Edwards Lifesciences (EW) is back in the spotlight after upbeat commentary around its latest earnings call, stronger sales growth, and raised guidance, a combination that often reshapes how investors think about long term upside and risk.

See our latest analysis for Edwards Lifesciences.

At around $85.32, Edwards Lifesciences has enjoyed a 90 day share price return of 13.46 percent and a 1 year total shareholder return of 15.11 percent, suggesting momentum is building as investors warm to its upgraded growth story.

If Edwards Lifesciences has renewed your interest in medical innovators, it could be worth scouting other healthcare names and uncovering fresh ideas through healthcare stocks.

Yet with revenue and earnings expanding at a healthy clip, and the share price still sitting below the average analyst target, the key question now is whether this represents a buying opportunity or whether markets are already pricing in future growth.

Most Popular Narrative Narrative: 10.5% Undervalued

With the most followed narrative pointing to a fair value near $95, compared with the last close at $85.32, the stage is set for a nuanced growth story.

The analysts have a consensus price target of $87.731 for Edwards Lifesciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $101.0, and the most bearish reporting a price target of $72.0.

Curious how steady but unspectacular growth, resilient margins, and a premium future earnings multiple can still argue for upside from here? The narrative explains the math behind that view, including how revenue, profit expectations, and a higher than typical earnings multiple all feed into that fair value estimate.

Result: Fair Value of $95.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering tariff headwinds and potential EPS dilution from the JenaValve acquisition could quickly challenge the current fair value optimism that investors are embracing.

Find out about the key risks to this Edwards Lifesciences narrative.

Another Angle on Valuation

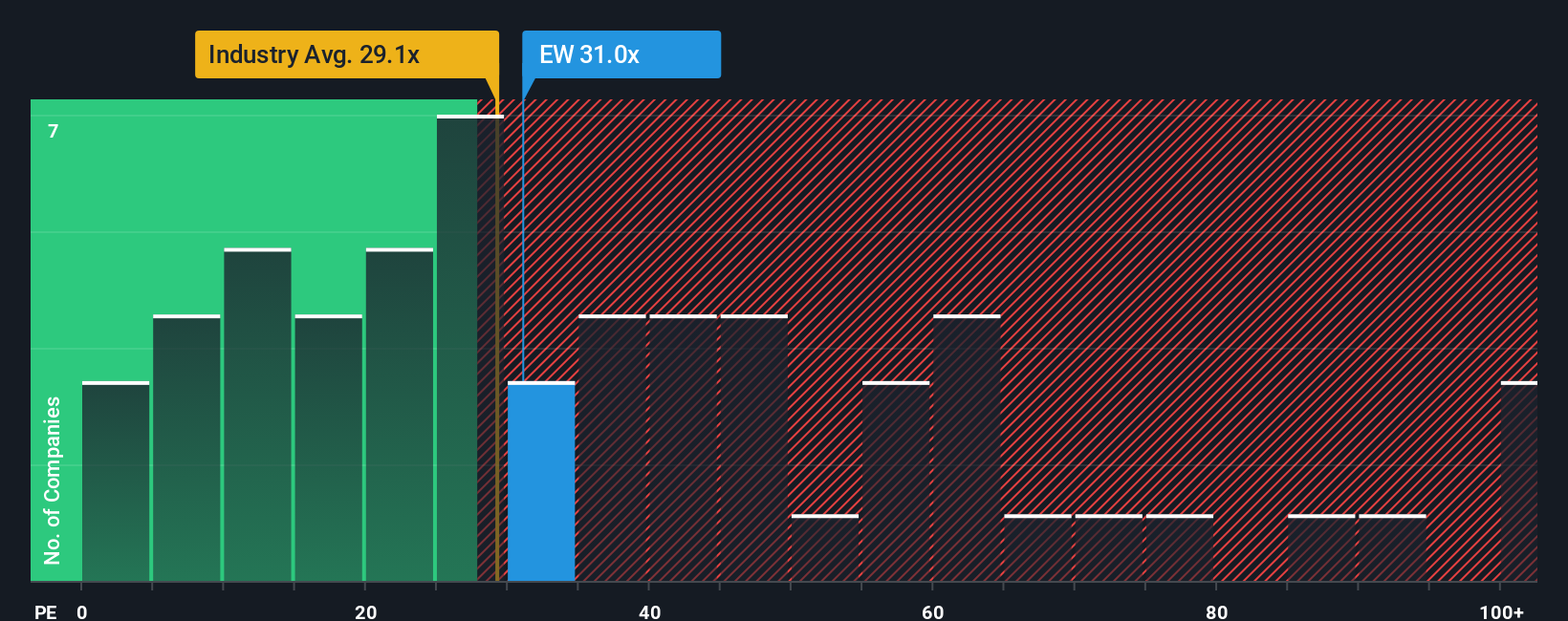

While the narrative fair value points to upside, our look at the earnings multiple tells a tougher story. Edwards trades on a 36.9x price to earnings ratio, versus 30.1x for the US Medical Equipment industry and a 29.9x fair ratio, suggesting clear valuation stretch rather than safety.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Edwards Lifesciences Narrative

If this perspective does not fully align with your own, or you would rather lean on your own analysis, you can build a custom view of Edwards Lifesciences in just a few minutes: Do it your way.

A great starting point for your Edwards Lifesciences research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall Street Screener now to pinpoint stocks that match your strategy so you are not chasing opportunities after sharper investors have moved.

- Capture potential bargains early by targeting companies priced below their cash flow potential with these 909 undervalued stocks based on cash flows.

- Capitalize on the AI revolution by focusing on innovative names shaping intelligent technology through these 25 AI penny stocks.

- Strengthen your income stream by zeroing in on reliable payers using these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com