Q1 2026 headline results and recent momentum

Construction Partners (ROAD) opened its Q1 2026 update with total revenue of US$809.5 million and basic EPS of US$0.31, anchored by net income of US$17.2 million for the quarter. Over recent periods, the company has seen revenue move from US$561.6 million and a basic EPS loss of US$0.06 in Q1 2025 to US$899.8 million with EPS of US$1.02 in Q4 2025. Trailing 12 month EPS reached US$2.20 on net income of US$122.0 million. This sets the stage for investors to focus on how margins are holding up after this run in profitability.

See our full analysis for Construction Partners.With the latest numbers on the table, the next step is to see how this revenue and EPS profile lines up with the key narratives investors follow around Construction Partners growth, profitability and execution.

Curious how numbers become stories that shape markets? Explore Community Narratives

Trailing profit surge stands out at US$122 million

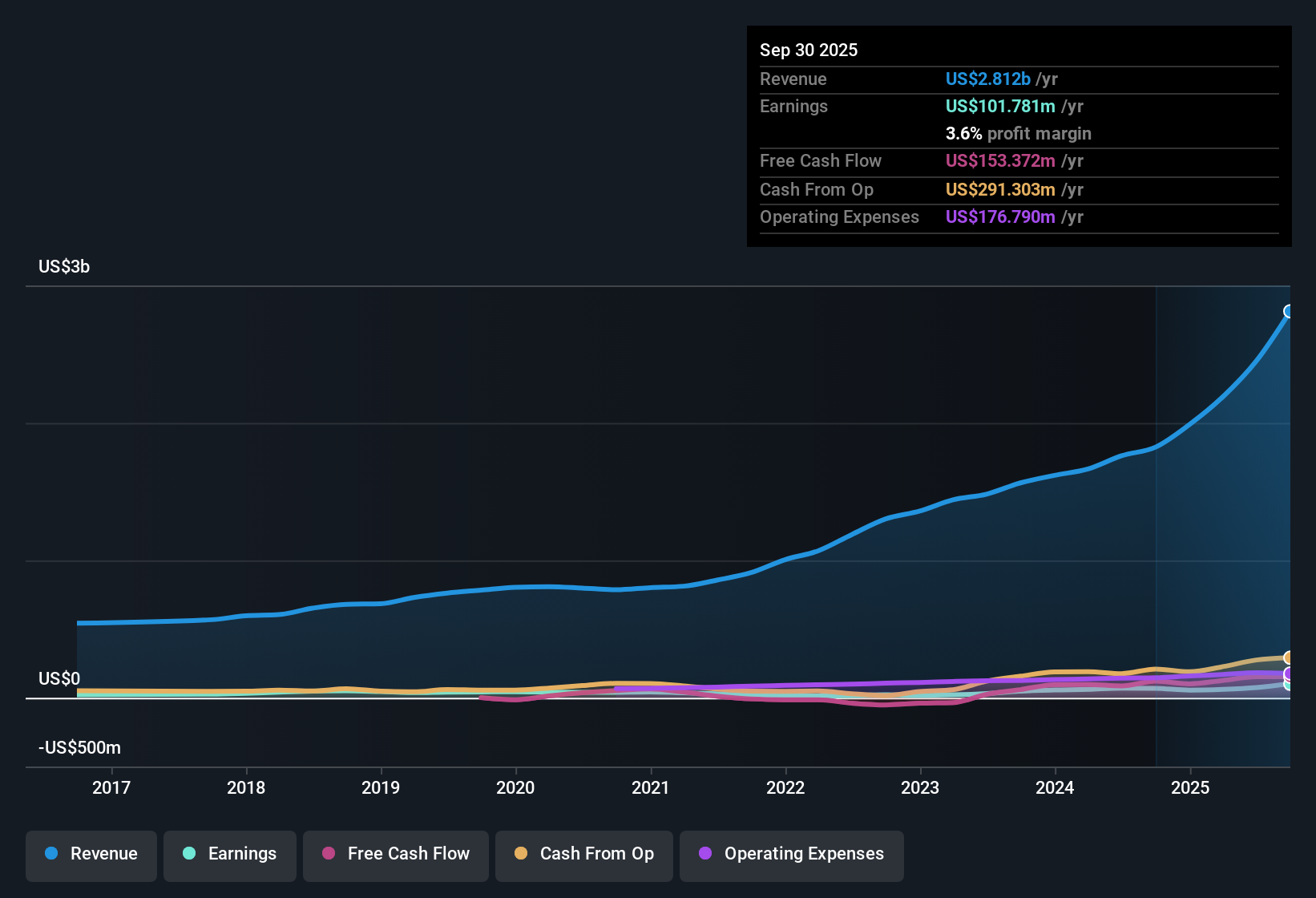

- Over the last 12 months, Construction Partners generated US$3.1b in revenue and US$122.0 million in net income, with trailing EPS of US$2.20 compared with US$1.85 on a trailing basis three months earlier.

- What stands out for a bullish view is that earnings grew 117.8% over the past year while trailing net margin sits at 4% versus 2.8% a year ago. This aligns with the idea of a business benefiting from both higher revenue and better profitability, even though Q1 2026 net income of US$17.2 million is below the US$56.6 million reported in Q4 2025.

- Supporters can point to revenue rising from US$1.8b on a trailing basis in Q4 2024 to US$3.1b in Q1 2026 as evidence that the company is operating at a much larger scale today.

- They can also highlight that trailing EPS increased from US$1.33 to US$2.20 over that same period, which supports the bullish case that recent profit expansion is more than just a one quarter event.

High P/E of 59x and price above DCF fair value

- At a share price of US$127.65, the stock trades at a P/E of 59.1x, above both the 36.4x industry average and 34.7x peer average, and ahead of the DCF fair value estimate of US$77.41.

- Critics focus on this valuation gap as a core bearish point, arguing that even with forecasts calling for roughly 11% annual revenue growth and about 15.6% annual earnings growth, the current price reflects a level of optimism that extends beyond the DCF fair value and sector multiples.

