- Earlier this week, Canaccord Genuity reiterated its positive view on Clover Health, pointing to the company’s technology-first care model, solid membership growth to about 153,000, rising revenues, and sustained adjusted EBITDA profitability as reasons for confidence in its progress toward profitability.

- The endorsement underscores how Clover Health’s combination of strong member retention and operational efficiencies is becoming central to its evolving business and financial profile.

- Next, we’ll examine how this analyst support, rooted in Clover Health’s technology-focused care model, influences the company’s broader investment narrative.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

What Is Clover Health Investments' Investment Narrative?

To own Clover Health, you need to be comfortable with a technology-heavy insurer that is still loss-making but aiming for scale and operating discipline to close the gap. The big picture is about its Medicare Advantage footprint, the Clover Assistant platform and whether management can turn solid revenue growth into consistent profitability while keeping medical costs in check. In the near term, key catalysts remain execution on 2025 guidance, member retention into the 2026 plan year, and evidence that administrative and claims efficiencies are sticking. Canaccord’s reaffirmed support fits into this by reinforcing confidence in the tech-first care model and the recent adjusted EBITDA trend, but a 2.5% share price move suggests the news does not fundamentally change the story. The core risks around regulatory shifts, medical cost variability and ongoing net losses are still front and center.

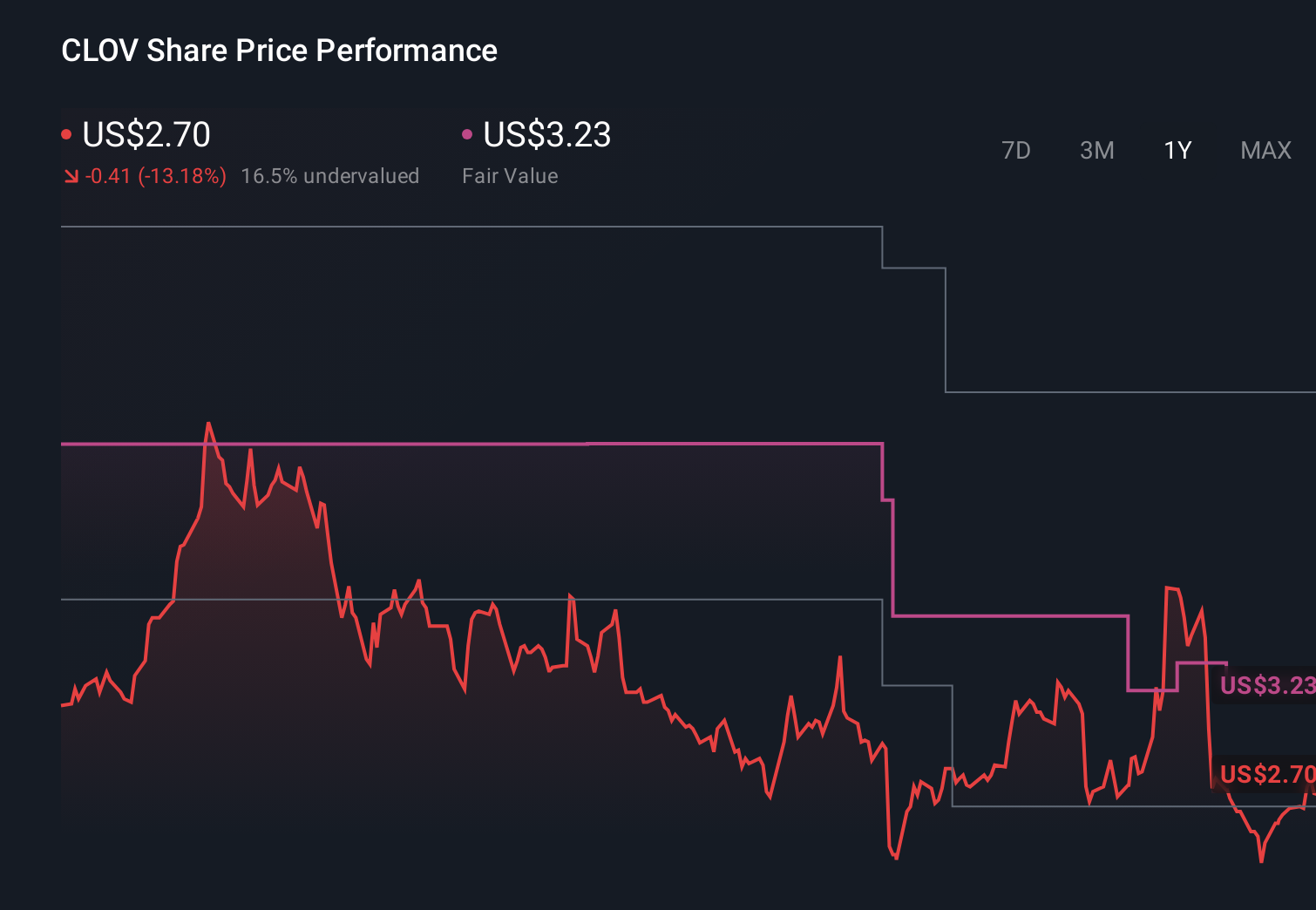

But one risk in particular could catch some investors off guard. Upon reviewing our latest valuation report, Clover Health Investments' share price might be too pessimistic.Exploring Other Perspectives

Explore 12 other fair value estimates on Clover Health Investments - why the stock might be a potential multi-bagger!

Build Your Own Clover Health Investments Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clover Health Investments research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clover Health Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clover Health Investments' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com