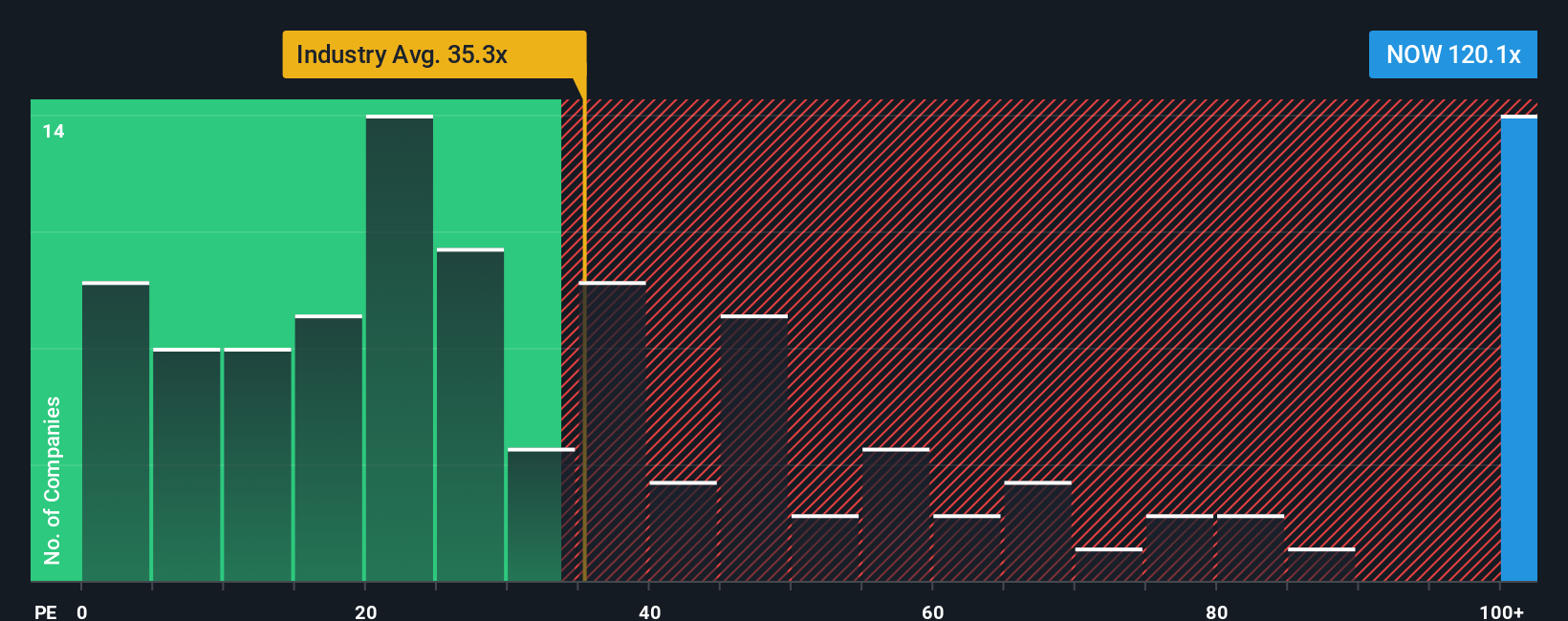

That fair value of $225.84 suggests ServiceNow looks undervalued, but the P/E ratio paints a tougher picture. At 61.4x earnings, the stock trades well above the US Software industry at 25.7x, peers at 43x, and even the 41.6x fair ratio our model points to.

In plain terms, the market price implies a rich earnings multiple that could compress if growth expectations cool, even if the long term narrative plays out. The key question is whether that premium reflects justified quality, or whether investors are being asked to pay too much for the story today.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ServiceNow Narrative

If you are not on board with this view or would rather weigh the numbers yourself, you can shape a custom thesis in minutes by starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding ServiceNow.

Looking for more investment ideas?

If this ServiceNow story has you thinking bigger about your portfolio, do not stop here; the next opportunity you research could be the one you remember.

- Target value by scanning companies our screener flags as 55 high quality undervalued stocks with quality fundamentals and prices that look out of step with their underlying numbers.

- Prioritise resilience by focusing on businesses highlighted in our 81 resilient stocks with low risk scores that score well on key risk checks and balance sheet strength.

- Spot under the radar potential with our screener containing 25 high quality undiscovered gems where smaller, less followed names still show robust financial underpinnings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com