Amentum Holdings (AMTM) has taken the lead in the NEXUS-NL consortium, securing a two-year Dutch government framework agreement valued at up to $207 million for new nuclear power plant development.

See our latest analysis for Amentum Holdings.

The NEXUS-NL win comes on the heels of Amentum’s recent roles with Rolls-Royce’s small modular reactors and NASA’s Artemis II mission. The stock’s 30-day share price return of 17.36% and 90-day share price return of 59.46% point to building momentum, while the 1-year total shareholder return of 62.05% underscores how those contracts have fed into a stronger overall performance from a US$34.89 share price today.

If this kind of nuclear and defense exposure interests you, it could be worth widening your search across aerospace and defense stocks to see what else fits a similar theme.

With Amentum trading near its price target and showing a lower value score, the key question is whether the current US$34.89 price still offers upside or if the market has already priced in future growth.

Most Popular Narrative: 4.3% Overvalued

Against the current $34.89 share price, the most followed narrative points to a fair value of $33.45, setting up only a small valuation gap.

Ramp up of large, long duration awards such as the U.S. Space Force Range contract, Sellafield remediation and NASA Cosmos is set to convert the current $47 billion backlog and $20 billion of pending bids into higher run rate revenues and improved operating leverage, supporting sustained earnings growth.

Want to see what is sitting behind that backlog story? The narrative leans heavily on future margins, earnings power and a very specific profit multiple. The exact mix matters.

Result: Fair Value of $33.45 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that backlog story can quickly change if large contracts run into execution issues or if government funding decisions delay the US$20b of pending bids.

Find out about the key risks to this Amentum Holdings narrative.

Another View: Cash Flows Tell a Different Story

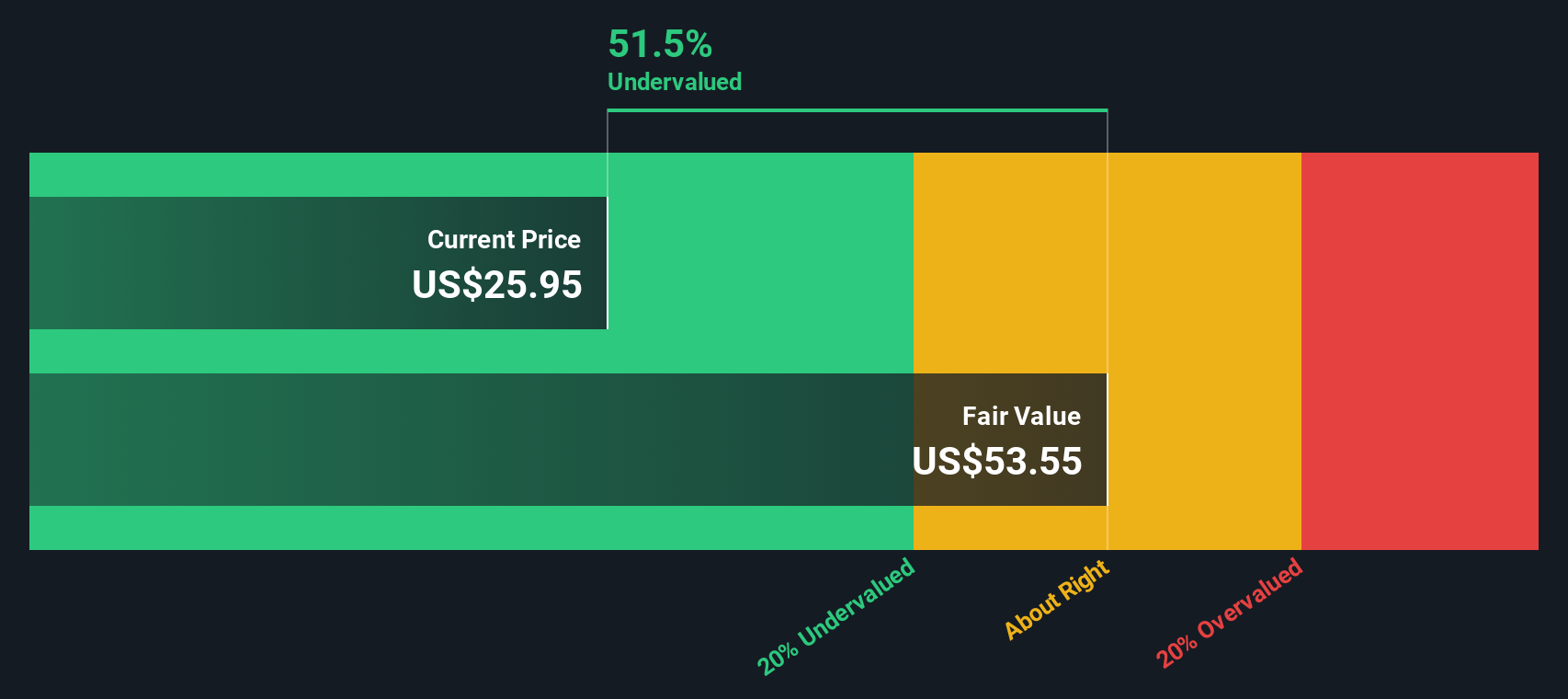

While the popular narrative flags Amentum as about 4.3% overvalued at a $33.45 fair value, our DCF model points in the opposite direction. On this view, the shares at $34.89 sit roughly 50% below an estimated cash flow value of $70.25, which represents a very different signal. Which lens do you find more convincing for a long term thesis?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amentum Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amentum Holdings Narrative

If you see the data pointing in a different direction, or simply want to test your own view, you can build a custom thesis in minutes: Do it your way.

A great starting point for your Amentum Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock today, you could miss other opportunities, so give yourself options by scanning a broader set of ideas in minutes.

- Spot potential deep value by checking out these 886 undervalued stocks based on cash flows where cash flow expectations and current prices appear out of sync.

- Capture growth themes at the frontier of tech by reviewing these 23 AI penny stocks that are building real businesses around artificial intelligence.

- Add income candidates to your watchlist by scanning these 13 dividend stocks with yields > 3% that combine yield above 3% with listed fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com