CCC Intelligent Solutions Holdings (CCC) has been drawing attention after recent share price pressure, with the stock down over the month and the past 3 months. This has prompted investors to reassess what they are paying for its SaaS exposure.

See our latest analysis for CCC Intelligent Solutions Holdings.

That recent share price pressure fits into a weaker trend, with a 30-day share price return of 5.99% decline and a 1-year total shareholder return of 32.65% decline, suggesting momentum has been fading rather than building.

If CCC’s recent pullback has you reassessing your tech exposure, it could be a good moment to widen your search across high growth tech and AI stocks for other SaaS and AI driven names.

So with CCC posting a 32.65% 1-year total return decline yet trading at US$7.53 against an analyst target of US$11.27, is this recent weakness a genuine buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 33.2% Undervalued

CCC Intelligent Solutions Holdings last closed at $7.53, compared with a most followed narrative fair value of about $11.27, creating a valuation gap for investors to consider.

The company's strong subscription-based recurring revenue model (80% of total), consistent gross dollar/net dollar retention above 99%/107%, and further penetration into OEMs and parts suppliers provide a cushion against industry cyclicality and claims volume fluctuations, supporting resilient revenue and profitability.

Curious what supports that higher fair value? This narrative focuses on recurring revenue, margin expansion, and a future earnings profile that assumes meaningfully stronger profitability. Interested in how those elements are combined into one valuation story?

Result: Fair Value of $11.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still a few pressure points to keep in mind, particularly the softer claim volumes and the reliance on a concentrated set of large insurance clients.

Find out about the key risks to this CCC Intelligent Solutions Holdings narrative.

Another Angle: Pricing Looks Full On Sales

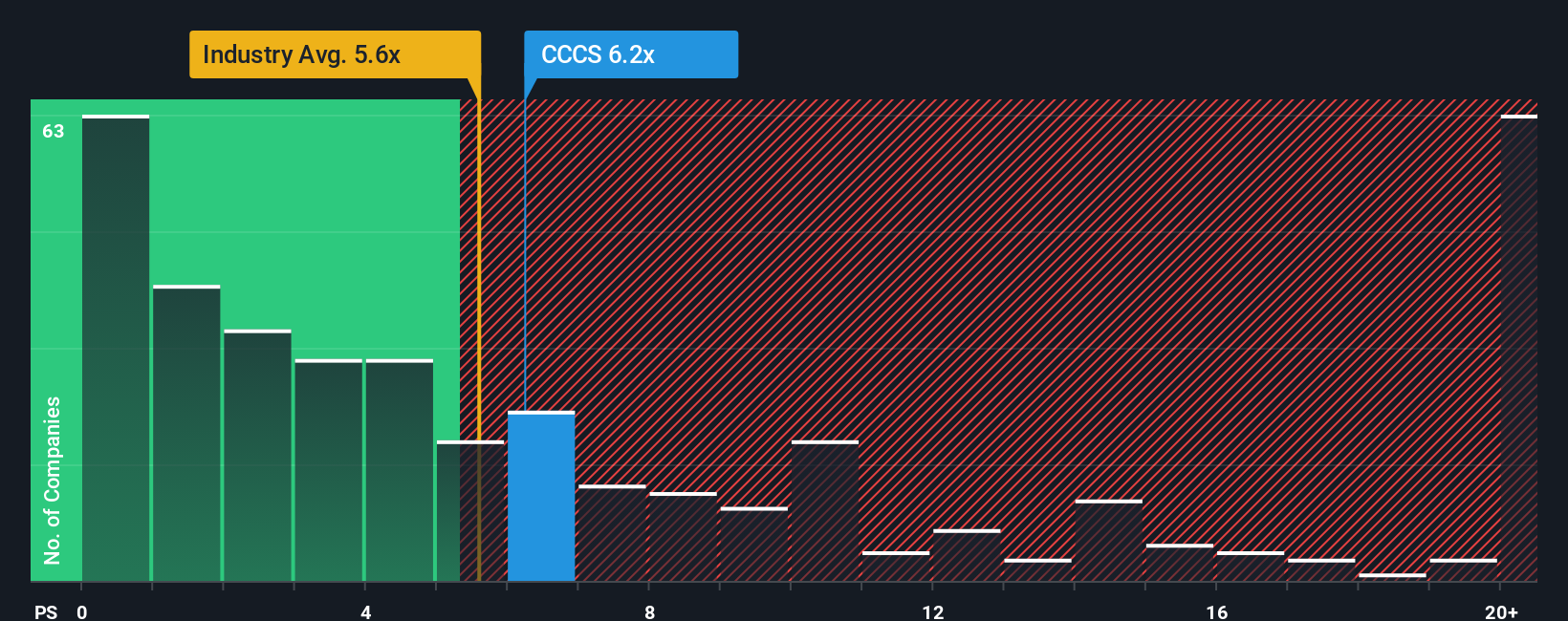

While the popular narrative points to CCC Intelligent Solutions Holdings trading below an $11.27 fair value, the current P/S of 4.7x tells a different story. It sits slightly above both the US Software industry at 4.5x and peers at 3.9x, and even lines up with the 4.7x fair ratio. This suggests there may be less obvious room for rerating. With growth forecasts in mind, is this a valuation you feel adequately compensates you for execution and concentration risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CCC Intelligent Solutions Holdings Narrative

If you feel the current narratives miss something, or you would rather weigh the numbers yourself, you can build a custom view in minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding CCC Intelligent Solutions Holdings.

Ready for more investment ideas?

If CCC has sharpened your focus, do not stop here, use the Simply Wall St screener to uncover other ideas that might better fit your approach.

- Spot potential value by scanning these 869 undervalued stocks based on cash flows that align with your preferred balance between price and fundamentals.

- Target future focused themes by checking out these 25 AI penny stocks that link artificial intelligence to real business models and revenue streams.

- Broaden your watchlist with these 14 dividend stocks with yields > 3% that combine income potential with clearly visible yield figures.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com