General Electric (GE) has been in the spotlight after GE Vernova unveiled a new fuel cell initiative aimed at powering AI data centers, alongside steady enthusiasm for GE Aerospace’s recurring engine service revenue.

See our latest analysis for General Electric.

Despite a brief pullback, with a recent 1 day share price return of minus 0.75 percent to 298.73 dollars, General Electric’s roughly 77 percent year to date share price return and powerful 3 year total shareholder return above 500 percent signal strong and still building momentum around its aerospace strength and Vernova growth story.

If GE’s mix of aerospace engines and energy tech has your attention, this is a good moment to explore other aerospace and defense names via aerospace and defense stocks.

With the stock up more than 75 percent year to date yet still trading about 15 percent below consensus targets, are investors staring at a rare mispricing here, or is the market already baking in years of aerospace and Vernova growth?

Most Popular Narrative: 12.1% Undervalued

With General Electric last closing at 298.73 dollars versus a narrative fair value near 339.69 dollars, the storyline leans toward upside driven by aerospace strength.

Major supply chain stabilization and productivity gains from the FLIGHT DECK operating model and 2B plus investment in capacity are unlocking pent up services demand and enabling double digit output growth, translating into sustained higher free cash flow conversion and improved operating leverage.

Curious how steady but unspectacular revenue growth can still justify a premium valuation multiple for an old industrial name rebranded around aerospace engines and defense demand? The narrative leans on rising margins, compound earnings growth and a future valuation usually reserved for market darlings, not legacy conglomerates. Want to see exactly which profitability and cash flow assumptions need to hold for this fair value to work?

Result: Fair Value of $339.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside thesis faces real tests if commercial aviation demand stalls, or if prolonged supply chain and cost pressures ultimately cap margin expansion.

Find out about the key risks to this General Electric narrative.

Another View: Multiples Point to Rich Pricing

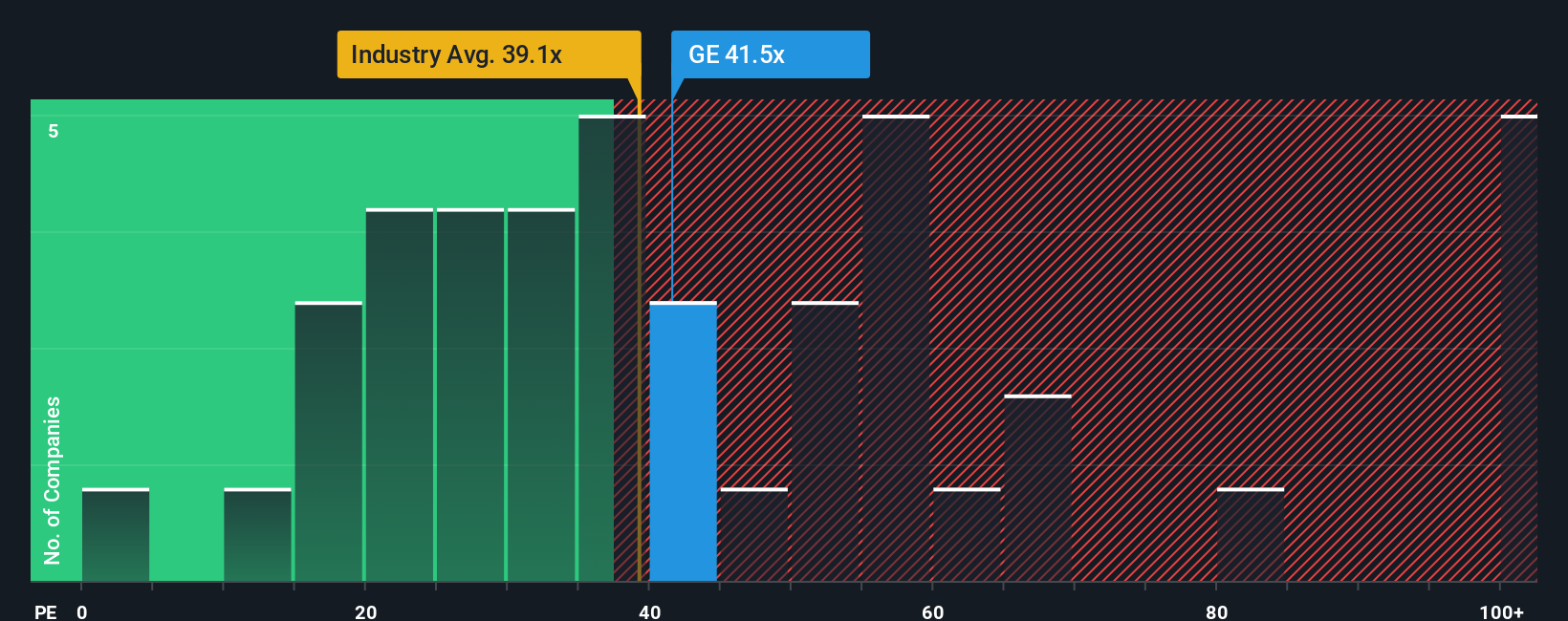

While the narrative fair value suggests upside, General Electric’s 39.1 times earnings stands above the US Aerospace and Defense average at 37.4 times, well above peers at 26.2 times, and even above its own fair ratio of 36.2 times. This raises the risk that sentiment, not fundamentals, is doing the heavy lifting, or raises the question of whether the market is correctly front running years of growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own General Electric Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape your own view in just minutes: Do it your way.

A great starting point for your General Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

If GE has sharpened your appetite for opportunity, do not stop here. Use the Simply Wall Street Screener to source your next smart, data backed move.

- Capture potential mispricings early by scanning these 908 undervalued stocks based on cash flows for companies whose cash flows suggest the market is still asleep at the wheel.

- Capitalize on powerful secular themes by targeting these 25 AI penny stocks that could benefit most from the AI build out reshaping entire industries.

- Strengthen your portfolio’s income engine by zeroing in on these 13 dividend stocks with yields > 3% that combine meaningful yields with underlying business resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com