- Adobe and Cognizant have expanded their partnership to help large enterprises use generative AI for end to end content creation.

- The collaboration focuses on integrating AI into content supply chains, from ideation through compliance, localization and delivery.

- The initiative targets scaled, industry specific deployment of AI to support real world creative and marketing workflows.

Adobe (NasdaqGS: ADBE) is pushing deeper into enterprise workflows with this expanded Cognizant partnership, as the company trades around $271.93 per share. The stock has seen declines of 18.4% year to date and 38.2% over the past year, with a 45.2% decline over five years. This kind of business focused AI move may be relevant for investors who are tracking how Adobe is positioning its core products.

For investors, this development is less about a single product update and more about how AI might be embedded into the everyday work of large corporate customers. The scale, compliance focus and industry specific angle of the partnership are key elements to watch as Adobe works to turn generative AI from a feature set into broader enterprise usage.

Stay updated on the most important news stories for Adobe by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Adobe.

How Adobe stacks up against its biggest competitors

Quick Assessment

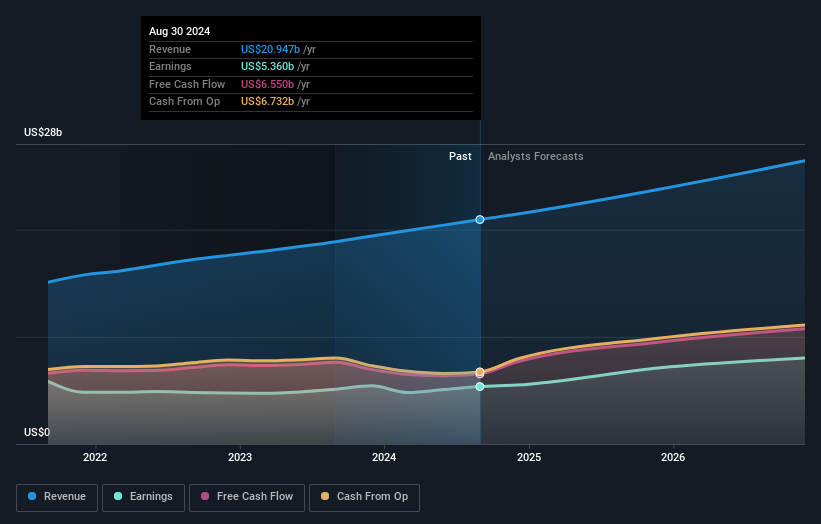

- ✅ Price vs Analyst Target: At US$271.93 versus a consensus target of about US$417.42, the price sits roughly 35% below analyst expectations.

- ✅ Simply Wall St Valuation: Simply Wall St flags Adobe as trading about 48.7% below its estimated fair value, suggesting a valuation gap.

- ❌ Recent Momentum: The 30 day return of about an 18.4% decline shows recent weakness despite the AI partnership news.

Check out Simply Wall St's in depth valuation analysis for Adobe.

Key Considerations

- 📊 The Cognizant partnership ties Adobe's generative AI directly into large enterprise content workflows, which could be important for future demand for its software.

- 📊 It may be useful to monitor how many enterprise clients adopt these AI driven content supply chains and how this relates to Adobe's revenue and earnings per share trends.

- ⚠️ A key risk is execution, as integrating AI into regulated, global enterprises can be complex and may take time to translate into measurable business results.

Dig Deeper

For the full picture including more risks and potential rewards, check out the complete Adobe analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com