- In recent days, United Rentals has drawn fresh attention as analysts at firms including Morgan Stanley and Citigroup reaffirmed positive views, while the company completed a US$1.50 billion senior notes offering and expanded internationally through the acquisition of Australian rental business Alfasi Hire.

- Together with a high GF Score of 95 out of 100 and an 18.45% operating margin increase over five years, these moves highlight how United Rentals is reinforcing its position as a broad-service equipment rental provider with an emphasis on higher-margin specialty capabilities.

- We’ll now examine how this analyst support, combined with the Alfasi Hire acquisition, may influence United Rentals’ existing investment narrative and risk profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

United Rentals Investment Narrative Recap

To own United Rentals, you need to believe in the long term value of its scaled rental network and growing specialty offering, while accepting exposure to project cycles and heavy capital needs. The latest analyst affirmations, debt raise and Alfasi Hire acquisition do not materially change the near term picture, where the key catalyst remains execution in higher margin specialty rentals and the main risk is pressure on free cash flow if large projects or equipment demand soften.

Among the recent developments, the US$1.50 billion senior notes offering stands out because it directly interacts with that capital intensive model. Fresh funding can support expansion and specialty growth, but it also sits alongside an already high debt load, which may matter if macro conditions worsen just as United Rentals leans into its one stop shop and cross selling ambitions.

Yet investors should also recognise the risk that high current CapEx commitments could pressure free cash flow if...

Read the full narrative on United Rentals (it's free!)

United Rentals’ narrative projects $18.8 billion revenue and $3.5 billion earnings by 2028. This requires 6.1% yearly revenue growth and about a $1.0 billion earnings increase from $2.5 billion today.

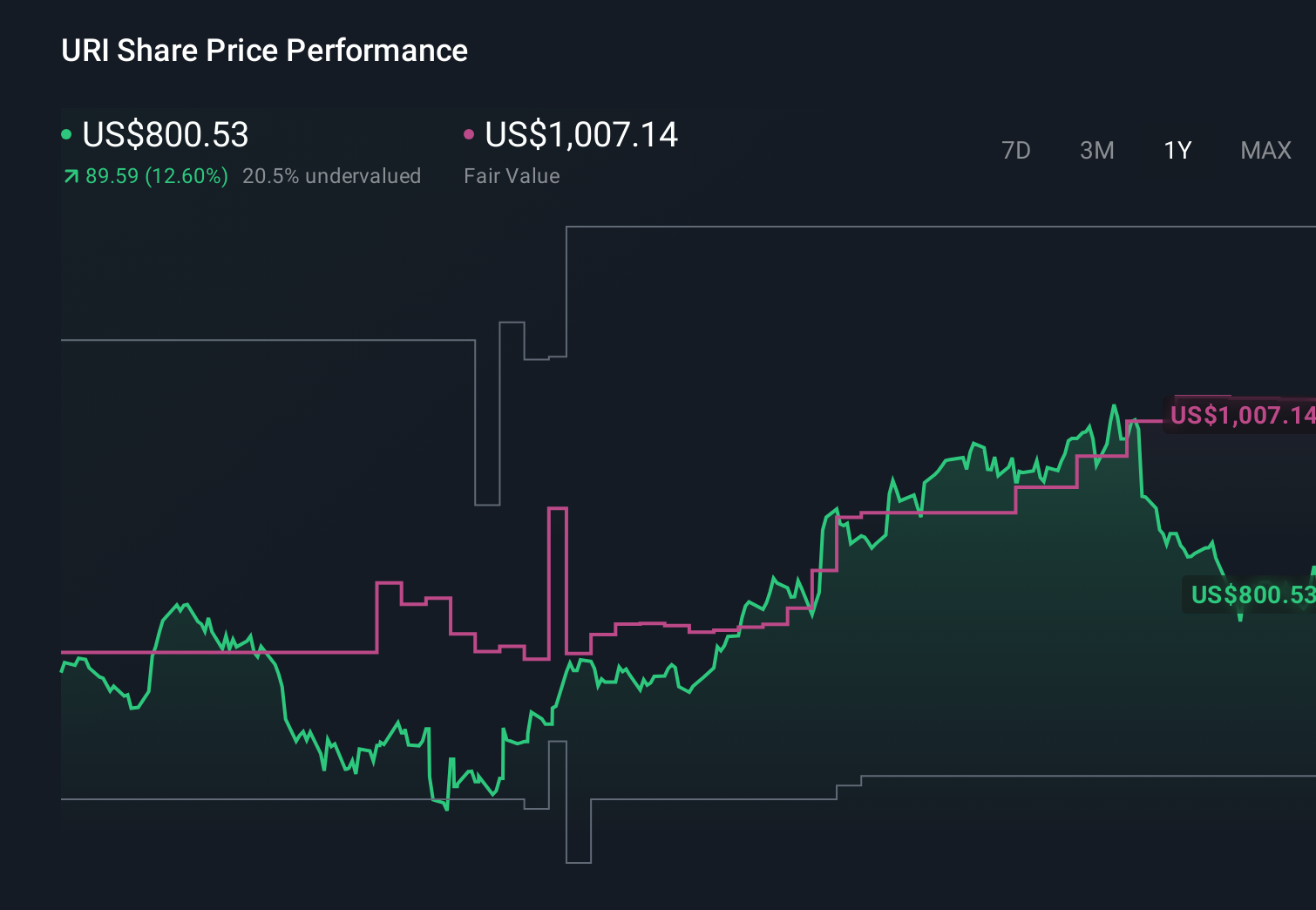

Uncover how United Rentals' forecasts yield a $1025 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span roughly US$533 to US$1,212 per share, showing how far apart individual views can be. As you weigh those opinions against the company’s push into higher margin specialty rentals, it is worth considering how much growth in that smaller segment would really need to offset any slowdown in large project activity.

Explore 5 other fair value estimates on United Rentals - why the stock might be worth 35% less than the current price!

Build Your Own United Rentals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Rentals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Rentals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Rentals' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com