- Bears argue that paying 59.1x earnings when peers are closer to the mid 30s leaves limited room if growth slows from the 117.8% earnings increase seen over the past year.

- They also point to the US$127.65 share price versus the US$77.41 DCF fair value as a sign that the market price is far ahead of a cash flow based reference point.

Interest coverage flagged alongside strong growth forecasts

- Forecasts call for earnings growth of about 15.6% per year and revenue growth around 11% per year, yet there is a specific flag that earnings do not comfortably cover interest payments.

- For a cautious investor, it is notable that the same data set that highlights strong profit growth also highlights weaker interest coverage. While trailing net income climbed from US$56.0 million to US$122.0 million over the past year, financing costs remain important to watch if growth and margins were to move closer to the forecasts rather than the recent 117.8% jump.

- This tension between rapid earnings expansion and flagged interest coverage means part of the recent improvement in EPS from US$1.07 to US$2.20 still has to be weighed against the ongoing cost of debt.

- For shareholders, this puts the spotlight on how future operating profits need to support both growth and these interest obligations rather than relying only on the strong trailing 12 month numbers.

Analysts tracking this name have pulled these numbers into a single balanced story so you can see how the recent profit run, valuation and financial risks fit together in one place, which can be helpful if you are trying to understand whether the current price is mainly about past momentum or future expectations. 📊 Read the full Construction Partners Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Construction Partners's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

For all the recent profit strength, the mix of a 59.1x P/E, price well above DCF fair value and flagged interest coverage leaves limited room for error.

If that combination of rich valuation and tight interest cover makes you uneasy, it could be worth checking out 81 resilient stocks with low risk scores that prioritise more resilient financial profiles right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com