Union Pacific (UNP) just signed a US$1.2b locomotive modernization agreement with Wabtec, described as the largest such investment in rail history. Investors are weighing what this means for efficiency, reliability and long term capital allocation.

See our latest analysis for Union Pacific.

The locomotive deal lands just after Union Pacific’s fourth quarter results, where revenue of US$6,085m was roughly in line with the prior year and earnings per share edged higher, and as its proposed US$85b Norfolk Southern acquisition remains under regulatory review. Against that backdrop, the stock’s 11.09% 90 day share price return and 31.97% five year total shareholder return indicate that recent momentum has picked up, while longer term gains have accumulated more gradually.

If this kind of large scale rail investment has caught your attention, it could be a useful moment to scan other aerospace and defense stocks that are tied to big infrastructure and transport themes.

With Union Pacific trading at US$241.49, about 9% below one analyst price target and with an estimated 20% intrinsic discount, the key question is whether this reflects a genuine valuation gap or if the market is already accounting for future growth.

Most Popular Narrative: 8.3% Undervalued

At $241.49, Union Pacific sits below the most followed fair value estimate of about $263, which is built on detailed cash flow and earnings projections.

Union Pacific is implementing multiple efficiency enhancements, such as energy management systems for locomotives and optimization tools, which are expected to improve operational efficiency and net margins. The company is expanding capacity with new infrastructure, such as facilities in Houston and Phoenix, which could support future growth and positively impact revenue.

Curious how efficiency upgrades, new terminals and pricing assumptions combine into that valuation gap? The narrative focuses on future revenue, margins and a richer earnings multiple. The full story is in how those ingredients shape the projected cash flows and the discount rate applied to them.

Result: Fair Value of $263.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that gap can quickly close if trade or tariff changes hit intermodal volumes or if regulators take a tougher line on the Norfolk Southern deal.

Find out about the key risks to this Union Pacific narrative.

Another View: What The P/E Ratio Is Saying

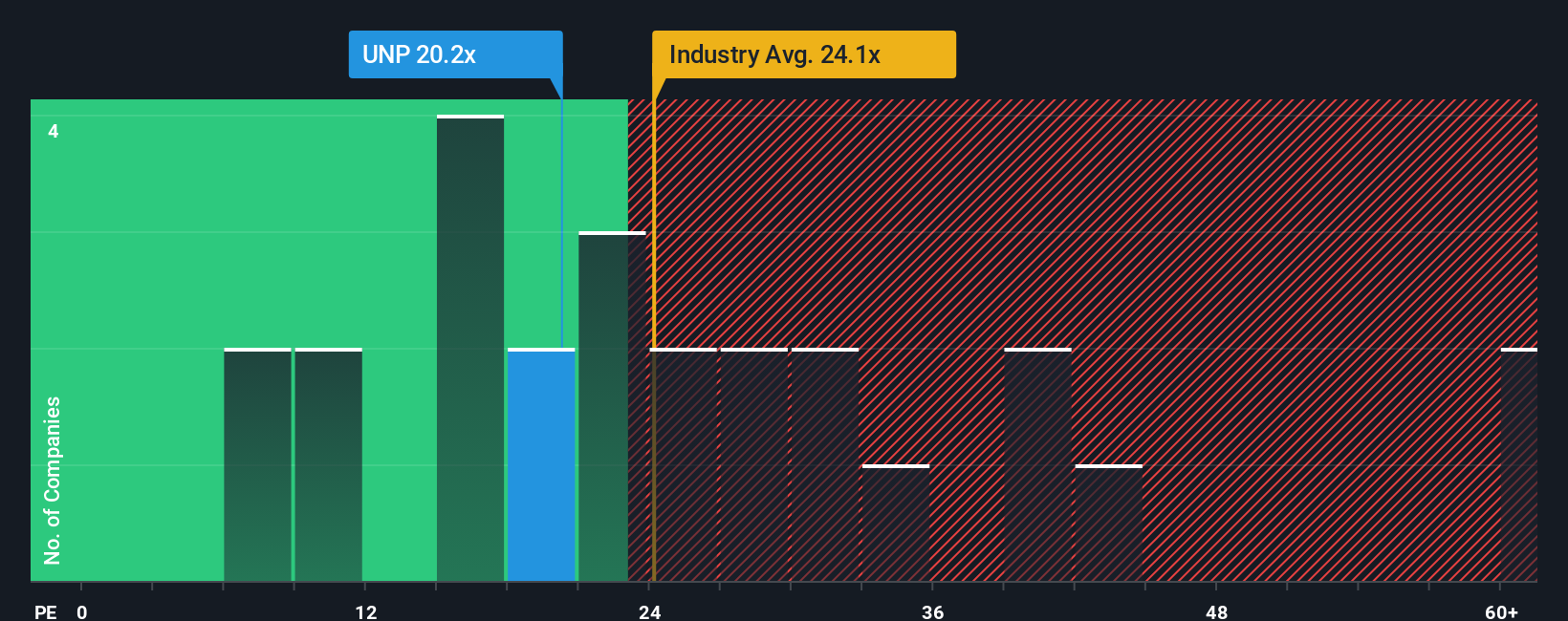

Our DCF work suggests Union Pacific trades at about a 20.3% discount to an estimated fair value of $302.92, which leans toward an undervalued story. Yet the market is already paying roughly 20.1x earnings, above the 18.8x peer average but below the 38.6x US transportation group and a fair ratio of 24.8x.

This raises the question of whether this is a genuine mispricing, or simply a case of investors already paying up for quality while still leaving some room if the market shifts closer to that fair ratio.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Union Pacific Narrative

If you see the numbers differently or simply prefer to test the assumptions yourself, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your Union Pacific research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Union Pacific has sharpened your interest, do not stop here. Use the screener to spot other opportunities that fit your style before the market moves on.

- Spot potential value candidates early by checking out these 867 undervalued stocks based on cash flows that might be trading below what their cash flows suggest.

- Position yourself in themes reshaping technology by scanning these 25 AI penny stocks tied to artificial intelligence and related growth stories.

- Target income focused opportunities by reviewing these 13 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com