- Earlier this month, Yara and Air Products announced they are in advanced talks to partner on low-emission ammonia projects, including a potential US$8.00–US$9.00 billion Louisiana complex and marketing of renewable ammonia from the nearly complete NEOM project in Saudi Arabia.

- A particularly important aspect is that Yara may acquire about a quarter of the Louisiana project’s ammonia assets and integrate the full output into its global distribution network under long-term agreements, potentially reshaping Air Products’ role across the low-carbon ammonia value chain.

- Now we’ll examine how this prospective Yara partnership, especially the Louisiana low-emission ammonia complex, could reshape Air Products’ investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Air Products and Chemicals Investment Narrative Recap

To own Air Products today, you need to believe that its heavy investment in low carbon hydrogen and ammonia will eventually translate into reliable, contract backed cash flows despite current losses and capital intensity. The Yara talks support that thesis by anchoring a large part of the Louisiana complex under long term offtake, but they also highlight that the key near term catalyst remains successful execution of these megaprojects, while the biggest risk is that delays or cost overruns keep capital tied up and free cash flow under pressure.

Among recent developments, the repeated analyst target cuts, including UBS trimming its target to US$250 and moving to Neutral after project updates around Louisiana and NEOM, feel most relevant here. They show how sensitive near term sentiment is to project timing and earnings visibility, even as multi decade contracts like the proposed 25 year hydrogen offtake to Yara aim to address exactly those concerns over time.

Yet even with long term contracts in sight, investors should be aware that execution risk on these large, capital intensive projects could still...

Read the full narrative on Air Products and Chemicals (it's free!)

Air Products and Chemicals' narrative projects $14.9 billion revenue and $3.8 billion earnings by 2028. This requires 7.4% yearly revenue growth and a roughly $2.2 billion earnings increase from $1.6 billion today.

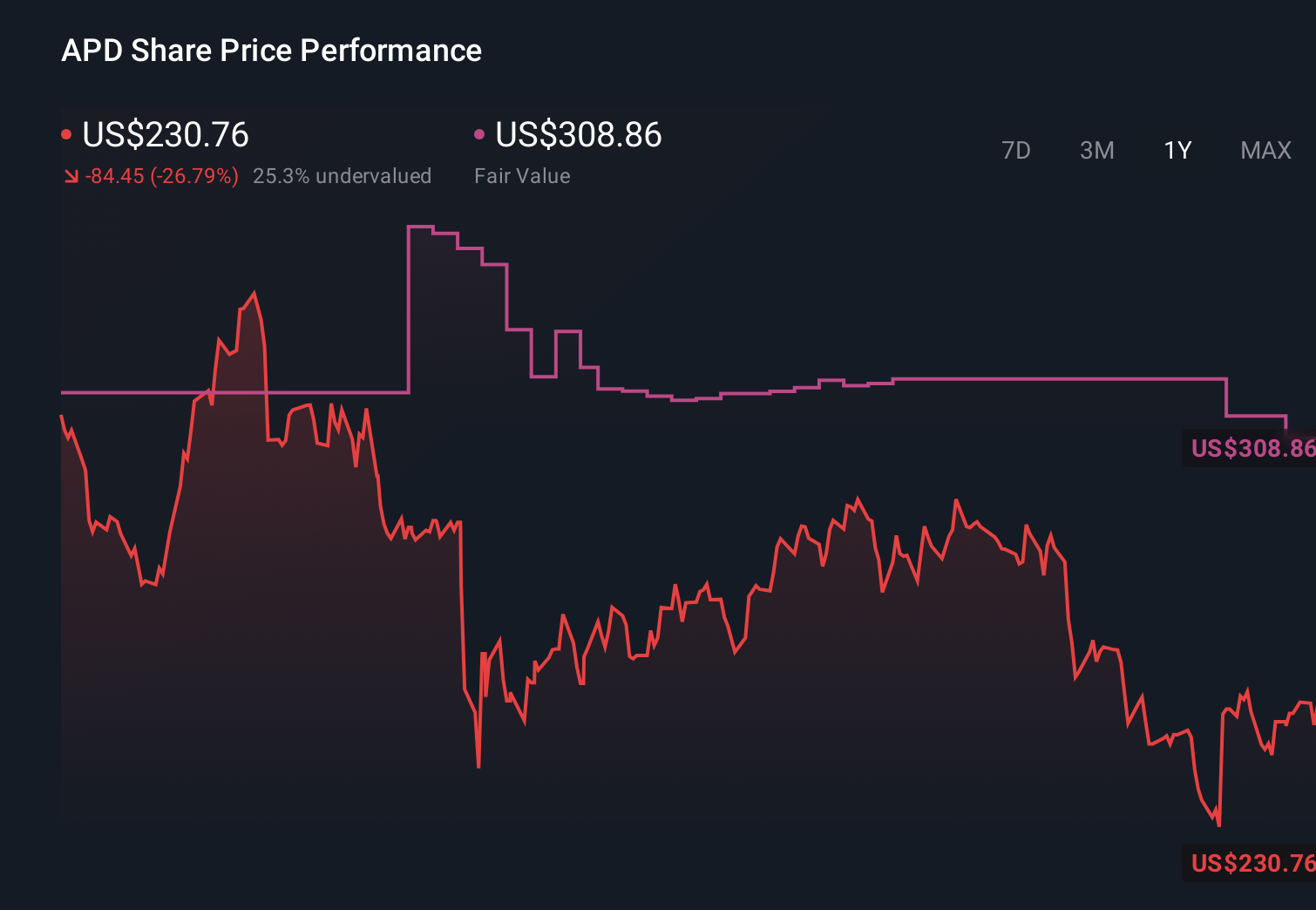

Uncover how Air Products and Chemicals' forecasts yield a $308.86 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community value Air Products between US$263.79 and US$308.86 per share, highlighting a fairly wide spread of expectations. You can weigh those views against the risk that large energy transition projects tie up capital for longer than planned and explore how different assumptions about execution and timing might affect the company’s eventual earnings power.

Explore 3 other fair value estimates on Air Products and Chemicals - why the stock might be worth as much as 27% more than the current price!

Build Your Own Air Products and Chemicals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Products and Chemicals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Air Products and Chemicals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Products and Chemicals' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com