Mastercard (MA) is back in focus after its latest quarterly earnings beat, coupled with fresh moves in AI driven products, fleet payments, and a renewed credit partnership with Capital One.

See our latest analysis for Mastercard.

At a share price of US$553.52, Mastercard has seen a 6.17% 7 day share price return following its earnings beat, AI product launches and Capital One renewal. Its 3 year total shareholder return of 52.09% and 5 year total shareholder return of 70.42% point to momentum that has built over a longer horizon.

If Mastercard's push into AI driven payments has your attention, it could be a good moment to broaden your research with other high growth tech and AI stocks on Simply Wall St.

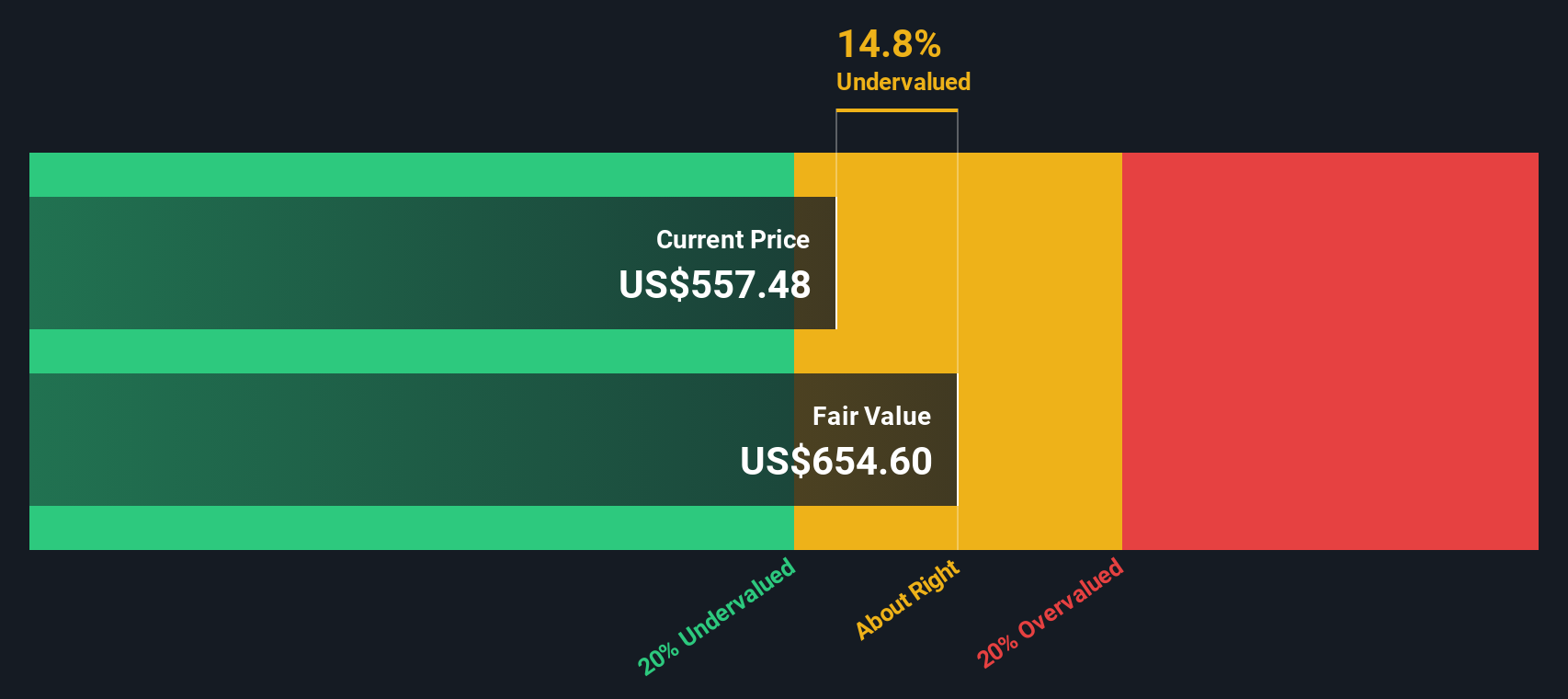

With Mastercard trading at US$553.52 and sitting about 19% below the average analyst price target and roughly 10% below one intrinsic value estimate, you have to ask: is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 6.4% Overvalued

According to the most followed narrative, Mastercard's fair value sits at $520, which lines up close to but below the current $553.52 share price.

Mastercard is more than just a card network; it’s a technology platform powering the global digital economy, secure, scalable, profitable, and increasingly diversified beyond swipe fees. With strong revenue growth, expanding VAS, cross-border strength, fintech-ready infrastructure (stablecoins, AI/analytics), and disciplined shareholder returns, Mastercard is well positioned to compound dividends and earnings for decades.

Want to see what sits behind that price tag? The narrative leans heavily on rich margins, steady top line expansion, and a premium future earnings multiple. Curious which revenue mix and profitability assumptions push the model to that fair value band, and how much weight it puts on newer services versus core payments?

Result: Fair Value of $520 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat story still bumps into risks, including regulatory pressure on fees and rising competition in areas such as cybersecurity, data services, and open banking.

Find out about the key risks to this Mastercard narrative.

Another View: Cash Flows Tell a Different Story

That user narrative pegs Mastercard at a fair value of $520, calling the stock about 6.4% overvalued. Our DCF model points the other way, with an estimated value of $617.15, around 10.3% above the current $553.52 price. Which set of assumptions do you find more convincing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mastercard for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 866 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mastercard Narrative

If you are not fully on board with these assumptions or prefer to work from your own numbers, you can build a custom Mastercard view in minutes. To get started, use Do it your way.

A great starting point for your Mastercard research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Mastercard has sparked your interest, do not stop there. Use the Simply Wall St Screener to quickly spot fresh ideas that might fit your style.

- Target potential big movers early by checking out these 3534 penny stocks with strong financials with solid financial foundations rather than just hype.

- Zero in on income opportunities by scanning these 11 dividend stocks with yields > 3% that offer yields above 3% and may complement growth names like Mastercard.

- Hunt for value candidates by reviewing these 866 undervalued stocks based on cash flows that screens for businesses priced below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com