Applied Digital (APLD) just lined up a US$50 million senior secured promissory note to acquire and start work on its Polaris Forge 2 data center, with repayment tied to the signing of large AI and cloud leases.

See our latest analysis for Applied Digital.

The new PF2 financing lands after a sharp pullback, with a 1 day share price return of an 11.72% decline and a 7 day share price return of a 26.86% decline, even though total shareholder return is about 2.5x over one year and roughly 8x over three years. Recent momentum has cooled after a very strong multi year run.

If this AI data center story has your attention, it could be a good moment to broaden your search and review 33 AI infrastructure stocks for potential next ideas.

With the stock pulling back sharply after a very strong multi year run, but still trading below the average analyst price target, you have to ask yourself: is this AI data center builder now on sale, or is the market already baking in years of growth?

Most Popular Narrative: 38.5% Undervalued

The most followed narrative pegs Applied Digital's fair value at $45.27 per share versus a last close of $27.85, framing a sizeable valuation gap that hinges on long dated AI data center cash flows.

The analysts have a consensus price target of $19.375 for Applied Digital based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $13.0.

Want to see what justifies a fair value well above both the current share price and the Street target range? The narrative leans on steep revenue ramps, a sharp swing from losses to profits, and a rich future earnings multiple tied to long term AI leasing assumptions. Curious how those ingredients come together and which single valuation lever does most of the heavy lifting? Read on in the full story behind the numbers.

Result: Fair Value of $45.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this relies on heavy debt-funded expansion and a small group of hyperscaler and crypto customers, so any project delays or contract setbacks could quickly challenge it.

Find out about the key risks to this Applied Digital narrative.

Another View: Rich Sales Multiple Raises the Bar

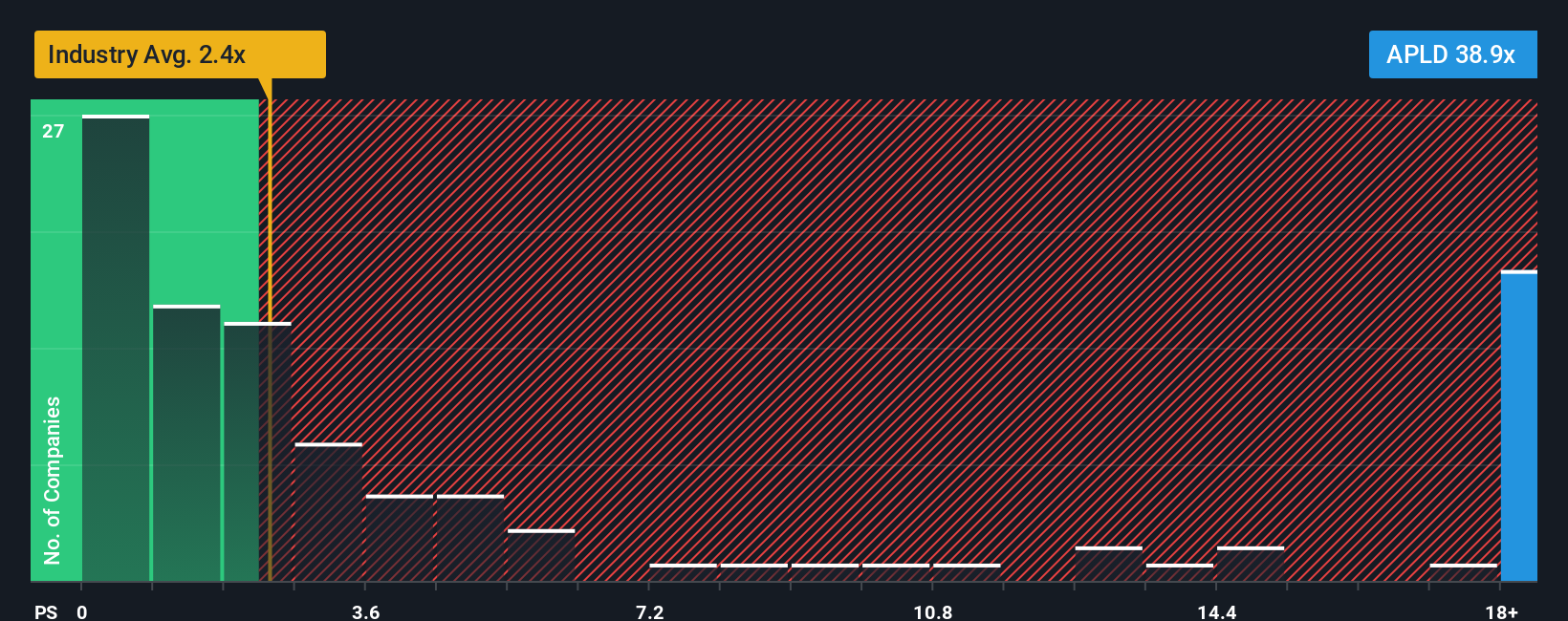

That $45.27 fair value hinges on long range cash flow assumptions, yet on simple sales math Applied Digital trades on a P/S of 29.5x, far above the US IT industry at 2x, peers at 4.1x, and even its own fair ratio of 9x. With that kind of premium, how much margin for error is really left?

To see what the numbers say about this price in plain terms, take a look at our valuation breakdown, starting with See what the numbers say about this price — find out in our valuation breakdown..

Build Your Own Applied Digital Narrative

If you see the data differently or prefer to stress test your own assumptions, you can build a complete Applied Digital story in just a few minutes, starting with Do it your way.

A great starting point for your Applied Digital research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Last thing before you move on, consider lining up a few fresh watchlist candidates using these focused stock idea lists built from our screener.

- Target value opportunities first by checking companies flagged as 55 high quality undervalued stocks that may offer more for every dollar you put to work.

- Prioritize resilience next by scanning 81 resilient stocks with low risk scores where business models and balance sheets are assessed with caution in mind.

- Look for potential standouts early by reviewing our screener containing 25 high quality undiscovered gems before they appear on more investors' radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com