- Clover Health Investments (NasdaqGS:CLOV) is reporting strong customer growth for its Medicare Advantage plans and related technology solutions.

- The company is seeing an expanding free cash flow margin even as revenue has declined over the past two years.

- This mix of higher customer counts and improving cash generation, alongside revenue pressure, is a fresh development that investors are assessing.

Clover Health focuses on Medicare Advantage insurance and technology driven care tools, placing it in the middle of the ongoing shift toward value based, data informed healthcare. For readers tracking managed care and health tech, the combination of more customers and a stronger free cash flow margin provides a new datapoint on how NasdaqGS:CLOV is repositioning its business mix. It also offers another reference point as you compare different approaches to serving the growing senior population.

For investors, a key question is how long the company can keep improving cash flow while managing through revenue declines. As you follow upcoming quarters, you may want to watch whether customer trends, unit economics, and cash generation continue to move in the same direction as they have in this latest update.

Stay updated on the most important news stories for Clover Health Investments by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Clover Health Investments.

Why Clover Health Investments could be great value

For investors watching Clover Health, the key tension in this update is between the 10.3% customer growth over the last two years and the revenue declines over the same period. A rising customer base and an expanding free cash flow margin point to improving unit economics and tighter cost control, which is often what longer term holders look for when a business is working through top line pressure.

Clover Health Investments Narrative: Cash Generation Versus Growth Story

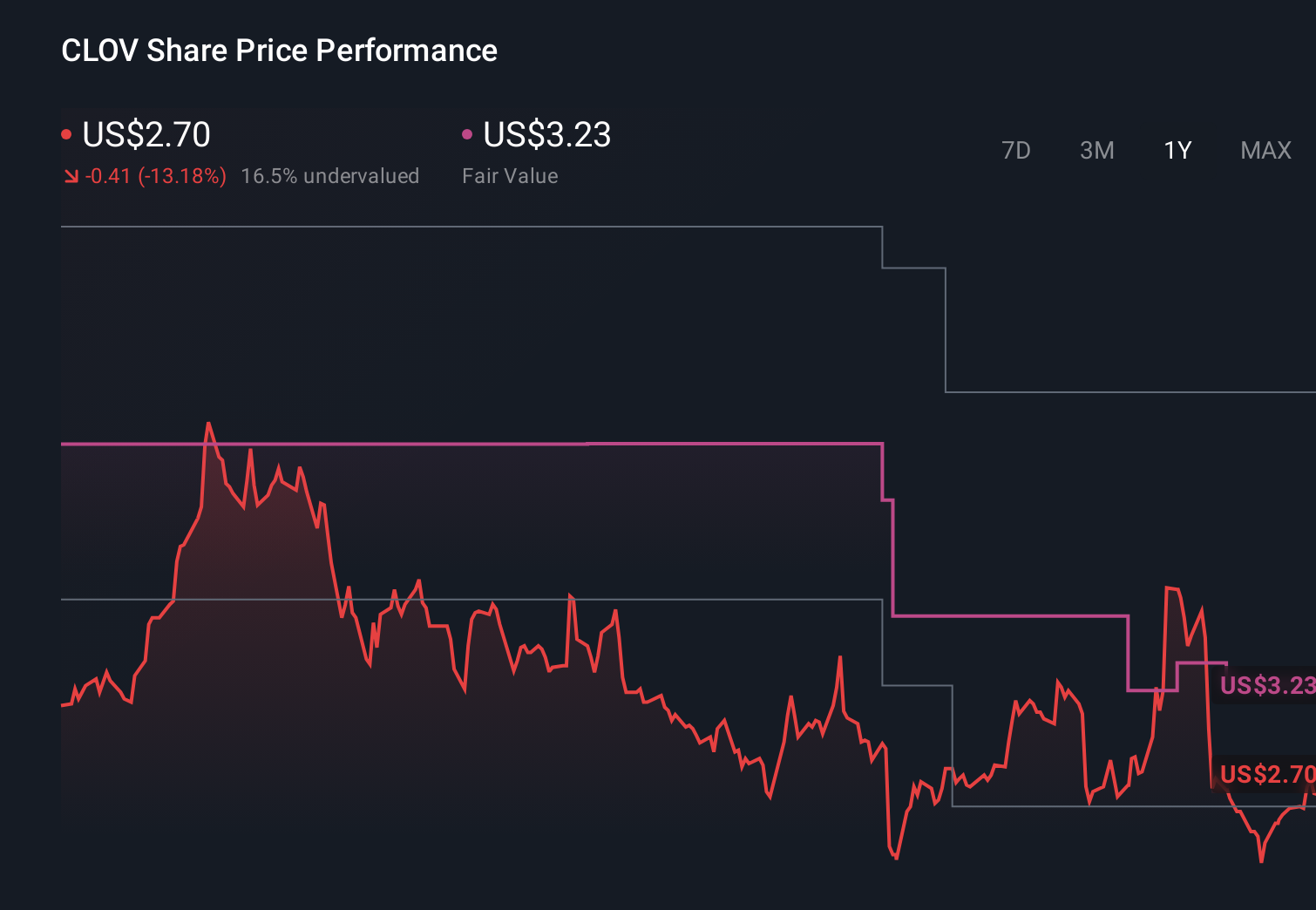

The current numbers add a new angle to the existing story around Clover Health, which has often focused on growth potential in Medicare Advantage rather than cash generation. With shares at US$2.60 and a 13.5% loss over six months compared to an 8.2% gain for the S&P 500, this shift toward better free cash flow margins may be seen by some investors as a test of whether the company can support a more cash focused narrative while it works through revenue headwinds.

Risks and Rewards: What This Update Signals

- Customer count at 109,226 with 10.3% growth over two years suggests the product continues to attract and retain members.

- An improving free cash flow margin can give Clover Health more flexibility to fund operations and potential expansion without relying as heavily on external capital.

- Revenue declines over the last two years raise questions about pricing, plan mix, or utilization trends that investors may want to understand in more detail.

- A 13.5% share price decline over six months while the S&P 500 gained 8.2% indicates more cautious market sentiment that could persist if revenue pressure continues.

What To Watch Next

From here, it makes sense to track whether customer growth, revenue, and free cash flow margins can move in a more aligned way, and how that affects market sentiment toward Clover Health over coming quarters. If you want to see how different investors are interpreting these trends, you can check out the latest community narratives and discussions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com