Brightstar Lottery (NYSE:BRSL) just landed a 19 year deal to run Lotterywest’s new central gaming and digital platforms in Western Australia, a long runway that reframes the stock’s growth visibility.

See our latest analysis for Brightstar Lottery.

The Lotterywest win and the recent Cash Pop rollout in Pennsylvania have helped the mood around Brightstar, with the 1 day share price return of 2.65 percent standing out against a negative year to date share price return and an 18.95 percent 1 year total shareholder return that suggests momentum is quietly rebuilding over the longer run.

If this kind of long dated contract has your attention, it could be worth seeing what else is setting up for multi year growth via fast growing stocks with high insider ownership.

With the stock still trading at a chunky discount to analyst targets despite modest revenue growth and surging earnings, are investors overlooking a longer term inflection, or is the market already pricing in Brightstar’s next leg of growth?

Most Popular Narrative: 20.2% Undervalued

Against the last close of $16.10, the most followed narrative anchors on a fair value just over $20, framing meaningful upside if its assumptions hold.

Implementation and expansion of structural cost-cutting initiatives (OPtiMa 3.0) are expected to drive $50 million in annualized savings by 2026 (60 percent realized this year), helping to offset temporary profit headwinds and support a rebound to normalized EBITDA and free cash flow, directly benefiting earnings in the coming years.

Curious how modest top line growth can still justify a richer valuation? The narrative leans on a powerful profit swing and a re rated earnings multiple. Want to see which specific growth, margin, and valuation bridges connect today’s losses to that upside case? Read on to unpack the full playbook behind this fair value call.

Result: Fair Value of $20.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on smooth execution, with both regulatory tightening and jackpots fading faster than expected capable of derailing the multiple expansion story.

Find out about the key risks to this Brightstar Lottery narrative.

Another View: Slower Growth, Sharper Multiple Test

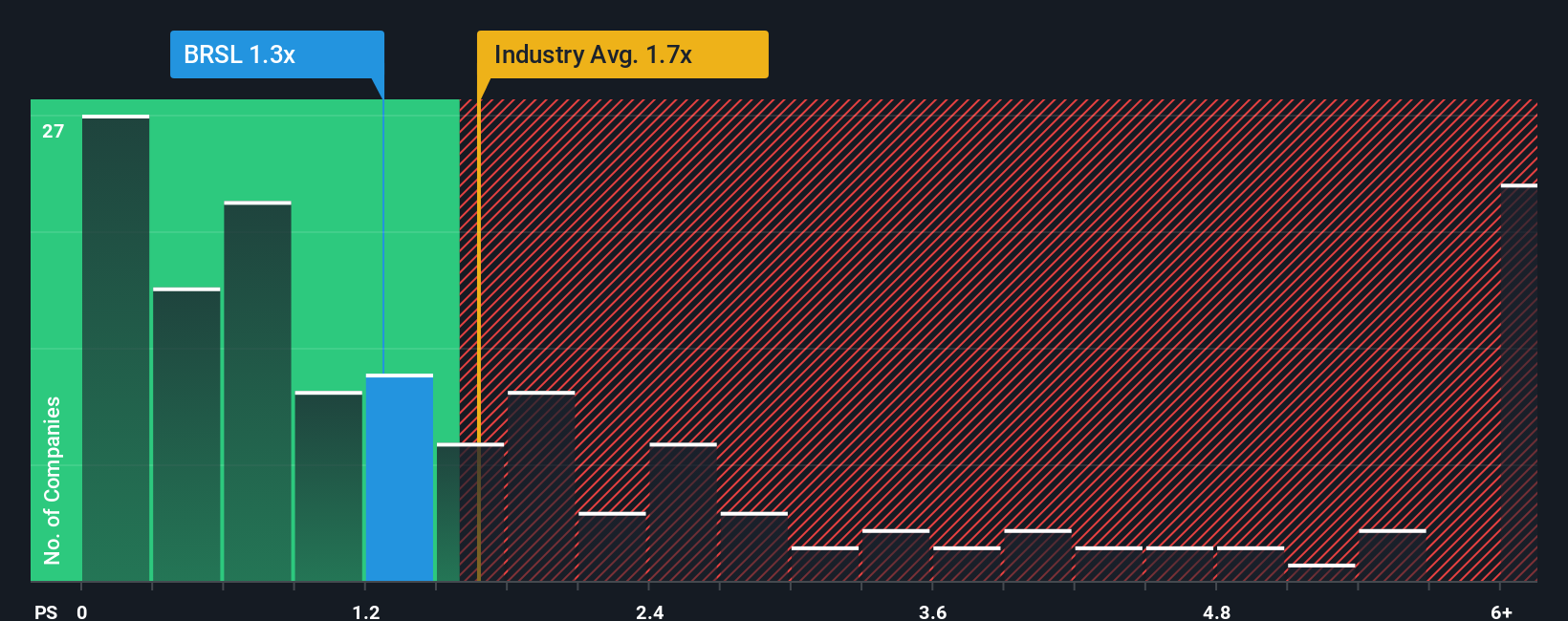

The narrative’s upside leans heavily on earnings inflecting higher, but revenue is only forecast to grow about 1.1 percent per year, well below the wider US market. With BRSL trading on a 1.2x sales ratio versus a 1.1x fair ratio, the question is whether the market is already paying up for that profit swing.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brightstar Lottery for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brightstar Lottery Narrative

If you want to stress test these assumptions or lean on your own due diligence instead, you can build a custom narrative in under three minutes, Do it your way.

A great starting point for your Brightstar Lottery research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next potential winners by using the Simply Wall St Screener to spot opportunities other investors could be missing.

- Capitalize on market mispricing by targeting value opportunities through these 917 undervalued stocks based on cash flows that combine robust cash flows with attractive entry prices.

- Ride the next wave of innovation by focusing on these 24 AI penny stocks positioned at the forefront of transformative artificial intelligence trends.

- Strengthen your income strategy by screening for dependable payouts with these 13 dividend stocks with yields > 3% offering yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com