Synopsys (SNPS) is back in focus after Lightmatter agreed to integrate its 224G SerDes and UCIe IP into Lightmatter’s Passage 3D co packaged optics platform for next generation AI infrastructure.

See our latest analysis for Synopsys.

Despite the Lightmatter agreement and other recent developments around AI driven design, Synopsys’ 7 day share price return of 18.06% and 30 day share price return of 15.22% contrast with a 1 year total shareholder return of 20.71% and 5 year total shareholder return of 51.33%. This suggests longer term investors have still seen gains even as shorter term momentum has cooled.

If you are looking beyond a single name in AI related chip design, this could be a good moment to scan high growth tech and AI stocks for other ideas shaping the next wave of computing.

With Synopsys shares down 12.79% year to date and 20.71% over the past year, yet trading at an intrinsic premium of 13.72%, are you looking at an overlooked AI design leader or a stock where future growth is already priced in?

Most Popular Narrative: 24.6% Undervalued

Synopsys last closed at $418.98, while the most followed narrative pegs fair value at about $555.65, implying a sizeable valuation gap based on future earnings expectations.

The accelerating complexity and proliferation of AI, high performance computing, and multi die or chiplet based architectures are increasing customer demand for Synopsys' advanced design, verification, and simulation solutions, solidifying its role as a mission critical partner in next generation chip and system development supporting both revenue growth and opportunities for higher margin recurring licensing.

Curious what kind of revenue run rate, profitability mix, and future earnings multiple are baked into that fair value gap? The narrative leans on compound growth, steadier margins, and a premium earnings profile tied to AI centric design wins. Want to see exactly how those expectations stack up over the next few years?

Result: Fair Value of $555.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the class action lawsuit around AI-focused IP disclosures and analyst concern about prolonged IP segment headwinds could easily challenge the underpriced story investors see today.

Find out about the key risks to this Synopsys narrative.

Another View: Expensive On Earnings

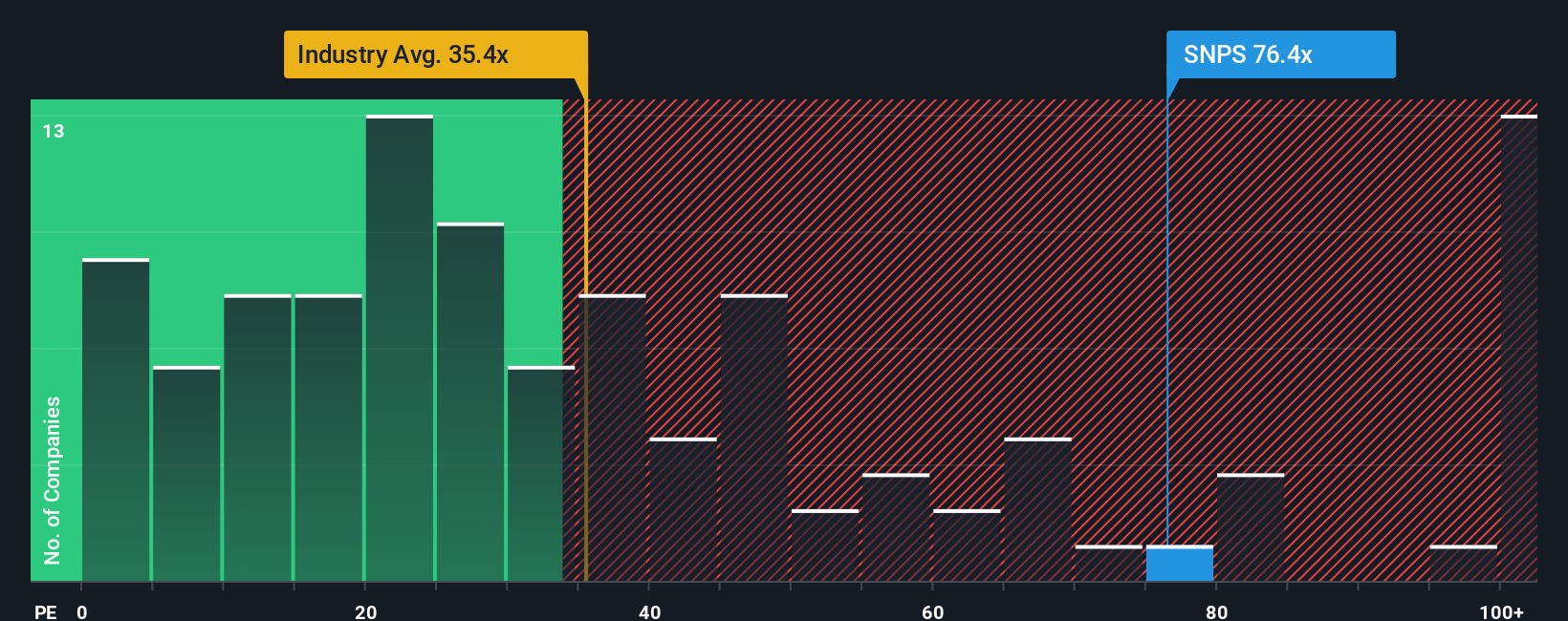

While the narrative points to Synopsys trading 24.6% below a fair value of $555.65, the earnings multiple tells a different story. The current P/E of 60x sits well above the US Software industry at 26.2x, the peer average at 40.6x, and a fair ratio of 39.6x.

That gap suggests you are paying a high price for each dollar of earnings, which could limit upside if growth or margins fall short of expectations. Does this make Synopsys a conviction idea worth the premium, or a name where you would rather wait for a better entry point?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Synopsys Narrative

If you look at the numbers and reach a different conclusion, or want to test your own view against the data, you can quickly build a custom thesis and see how it stacks up using Do it your way.

A great starting point for your Synopsys research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Synopsys has you thinking bigger about your portfolio, do not stop here. Broaden your watchlist with other focused ideas that match how you like to invest.

- Target income first and scan these 11 dividend stocks with yields > 3% that may help you build a steadier stream of cash returns on top of potential price moves.

- Spot high potential growth themes early by checking out these 27 AI penny stocks that sit at the intersection of data, compute, and real world adoption of AI.

- Hunt for price gaps with these 868 undervalued stocks based on cash flows that could surface companies where current market expectations differ from fundamentals based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com