Academy Sports and Outdoors, Inc. (NASDAQ:ASO) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Unfortunately, despite the strong performance over the last month, the full year gain of 5.7% isn't as attractive.

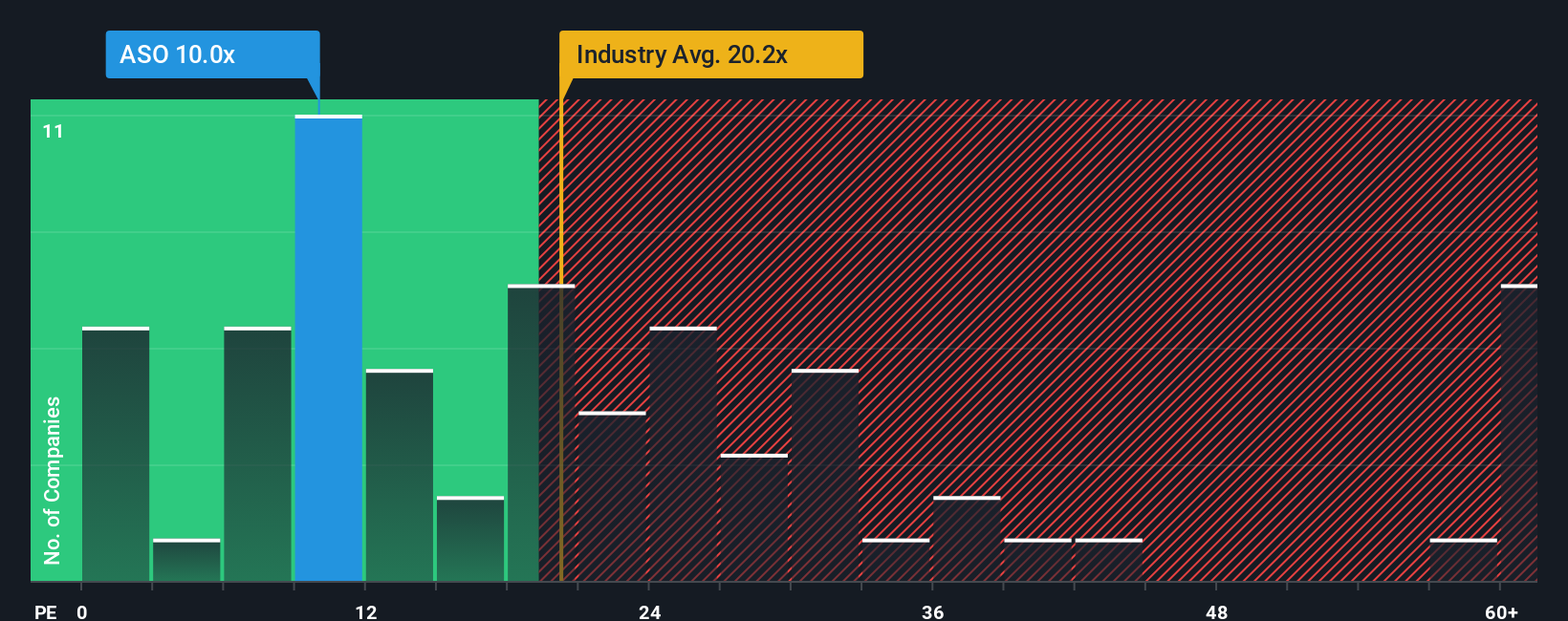

Although its price has surged higher, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 20x, you may still consider Academy Sports and Outdoors as an attractive investment with its 10x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

While the market has experienced earnings growth lately, Academy Sports and Outdoors' earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Academy Sports and Outdoors

Is There Any Growth For Academy Sports and Outdoors?

Academy Sports and Outdoors' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 11%. The last three years don't look nice either as the company has shrunk EPS by 22% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 12% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 11% per year, which is not materially different.

In light of this, it's peculiar that Academy Sports and Outdoors' P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Academy Sports and Outdoors' P/E

Despite Academy Sports and Outdoors' shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Academy Sports and Outdoors currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Academy Sports and Outdoors with six simple checks on some of these key factors.

If you're unsure about the strength of Academy Sports and Outdoors' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.