Morgan Stanley’s downgrade of HCA Healthcare (HCA) to Underweight, paired with L1 Capital trimming its stake after strong gains, has investors rethinking whether the recent run up justifies today’s valuation.

See our latest analysis for HCA Healthcare.

Those concerns are landing after a huge run, with HCA’s share price at $484.77 and a powerful year to date share price return of 62.81%. Its five year total shareholder return of 209.92% signals long term momentum that may now be cooling at the margins.

If this kind of debate over momentum and valuation has you curious about the rest of the sector, it might be a good time to explore healthcare stocks.

With shares now trading just above analyst targets but still showing a hefty intrinsic value gap, the central question emerges: is HCA undervalued on long term fundamentals, or is the market already pricing in years of future growth?

Most Popular Narrative Narrative: 1.5% Overvalued

With HCA closing at $484.77 against a narrative fair value of about $477.70, the prevailing view sees only a slim valuation premium.

They highlight that stronger revenue per adjusted admission, solid margin execution, and increased visibility into state directed and supplemental payment flows together support a higher valuation multiple and above trend earnings growth over the next several years.

Want to see why steady volume growth, firm margins, and aggressive buybacks might still justify a richer multiple at these levels? The earnings roadmap, embedded growth pace, and assumed future valuation all hide in the details. Curious which forecasts are doing the heavy lifting in that fair value math?

Result: Fair Value of $477.70 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn labor and supply cost pressures, or policy shifts to Medicaid and supplemental payments, could quickly challenge today’s premium narrative.

Find out about the key risks to this HCA Healthcare narrative.

Another View: Ratios Point To Deep Value

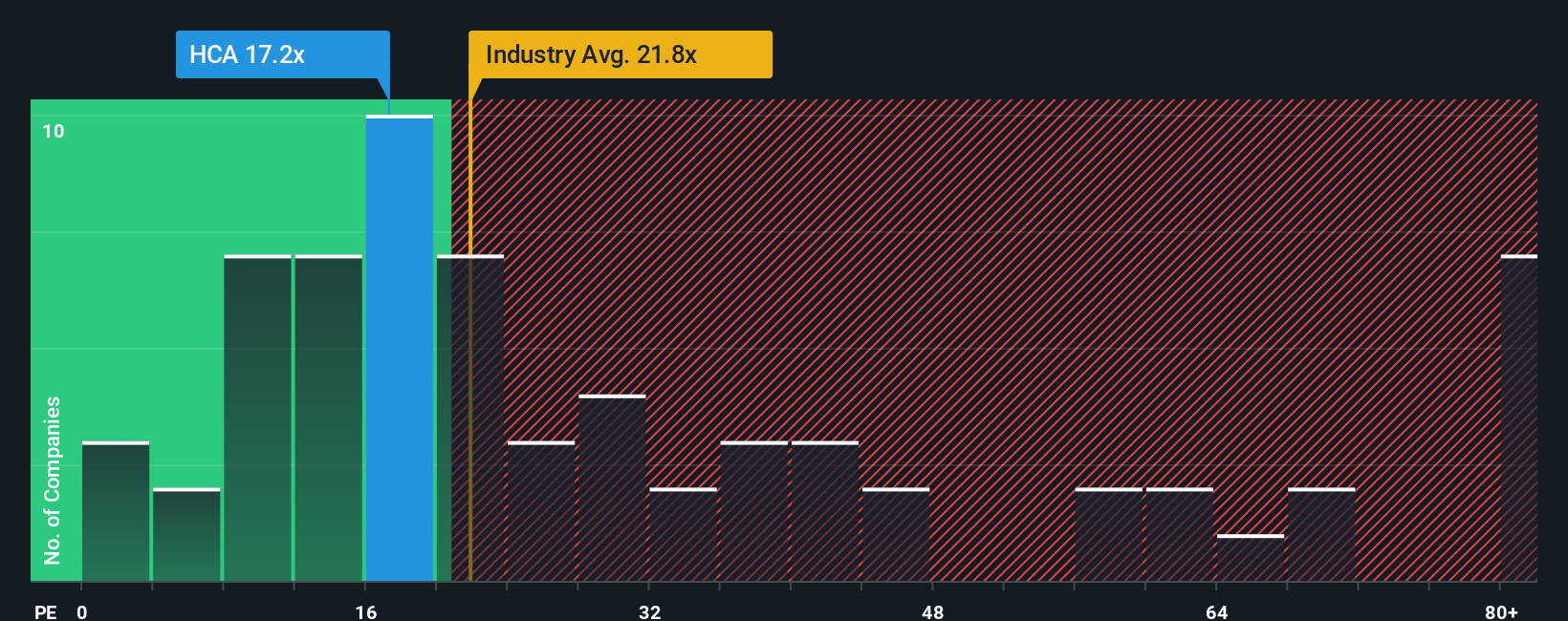

While the narrative fair value suggests HCA is 1.5% overvalued, the earnings ratio story is very different. At 17.4 times earnings, HCA trades below peers at 18.4 times and well under a fair ratio of 29.6 times, which hints at upside potential if sentiment normalizes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HCA Healthcare Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized narrative in just a few minutes with Do it your way.

A great starting point for your HCA Healthcare research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall St Screener to move beyond one stock, quickly spot fresh opportunities, and avoid missing quality ideas that could shape your next big win.

- Capture potential high-upside trades by targeting these 3612 penny stocks with strong financials that already back their small size with surprisingly strong balance sheets and fundamentals.

- Position your portfolio ahead of the next tech shift by focusing on these 26 AI penny stocks building real revenue momentum from artificial intelligence innovation.

- Strengthen your long term returns by zeroing in on these 13 dividend stocks with yields > 3% that combine solid payouts with the potential for sustainable income growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com