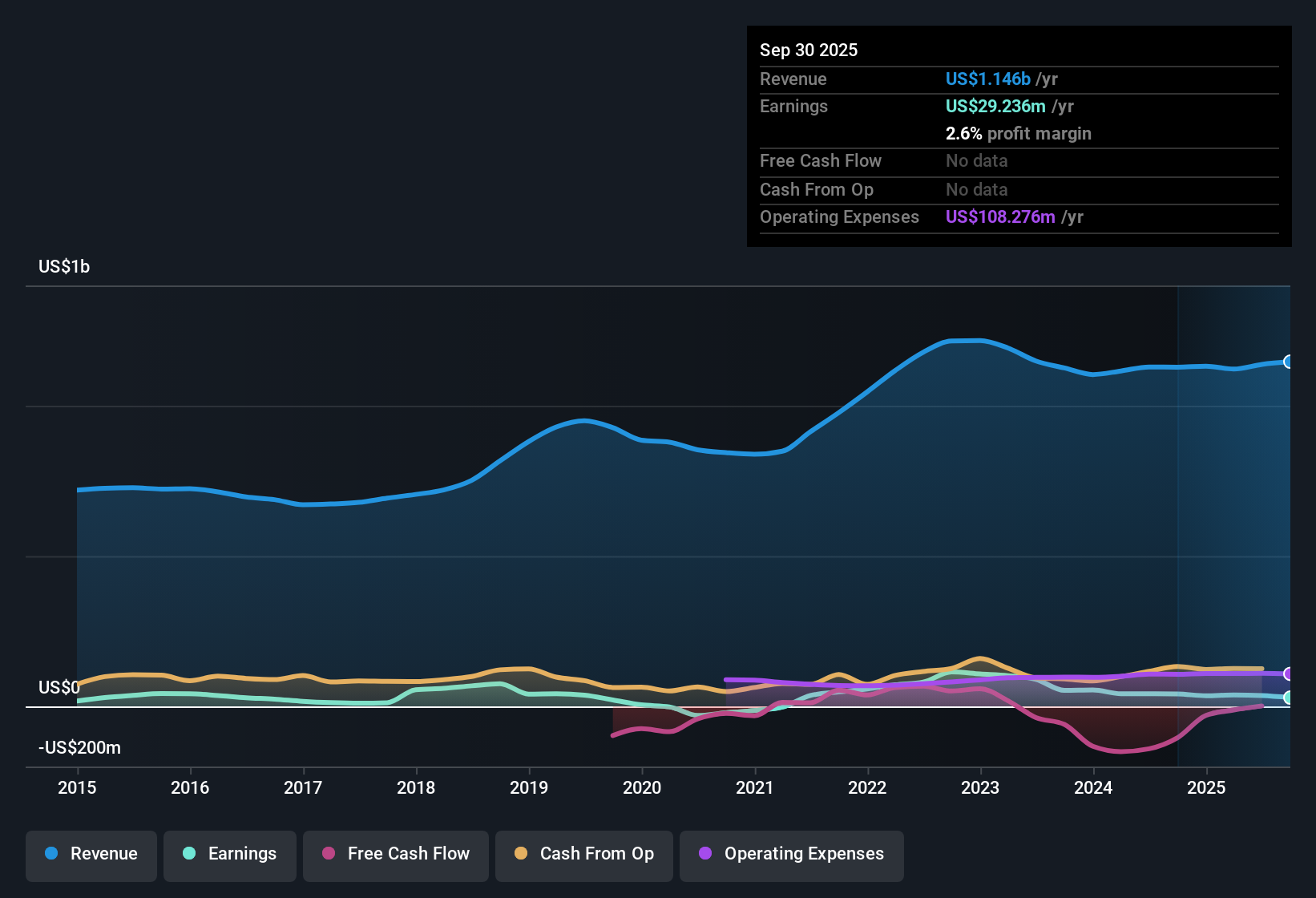

Covenant Logistics Group (CVLG) closed out FY 2025 with fourth quarter revenue of US$295.4 million and a basic EPS loss of US$0.73, capping a trailing twelve month period where revenue was US$1.16 billion and basic EPS was US$0.17. Over that stretch, quarterly revenue moved from US$277.3 million in Q4 2024 to a range of roughly US$269.4 million to US$302.9 million across 2025. Basic EPS shifted from US$0.25 in Q4 2024 to positive readings between US$0.25 and US$0.38 in the first three quarters of 2025 before the Q4 loss. For investors, the story starts with thin profitability and a recent quarterly loss that keep margins firmly in focus as they weigh the latest results.

See our full analysis for Covenant Logistics Group.With the numbers on the table, the next step is to see how this earnings profile lines up against the widely followed narratives around Covenant Logistics Group and where those stories might be reinforced or challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Squeezed, Net Margin Now 0.4%

- Over the last 12 months, Covenant produced US$1.16b of revenue and US$4.41 million of net income excluding extra items, which works out to a 0.4% net margin compared with 3.1% a year earlier.

- What stands out for a more cautious, bearish view is how thin that 0.4% margin is alongside the US$18.26 million Q4 loss,

- bears point to the one off US$11.0 million loss in the trailing period as a sign that profitability can be fragile when conditions turn and

- they also highlight that basic EPS for the latest twelve months is US$0.17, which is modest relative to the size of the revenue base.

High P/E At 139.7x Despite One Off Loss

- The trailing P/E ratio sits at 139.7x, even though trailing net profit includes a US$11.0 million one off loss and totals only US$4.41 million of net income on US$1.16b of revenue.

- Supporters with a more bullish tilt argue that one off items and compressed margins can make near term earnings look worse than the broader business mix of expedited, dedicated, managed freight and warehousing suggests.

- Yet the current share price of US$24.60 versus basic EPS of US$0.17 produces that very high P/E, which critics say makes it hard to lean on an earnings based multiple and

- the tension is that a trucking and logistics operator with several fee based services is trading at a level that usually assumes stronger or more stable earnings than the recent numbers show.

DCF Fair Value Far Above US$24.60

- The provided DCF fair value is US$110.16 per share compared with a current share price of US$24.60, meaning the market price is about 22.3% of that modelled value while the same trailing period shows a 0.4% net margin and a US$11.0 million one off loss.

- What is interesting for a bullish angle is that the large DCF gap exists alongside weak trailing earnings quality.

- Supporters point out that the DCF model values the business on cash flows rather than just the recent EPS of US$0.17, which includes that sizeable one off hit and

- skeptics counter that earnings do not fully cover interest expense on a trailing basis, so they question how quickly cash flows can support a DCF fair value that is well above the current share price.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Covenant Logistics Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Covenant Logistics Group is working with a 0.4% net margin, a Q4 loss of US$18.26 million, and a P/E of 139.7x on US$0.17 EPS.

If thin margins and a stretched multiple make you cautious, check out these 871 undervalued stocks based on cash flows to focus on companies where current prices sit closer to underlying earnings power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com