- Wolfe Research has issued a positive view on Quanta Services (NYSE:PWR) in light of changing U.S. political conditions.

- The firm highlights policy impacts under the new U.S. presidential administration and sector wide improvements in clean energy fundamentals.

- Wolfe Research points to Quanta Services' roles in power, gas, and transmission as well as its exposure to rising corporate data center spending as key factors in its outlook.

Quanta Services, traded as NYSE:PWR, focuses on infrastructure services for electric power, gas, and related transmission systems. These are areas that sit directly in the path of U.S. energy and grid policy decisions. Wolfe Research is tying its positive stance to how new federal priorities around clean energy and grid reliability could intersect with these core business lines. The firm also points to sector wide clean energy fundamentals as an important part of the context for the company.

For you as an investor, an added angle here is Quanta Services' link to rising corporate data center investments, which increasingly depend on dependable power and transmission capacity. The combination of energy transition policies and growing data center demand is now part of the discussion around NYSE:PWR, and Wolfe Research's comments put both themes on the radar as you consider the stock's overall risk and opportunity profile.

Stay updated on the most important news stories for Quanta Services by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Quanta Services.

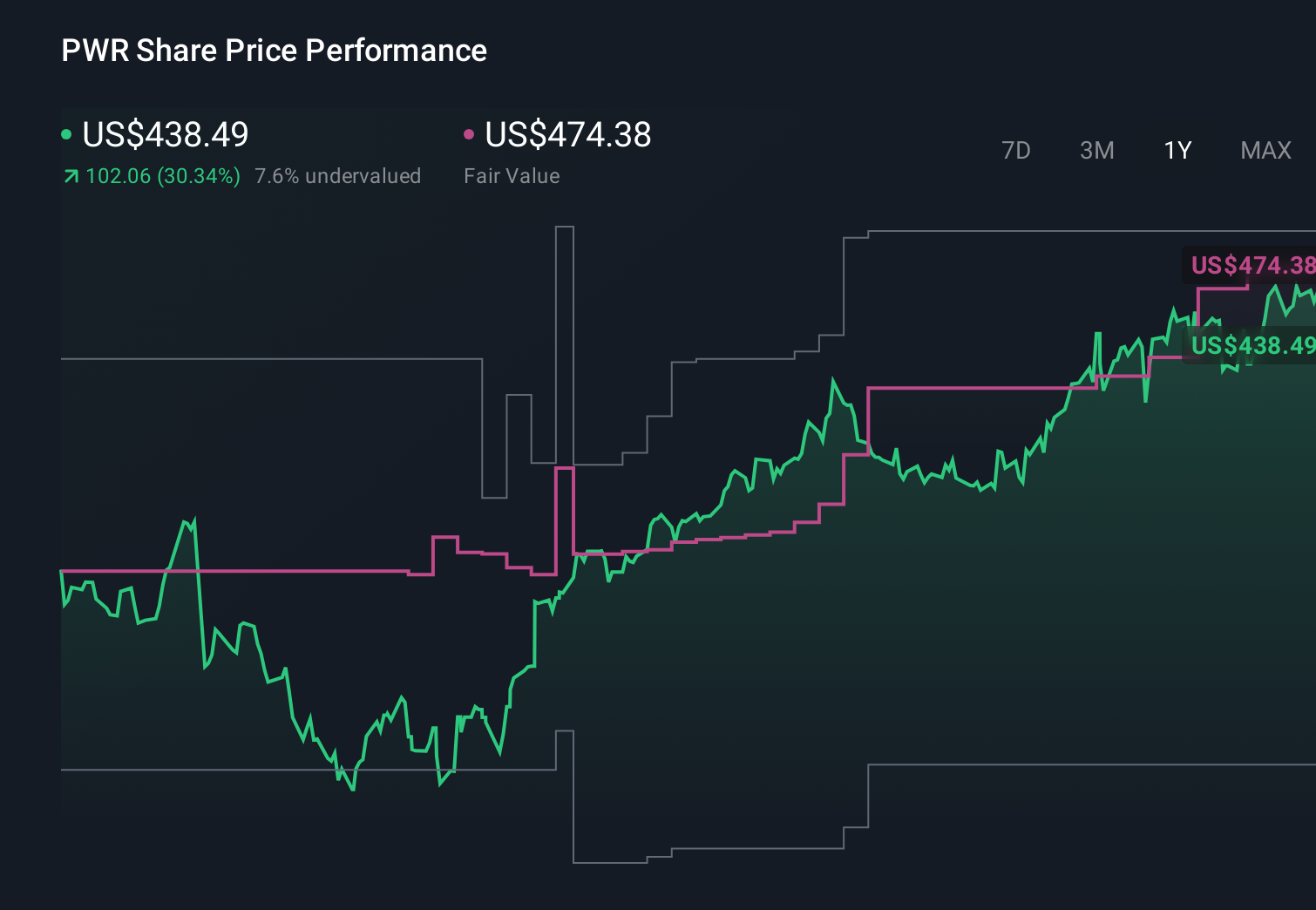

Why Quanta Services could be great value

For investors, Wolfe Research’s positive stance reads as a signal that institutional money is still comfortable with Quanta’s role in large-scale energy and grid projects, even with a different policy tone coming out of Washington. The emphasis on power, gas, and transmission, plus data center related work, suggests that Wolfe sees multiple capital spending streams supporting Quanta’s project pipeline rather than a single policy lever.

How this ties into the Quanta Services narrative investors are watching

The research call lines up closely with existing narratives that highlight long-term demand for grid modernization, renewables, and power for AI and data centers as key themes for NYSE:PWR. Prior analyst work already framed Quanta as exposed to a multi year power supercycle and expanding power generation platform, and Wolfe’s commentary on clean energy fundamentals and data center spending effectively reinforces that storyline for investors tracking consistency across different research shops.

Risks and rewards investors should weigh

- Institutional support from firms like Wolfe Research can signal confidence in Quanta’s positioning across power, gas, and transmission work and may support investor interest in the stock.

- Exposure to rising data center and AI related power demand gives Quanta access to a corporate capex theme that sits alongside traditional utility spending, which some analysts view as a multi year driver.

- Analysts have flagged execution and acquisition risks, so more complex, long dated projects tied to policy and data center demand could still lead to timing swings in backlog and earnings.

- The thesis depends on continued infrastructure and clean energy spending, so any slowdown in utility or corporate capex, or policy changes, could weigh on the expectations embedded in current narratives.

What to watch next

From here, you may want to watch how management talks about data center related bookings, any commentary on U.S. federal energy policy impacts, and whether other large investors echo Wolfe’s constructive tone on the sector. If you want to see how different analysts and community members are framing these themes, take a look at the community narratives for Quanta Services and see how your own view lines up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com