Constellation Brands (STZ) is back in focus after management sharpened its emphasis on higher priced beer, wine, and spirits, while Berkshire Hathaway increased its stake during share weakness, drawing fresh attention to the stock.

See our latest analysis for Constellation Brands.

That renewed focus on higher priced brands and Berkshire Hathaway’s interest come after a strong stretch of share price performance, with a 30 day share price return of 13.88% and a 90 day share price return of 22.39%, even though the 1 year total shareholder return is still down 10.66%.

If you are comparing Constellation Brands with other consumer names, it could be a good time to scan stable growth stocks screener (None results) for ideas that fit a steadier growth profile.

With Constellation Brands trading at US$157.74, showing a 49.53% intrinsic discount estimate and sitting about 8.23% below one set of analyst targets, you have to ask: is this a genuine opening, or is future growth already priced in?

Most Popular Narrative: 7.6% Undervalued

Constellation Brands' most followed narrative pegs fair value at about $170.73 per share, a touch above the last close of $157.74, framing the current setup as modestly discounted.

The company plans to generate approximately $9 billion in operating cash flow and $6 billion in free cash flow from fiscal '26 to fiscal '28. This robust cash flow will support investment in growth initiatives, primarily the modular development of their third brewery in Veracruz and additions to existing facilities in Mexico, potentially enhancing revenue.

Curious what kind of revenue glide path, margin rebuild, and future earnings multiple are being baked into that fair value, and how share buybacks fit into the story? The full narrative lays out the assumptions in detail and shows how they add up to that number.

Result: Fair Value of $170.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can quickly wobble if new tariffs and inflation pressure margins, or if cautious beer demand and weaker Hispanic spending linger longer than analysts expect.

Find out about the key risks to this Constellation Brands narrative.

Another View: Multiples Tell A Different Story

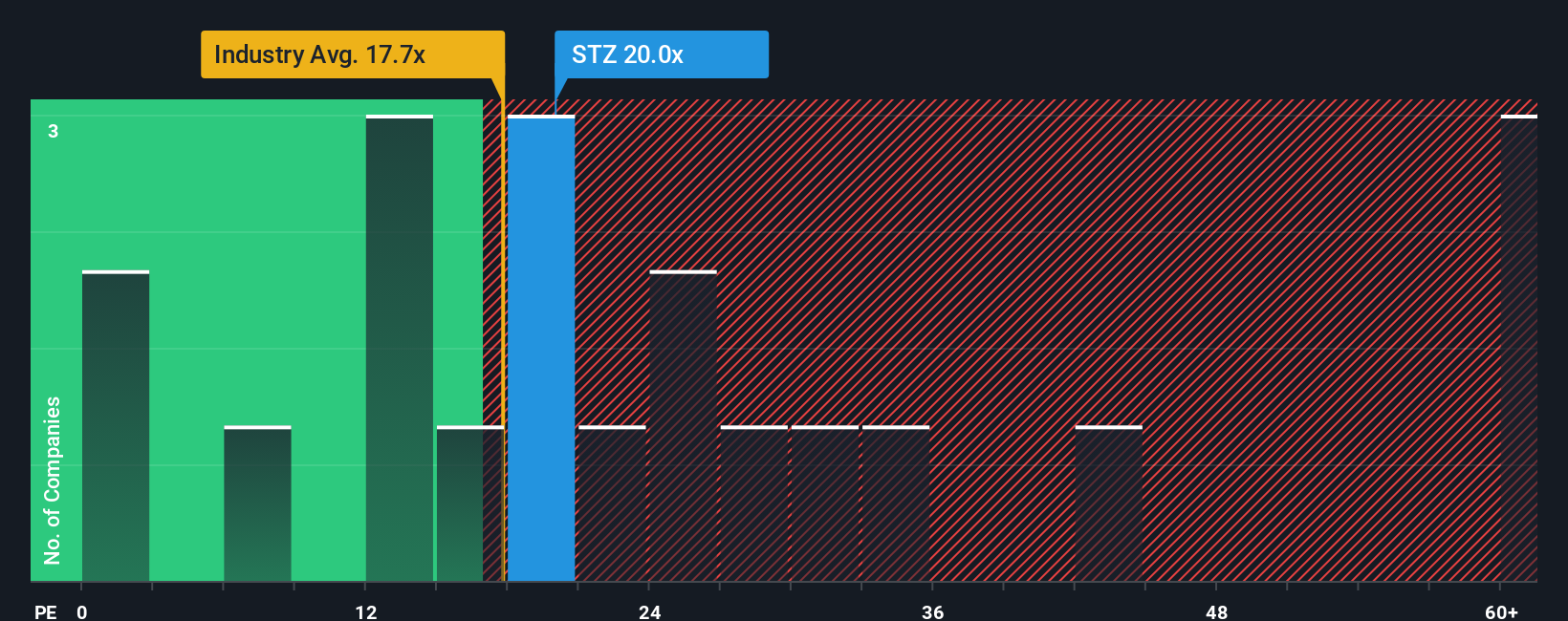

Our fair value estimate flags Constellation Brands as undervalued, yet the current P/E of 24.6x sits above both the estimated fair ratio of 21.7x and peer and industry averages of 18.8x and 17.8x. That richer multiple can signal valuation risk if the earnings story does not keep improving.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Constellation Brands Narrative

If you see the numbers differently or prefer to work from your own assumptions, you can build a personalised Constellation Brands story in just a few minutes with Do it your way.

A great starting point for your Constellation Brands research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready to uncover more stock ideas?

If you only stop at Constellation Brands, you might miss other compelling setups that fit your style, so put the Simply Wall St Screener to work for you.

- Spot opportunities in smaller names that still have solid fundamentals by reviewing these 3523 penny stocks with strong financials that pass key financial health checks.

- Target tomorrow's potential growth stories by zeroing in on these 23 AI penny stocks that are already gaining traction in artificial intelligence.

- Focus on value by scanning these 868 undervalued stocks based on cash flows that trade at discounts based on their cash flow profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com