Morgan Stanley’s upgrade just put Hershey (HSY) back on a lot of radar screens, as easing cocoa costs and a clearer path to earnings growth into 2026 reshape how investors are valuing this classic consumer name.

See our latest analysis for Hershey.

The upgrade comes after a choppy year, where a recent 1 month share price return of about 5 percent and 7 day share price return just over 4 percent hint that momentum is rebuilding, despite a slightly negative 3 month share price return and a still modest 1 year total shareholder return of roughly 9 percent.

If this kind of renewed interest in a steady compounder has you thinking more broadly about defensives, it might be worth exploring fast growing stocks with high insider ownership for other under the radar names showing strong conviction from their own leadership teams.

Yet with Hershey now trading close to Wall Street’s targets after a sharp rebound, are investors still getting paid for the looming earnings acceleration, or is the market already baking in every ounce of future growth?

Most Popular Narrative: 2% Undervalued

With Hershey last closing at $188.11 versus a narrative fair value of about $191.95, the story leans toward modest upside driven by earnings power.

The company is investing in its chocolate processing capacity, aiming for more agility and better management of supply chains, which should provide long term revenue growth through increased production and efficiency improvements, positively impacting net margins.

If you want to see what kind of revenue runway and margin reset could support that higher value, and why the projected earnings multiple looks more like a market leader than a sleepy staple, explore the full narrative to unpack the financial assumptions behind this seemingly conservative upside.

Result: Fair Value of $191.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubbornly high cocoa costs and a softer consumer backdrop could compress margins and delay the earnings acceleration that investors are currently banking on.

Find out about the key risks to this Hershey narrative.

Another Lens on Valuation

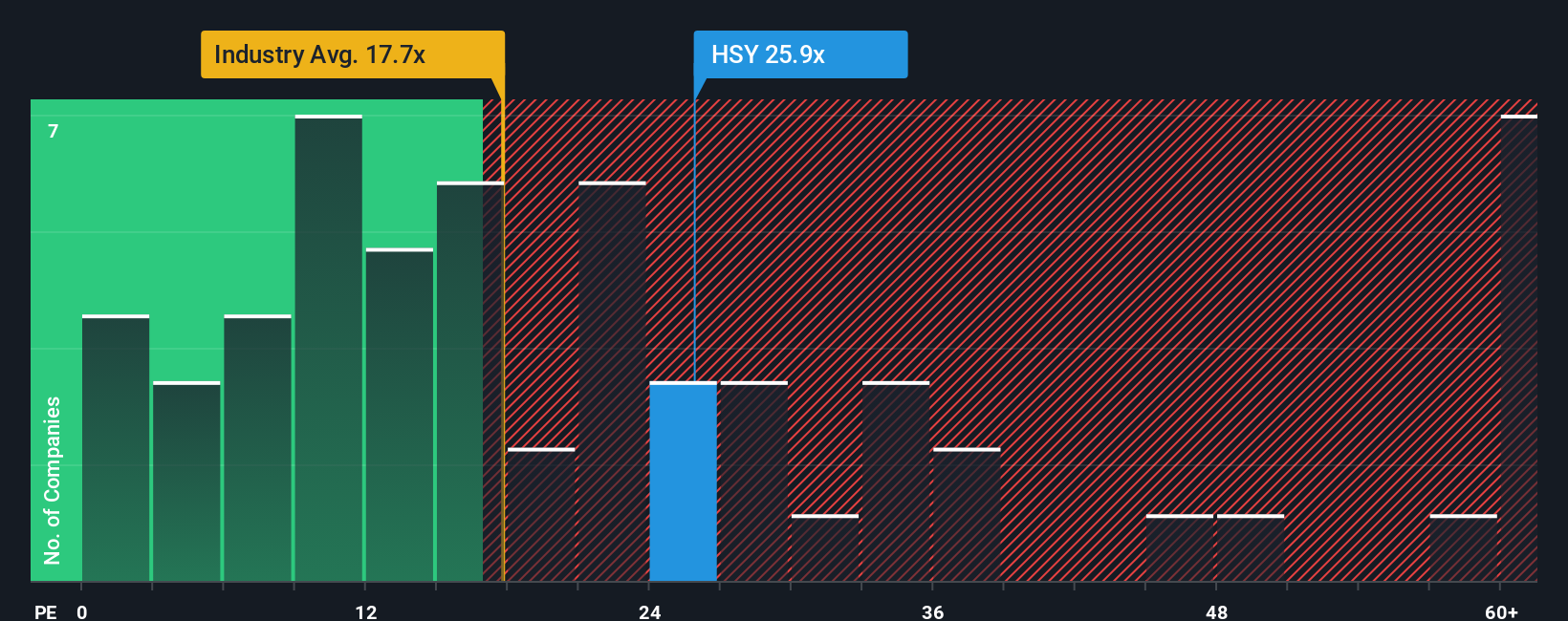

While the narrative fair value suggests Hershey is modestly undervalued, our ratio work paints a tougher picture. At 28.1 times earnings versus a 24.1 times peer average and a 22.9 times fair ratio, the stock looks rich, leaving less room for execution missteps or macro surprises.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hershey Narrative

If you see the numbers differently or want to stress test your own assumptions, build a custom take in under three minutes: Do it your way.

A great starting point for your Hershey research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas beyond Hershey?

Before you move on, turn today’s research momentum into action by hunting for your next opportunity with targeted screeners built to surface high conviction ideas fast.

- Secure potentially mispriced opportunities by scanning these 903 undervalued stocks based on cash flows that trade below their estimated cash flow value, before the wider market catches on.

- Capitalize on innovation trends by targeting these 26 AI penny stocks positioned to benefit from accelerating adoption of artificial intelligence across industries.

- Strengthen your portfolio income by focusing on these 13 dividend stocks with yields > 3% that may offer attractive yields with the potential for long term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com