- Recent reports show Southern Copper’s short interest has risen 9.14% since the last update, with 9.47 million shares now sold short, representing 9.91% of the freely tradable float and far exceeding the sector’s 1.57% average.

- This elevated short positioning signals a sharp shift toward caution among traders and places Southern Copper under much closer scrutiny than its peers.

- With short interest now far above industry levels, we’ll explore how this growing bearish positioning may influence Southern Copper’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Southern Copper Investment Narrative Recap

To own Southern Copper, you generally need to believe in sustained demand for copper and the company’s ability to convert high margins into long term cash generation, despite sizable capex and cost pressures. The sharp rise in short interest heightens short term scrutiny but does not directly change the core catalyst around earnings resilience or the main risk of rising operating costs and large, long duration investment commitments.

Against that backdrop, the recent pattern of rising cash dividends, including the US$0.90 per share payout authorized on October 29, 2025, highlights management’s confidence in current earnings power. While supportive for the near term narrative, these higher distributions sit alongside more than US$15,000,000,000 in planned capital spending, which could test the balance between rewarding shareholders today and funding future growth.

Yet investors should be aware that if operating costs continue to rise faster than sales growth, then...

Read the full narrative on Southern Copper (it's free!)

Southern Copper's narrative projects $13.0 billion revenue and $4.3 billion earnings by 2028.

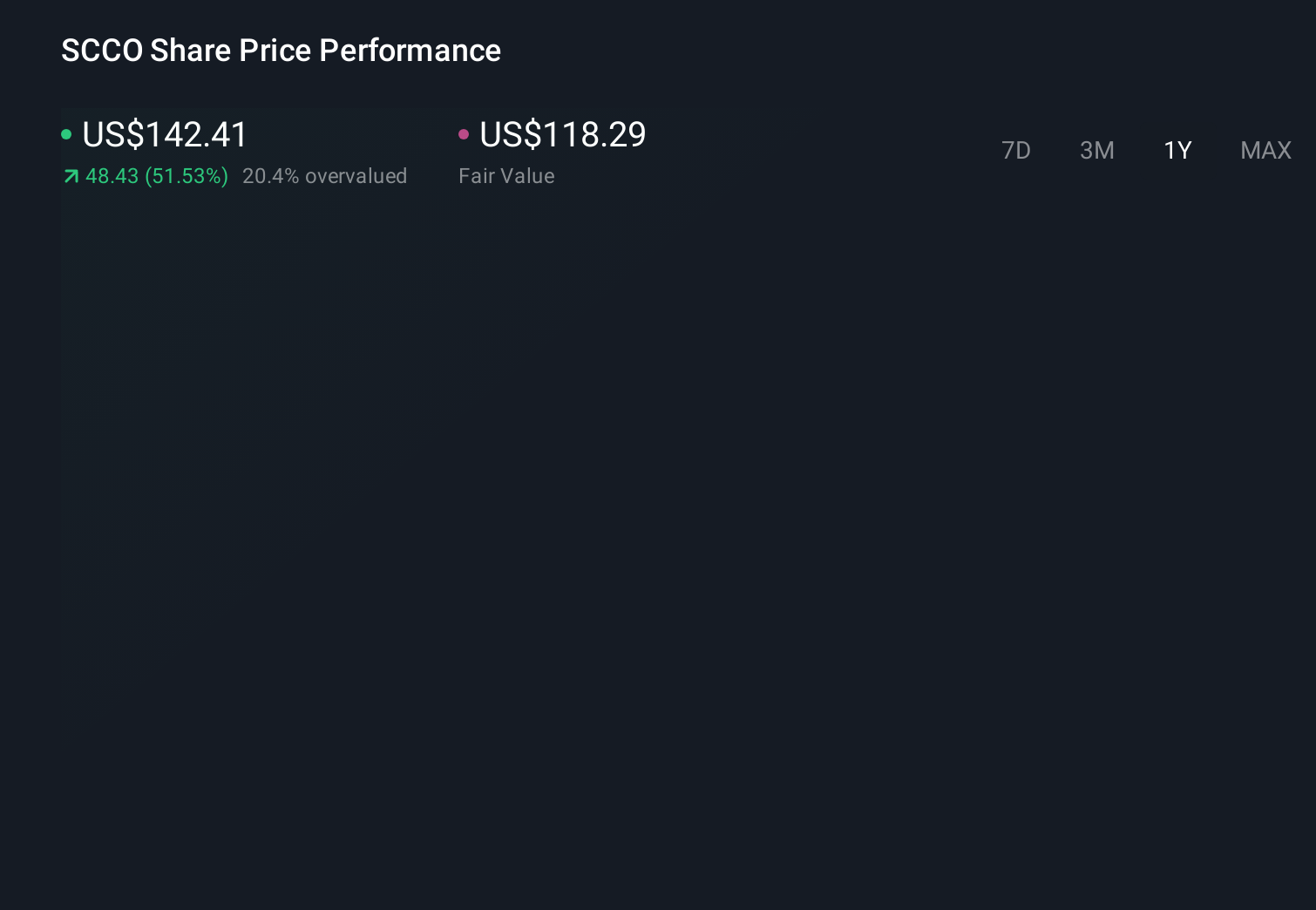

Uncover how Southern Copper's forecasts yield a $118.29 fair value, a 20% downside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community fair value estimates for Southern Copper cluster between US$100 and about US$124.82 per share, showing how differently individual investors can size up the same business. Set against elevated short interest and rising operating cost risk, these contrasting views underline why it helps to compare several independent opinions before deciding how Southern Copper fits into your own expectations.

Explore 4 other fair value estimates on Southern Copper - why the stock might be worth 32% less than the current price!

Build Your Own Southern Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southern Copper research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southern Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southern Copper's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com