Why Nissan’s OEM Link partnership matters for CCC Intelligent Solutions Holdings (CCC)

CCC Intelligent Solutions Holdings (CCC) recently announced that Nissan will be the first automaker to join its new OEM Link Network. This will tie CCC’s software more deeply into Nissan’s Certified Collision Repair Network.

Through this arrangement, CCC will manage certified network operations for roughly 2,000 Nissan affiliated repair facilities across the U.S., handling shop audits, billing, and communications between Nissan and its certified repairers.

See our latest analysis for CCC Intelligent Solutions Holdings.

Despite the Nissan announcement, CCC Intelligent Solutions Holdings’ share price return over the past 90 days shows a 12.97% decline, and the 1 year total shareholder return sits at a 30.59% loss. This signals pressure on sentiment even as the business signs new partnerships.

If this kind of auto tech story has your attention, it could be a good moment to see how other auto names are positioned through auto manufacturers.

With the stock down over the past year and trading around a reported discount to analyst targets, yet flagged with a low value score and an intrinsic premium, you have to ask whether there is a buying opportunity here or whether the market is already pricing in future growth.

Price-to-Sales of 5x: Is it justified?

CCC Intelligent Solutions Holdings currently trades on a P/S of 5x, which screens as expensive against several benchmarks even with recent share price weakness.

The P/S ratio compares a company’s market value to its revenue and is often used for software and other businesses where earnings are still developing or volatile. For CCC, this lens matters because the company is still loss making on a net income basis, so revenue based measures tend to get more attention.

Against that backdrop, CCC’s 5x P/S is described as expensive in three different ways. It is higher than the US Software industry average of 4.5x, above a peer group average of 4.2x, and above an estimated fair P/S ratio of 4.6x that the market could potentially move toward if sentiment or expectations change.

This combination suggests investors are currently paying a premium to sales compared to both peers and an implied fair level, even as the share price has fallen over 1 year. If you want to see how that fair multiple is calculated and what might justify a premium or discount over time, Explore the SWS fair ratio for CCC Intelligent Solutions Holdings.

Result: Price-to-Sales of 5x (OVERVALUED)

However, you still have to weigh risks such as CCC’s recent 30.6% 1-year total return decline and its loss of US$2.86m on US$1.03b in revenue.

Find out about the key risks to this CCC Intelligent Solutions Holdings narrative.

Another View: What The SWS DCF Model Says

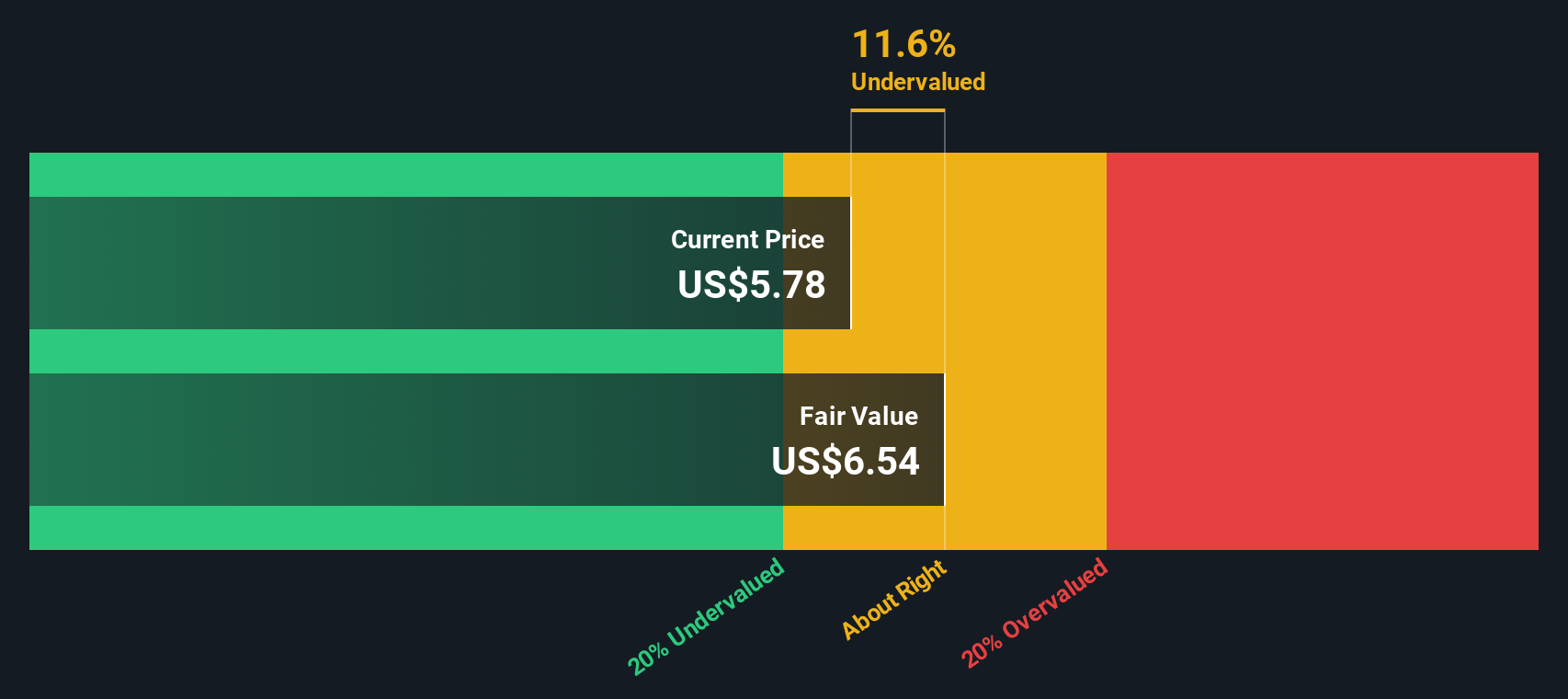

While CCC Intelligent Solutions looks expensive on a 5x P/S ratio, our DCF model points in the same direction rather than offering a bargain signal. At a share price of US$7.92 versus an estimated future cash flow value of US$6.56, the model suggests CCC is overvalued. So where do you place more weight: sales multiples or long term cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CCC Intelligent Solutions Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CCC Intelligent Solutions Holdings Narrative

If you look at this and come to a different conclusion, or simply want to test your own view against the numbers, you can build a personalized CCC thesis in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding CCC Intelligent Solutions Holdings.

Looking for more investment ideas?

If CCC is only one piece of your watchlist, do not stop here. Use targeted stock ideas to quickly spot opportunities that might better fit your approach.

- Target potential value opportunities by scanning these 881 undervalued stocks based on cash flows that trade at a discount to what their cash flows suggest they could be worth.

- Ride long term technology shifts by checking out these 24 AI penny stocks that are building tools and platforms around artificial intelligence.

- Tap into the energy around digital assets with these 19 cryptocurrency and blockchain stocks that link listed companies to cryptocurrency and blockchain themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com