Sherwin-Williams (SHW) shares have slipped about 9% over the past year, even as revenue and net income kept growing. That disconnect is what has investors asking whether the stock now offers better value.

See our latest analysis for Sherwin-Williams.

The stock has been drifting lower in recent months, with a 90 day share price return of minus 6.4 percent even as the three year total shareholder return sits above 40 percent. This suggests that longer term momentum is intact but near term enthusiasm has cooled.

If Sherwin-Williams has you rethinking where growth and pricing power might show up next, it could be worth scanning fast growing stocks with high insider ownership for other under the radar opportunities.

With earnings still climbing and the share price treading water, Sherwin-Williams now trades at a noticeable discount to Wall Street targets. But does that signal a buying opportunity, or has the market already priced in future growth?

Most Popular Narrative: 15% Undervalued

Compared to the last close at $327.87, the most widely followed narrative sees Sherwin-Williams worth closer to $385, framing a sizable value gap driven by long term earnings power rather than short term sentiment.

The company's sustained focus on cost control, broad and deep restructuring (doubling annual savings targets to ~$80 million), and disciplined SG&A management is structurally improving fixed cost leverage and expected to yield improved net margins and earnings power as sales volumes recover.

Want to see the full playbook behind that higher value? It hinges on steady growth, rising margins and a punchy future earnings multiple. Curious which specific financial leaps have to happen to make that price make sense? Dive in to see the assumptions this narrative is quietly betting on.

Result: Fair Value of $385.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weak demand in key construction end markets and ongoing supply chain inefficiencies could easily derail the margin and earnings recovery that this narrative assumes.

Find out about the key risks to this Sherwin-Williams narrative.

Another Angle on Value

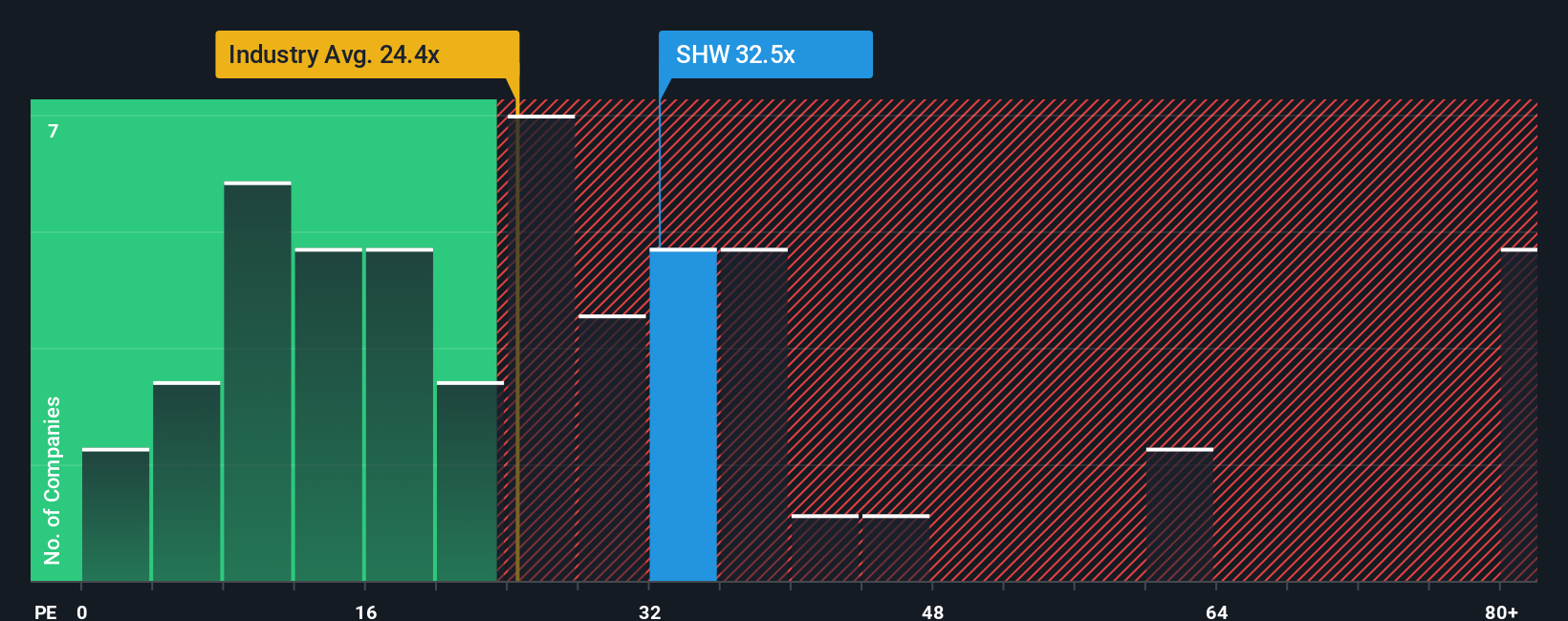

Analyst narratives say Sherwin-Williams looks about 15 percent undervalued, but its 31.4 times earnings multiple tells a different story. That is richer than the US Chemicals industry at 24.1 times, peers at 24.7 times, and our fair ratio estimate of 24.6 times, hinting at valuation risk if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sherwin-Williams Narrative

If this perspective is not quite yours, or you would rather dive into the numbers firsthand, you can craft a personalized view in minutes: Do it your way.

A great starting point for your Sherwin-Williams research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop with one stock. Sharpen your edge by hunting for fresh opportunities across sectors where growth, value, and income potential are already lining up.

- Explore potential upside by targeting earlier-stage companies with improving fundamentals through these 3636 penny stocks with strong financials before the wider market catches on.

- Position yourself within the AI theme by scanning these 26 AI penny stocks that may benefit from increasing demand for intelligent automation.

- Seek dependable income streams by focusing on these 13 dividend stocks with yields > 3% that can support both income and resilience in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com