Tradeweb Markets (TW) has quietly slid about 21% over the past year, even as its electronic trading platform continues to generate solid revenue and profit growth. This has created an interesting gap between share performance and business momentum.

See our latest analysis for Tradeweb Markets.

Despite the latest share price of $104.2 and a recent stretch of weaker momentum, including a double digit 3 month share price pullback, Tradeweb still boasts a strong three year total shareholder return of about 71%. This hints that the longer term story remains intact even as sentiment cools.

If Tradeweb’s recent wobble has you rethinking your watchlist, this could be a good moment to explore other fast growing stocks with high insider ownership that might offer a more compelling mix of growth and conviction.

With revenue and profits still climbing, analysts seeing double digit upside to fair value, yet the share price lagging, investors now face a pivotal question: is Tradeweb undervalued, or is the market already discounting its future growth?

Most Popular Narrative: 19.1% Undervalued

With Tradeweb last closing at $104.20 against a narrative fair value near $128.77, the valuation story leans optimistic and hinges on aggressive profitability gains.

The company's international and multi-asset expansion, particularly in emerging markets and APAC, is delivering above-average growth rates (e.g., 41% international revenue growth and EM swaps revenue up 40%+), reflecting cross-border flows and the need for global, multi-currency platform connectivity, supporting long-term diversification of revenues and reducing geographic concentration.

Want to see why this narrative treats Tradeweb more like a high growth platform than a mature exchange? Revenue mix shifts, richer margins, and a future earnings multiple that assumes the story is only just getting started sit at the core of this valuation. Curious how those moving parts add up to that implied upside? Open the full narrative to unpack the numbers behind the conviction.

Result: Fair Value of $128.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slipping US Treasuries share and persistent fee pressure could temper electronification upside and challenge the upbeat valuation narrative if growth normalizes.Find out about the key risks to this Tradeweb Markets narrative.

Another Angle on Valuation

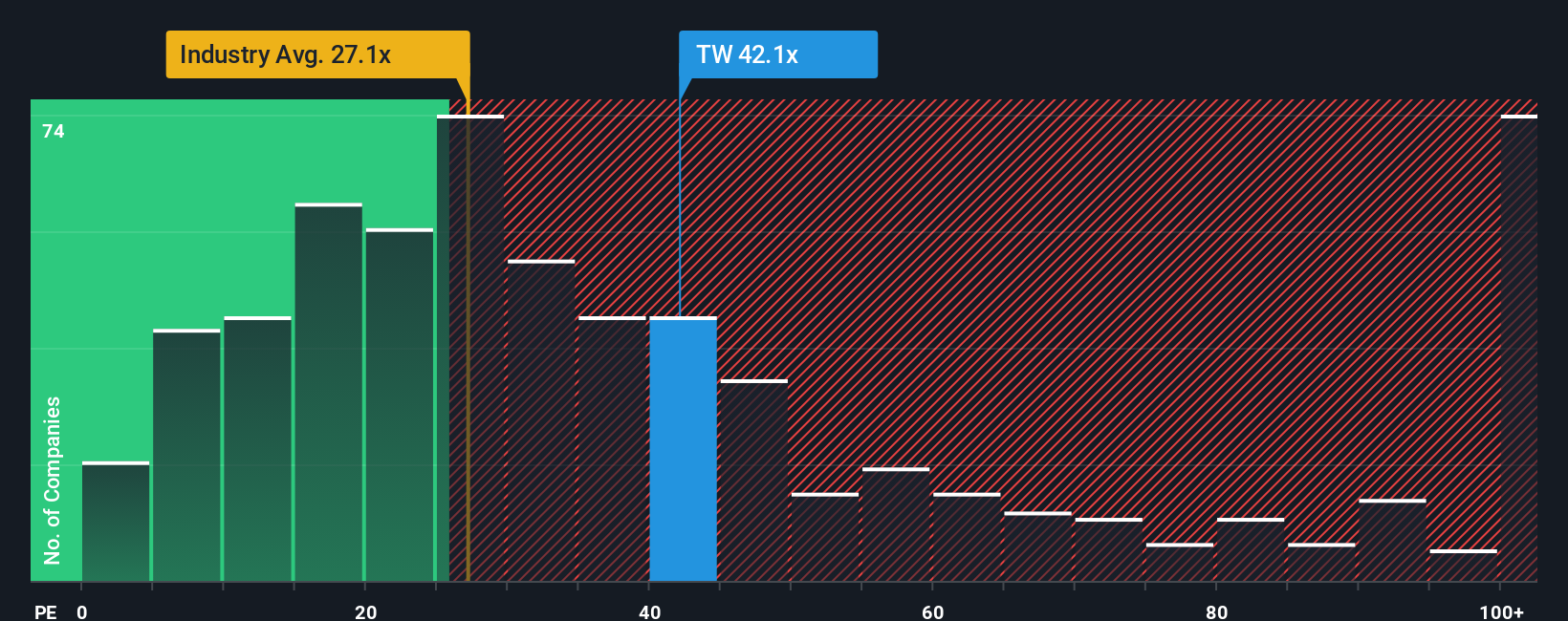

On simple earnings metrics, Tradeweb looks much richer than the narrative suggests. Its 35.3x price to earnings ratio towers over the industry at 25.2x and a fair ratio of 16.5x. This points to a market that is already pricing in a lot of success. Is that premium really a safety net or a source of downside risk if growth cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tradeweb Markets Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a fresh narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Tradeweb Markets.

Looking for more investment ideas?

Before the next move in Tradeweb unfolds, use the Simply Wall Street Screener to explore additional opportunities that could change your portfolio’s return potential.

- Consider early-stage momentum by reviewing these 3612 penny stocks with strong financials that already show financial strength rather than pure speculation.

- Explore the next wave of innovation by focusing on these 26 AI penny stocks building real products around artificial intelligence, not just hype.

- Look for potential mispricings by examining these 908 undervalued stocks based on cash flows where cash flow fundamentals suggest value that the market may not have fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com