Why Progyny Stock Moved

Progyny (PGNY) shares moved after Citizens upgraded the stock to Market Outperform, following a management meeting where leadership reiterated client retention approaching 100% and a diversified base of more than 600 employer clients.

See our latest analysis for Progyny.

At a share price of $25.45, Progyny has given investors a 30.51% 90-day share price return and a 20.33% 1-year total shareholder return. However, longer term total shareholder returns over three and five years remain negative, so recent momentum is still rebuilding from a weaker multi-year picture.

If this fertility benefits story has your attention, it could be a good moment to see what else is happening across US healthcare by checking out healthcare stocks.

With Progyny trading at $25.45, recent gains, a 20.33% 1 year return and an analyst price target around $30, the key question for investors is whether the current valuation leaves upside or if the market is already pricing in future growth.

Price-to-Earnings of 38.8x: Is it justified?

Progyny closed at $25.45 and is trading on a P/E of 38.8x, which sits well above both its peers and the wider US Healthcare sector.

The P/E multiple compares the current share price to earnings per share, so a higher figure usually means investors are paying more today for each dollar of current earnings.

For Progyny, the 38.8x P/E is significantly higher than the peer average of 24.1x and the US Healthcare industry average of 23.3x. The market is currently assigning a richer earnings multiple to this stock than to many of its sector peers, even though its revenue is forecast to grow at 8% per year and earnings are forecast to grow at 19% per year, which are not flagged as very high growth rates in the data provided.

That gap is also wide versus the estimated fair P/E of 22.8x. This is a level the market could move toward if sentiment or expectations change materially.

Explore the SWS fair ratio for Progyny

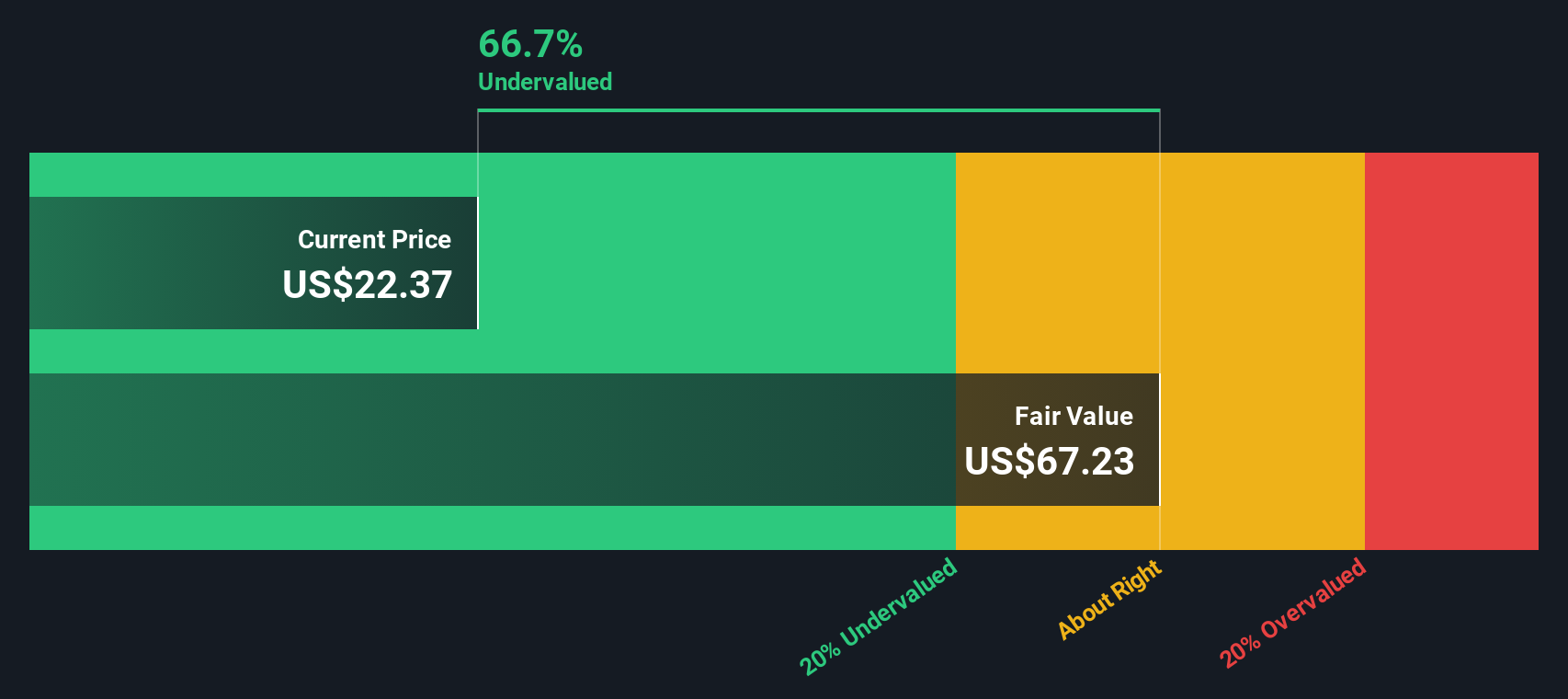

At the same time, our DCF model points to a different picture, with an estimated future cash flow value of $74.28 per share compared with the current $25.45 price, and Progyny flagged as trading 65.7% below that DCF based fair value estimate.

The SWS DCF model looks at projected future cash flows and discounts them back to today using a required rate of return. This produces a single estimate of intrinsic value for each share.

For a benefits management company like Progyny, with positive earnings and forecast profit growth, DCF can help investors compare long term cash flow potential to today’s market pricing, especially when the P/E multiple is well above sector averages.

Look into how the SWS DCF model arrives at its fair value.

Result: Price-to-Earnings of 38.8x (OVERVALUED)

However, there are still risks to watch, including the weaker 3 and 5 year total returns and any future reset in growth expectations that could pressure a 38.8x P/E.

Find out about the key risks to this Progyny narrative.

Another View: Cash Flows Tell a Different Story

If the 38.8x P/E makes Progyny look expensive, our DCF model paints a very different picture. On this view, estimated future cash flows point to a value of US$74.28 per share versus the current US$25.45 price, with the stock trading 65.7% below that estimate. Which signal do you give more weight to?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Progyny for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Progyny Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom Progyny view in minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Progyny.

Looking for more investment ideas?

If Progyny has sharpened your focus, do not stop here. You may miss plenty of other angles if you do not check a few more screens.

- Spot potential high risk high reward names using these 3535 penny stocks with strong financials and see which smaller companies line up with your comfort level.

- Explore the AI trend more deliberately by scanning these 23 AI penny stocks for businesses tied to artificial intelligence themes.

- Look for possible mispriced opportunities through these 878 undervalued stocks based on cash flows and see which stocks currently screen as inexpensive relative to their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com