- Comfort Systems USA has recently reported strong operating results, raised its quarterly dividend, expanded through acquisitions tied to AI infrastructure and healthcare, and secured future leadership changes as Trent T. McKenna is set to become President and COO in 2026.

- The company’s upcoming inclusion in the S&P 500 index, combined with a very large backlog and steady dividend growth, underscores how its scale and recurring demand are reshaping its role in US non-residential construction and services.

- Next, we’ll examine how Comfort Systems USA’s very large backlog growth influences its investment narrative and perceived earnings resilience.

This technology could replace computers: discover 22 stocks that are working to make quantum computing a reality.

What Is Comfort Systems USA's Investment Narrative?

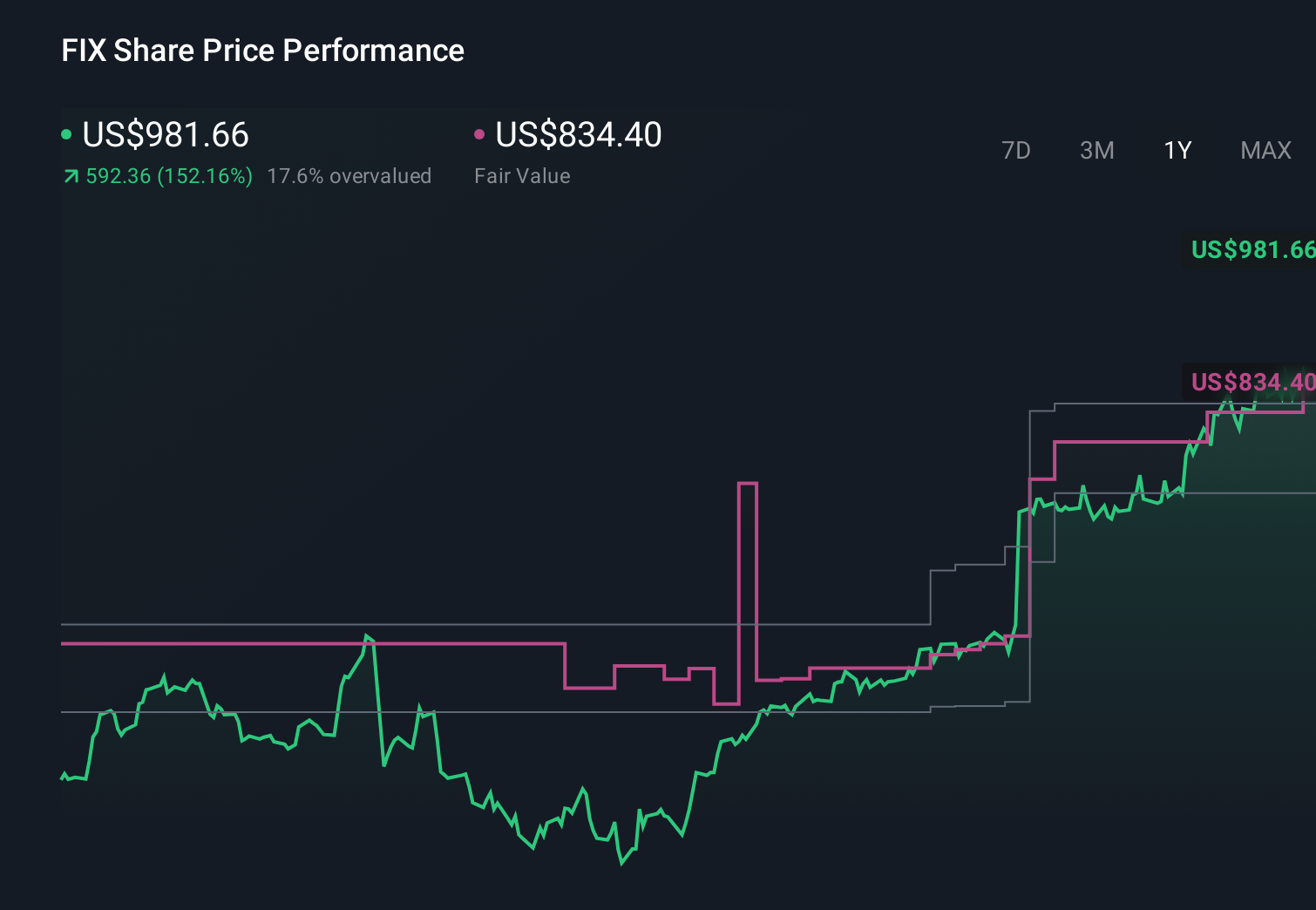

To own Comfort Systems USA, you need to be comfortable with a company that is riding a surge in non‑residential demand while trading on a rich earnings multiple. The recent news around S&P 500 inclusion, strong operating results, rapid dividend growth and acquisitions tied to AI infrastructure and healthcare all reinforce the current bull narrative and could amplify short term catalysts such as index-driven buying and confidence in its multi‑year, multi‑billion dollar backlog. At the same time, that backdrop raises the stakes: expectations are already high, insider selling has picked up, and the shares still screen as expensive versus the wider construction industry. If growth in data centers, healthcare and other complex projects slows or margins compress, today’s premium could come under pressure faster than many new shareholders might expect.

However, one risk stands out that many new shareholders may be underestimating. Despite retreating, Comfort Systems USA's shares might still be trading 24% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 11 other fair value estimates on Comfort Systems USA - why the stock might be worth less than half the current price!

Build Your Own Comfort Systems USA Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Comfort Systems USA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Comfort Systems USA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Comfort Systems USA's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 30 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've uncovered the 15 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 31 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com