- Earlier this week, BMO Capital Markets upgraded Ashland to an Outperform rating, citing operational improvements following restructuring and a more streamlined specialty chemicals portfolio.

- BMO also highlighted the potential involvement of an activist investor as a possible catalyst for sharpening management execution and influencing how value is returned to shareholders.

- Next, we will explore how BMO's upgrade and possible activist influence could reshape Ashland's investment narrative and future expectations.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ashland Investment Narrative Recap

To own Ashland, you need to believe its reshaped specialty chemicals portfolio and cost savings can overcome recent earnings volatility and end market softness. BMO’s upgrade, tied to restructuring progress and potential activist involvement, speaks directly to the near term catalyst of sharper execution, while the key risk remains structurally weaker demand and pricing pressure in core Specialty Additives if global conditions stay challenging.

One recent announcement that stands out alongside BMO’s call is Ashland’s November 2025 earnings release, where full year sales fell to US$1,824.0 million and the company posted a net loss of US$845.0 million following a large goodwill impairment. For investors, this combination of operational improvement commentary and stark financial results puts the spotlight on whether ongoing cost reductions and portfolio focus can offset slower top line momentum and help rebuild confidence in the earnings path.

But while the upgrade is encouraging, investors should also be aware of the risk that current demand softness in key markets could prove more structural than temporary...

Read the full narrative on Ashland (it's free!)

Ashland's narrative projects $2.0 billion revenue and $347.1 million earnings by 2028.

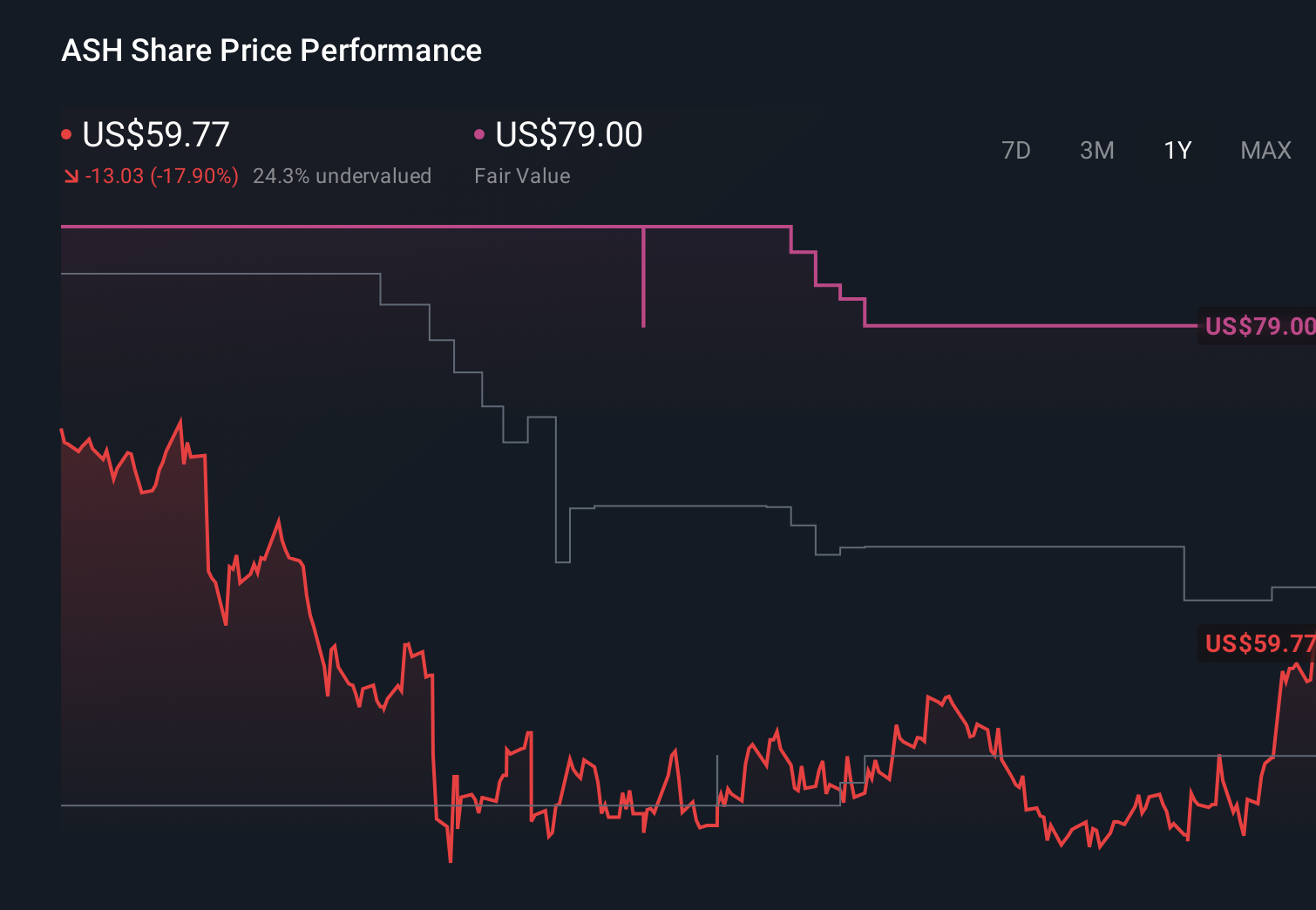

Uncover how Ashland's forecasts yield a $63.20 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community currently estimate Ashland’s fair value between US$63.20 and US$184.41, highlighting very different outlooks. When you set those views against the risk that persistent demand and pricing pressure in core additives markets could cap margin recovery, it underlines why checking multiple perspectives before forming an opinion on Ashland’s performance really matters.

Explore 2 other fair value estimates on Ashland - why the stock might be worth just $63.20!

Build Your Own Ashland Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ashland research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ashland research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ashland's overall financial health at a glance.

No Opportunity In Ashland?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 33 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com