How the latest earnings beat is shaping the Fair Isaac (FICO) story

Fair Isaac (FICO) has just delivered another quarter where revenue and earnings topped analyst expectations, with both the Scores and Software segments contributing to year over year growth.

That mix of outperformance, record Scores revenue and strong software ACV bookings, supported by new scoring models and partnerships, is what has pushed Fair Isaac back onto many investors’ radar.

See our latest analysis for Fair Isaac.

Even with the upbeat earnings, the share price has pulled back recently. The 1 month share price return is 11% and the year to date share price return is also 11%, while the 1 year total shareholder return of 21.9% contrasts with very large 3 year and 5 year total shareholder returns. This suggests long term momentum has been strong even as near term sentiment has cooled.

If strong earnings and new AI partnerships have you looking beyond a single name, this can be a good moment to scan other high growth tech and AI stocks that fit your thesis.

With shares down about 11% over the past month and year to date, yet still showing very large 3 year and 5 year total returns, are you looking at a reset that leaves upside on the table, or is the market already baking in future growth?

Most Popular Narrative: 27.7% Undervalued

At a last close of $1,463.17 versus a narrative fair value of $2,023.18, the current price sits well below what this widely followed model suggests.

The ongoing transition to SaaS and cloud-based delivery, evidenced by double-digit growth in FICO Platform ARR and emphasis on conversion to next-generation AI-driven decisioning solutions, is increasing recurring revenues, supporting margin expansion and greater earnings predictability.

Curious what kind of revenue growth, margin profile and future earnings multiple are built into that fair value, and how much optimism analysts are baking in? The full narrative lays out the assumptions.

Result: Fair Value of $2,023.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory changes around mortgage credit scores and slower software growth could challenge the current story if they weigh on pricing power or on future earnings expectations.

Find out about the key risks to this Fair Isaac narrative.

Another way to look at FICO’s valuation

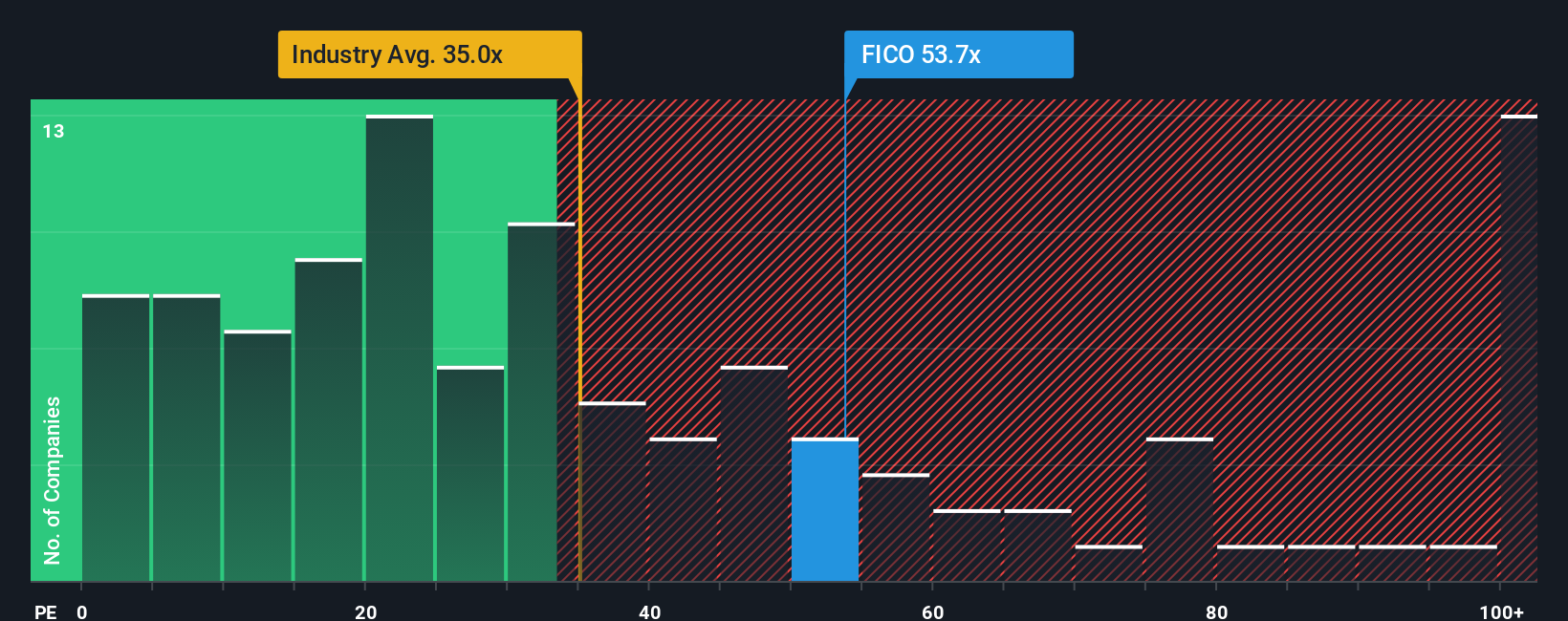

The popular narrative pegs Fair Isaac at a fair value of $2,023.18 and calls the stock undervalued, but the current P/E of 52.8x tells a different story. That is well above the US Software industry at 28.2x, peers at 40.7x, and a fair ratio of 36.6x. This suggests a valuation that leaves less margin for error. Which signal do you think carries more weight right now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fair Isaac Narrative

If this view does not quite match your own, or you prefer to test the numbers yourself, you can build a custom Fair Isaac story in minutes by starting with Do it your way.

A great starting point for your Fair Isaac research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one stock when you can scan a wider field of opportunities that match how you like to invest and manage risk.

- Spot potential high growth names early by checking out these 3528 penny stocks with strong financials that already show stronger financial footing than many expect from this end of the market.

- Ride the AI wave with focus by filtering for these 24 AI penny stocks that align with your view on where real earnings potential could come from.

- Target mispriced opportunities by running through these 875 undervalued stocks based on cash flows that appear cheap based on cash flows before the crowd pays closer attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com