New Oriental Education & Technology Group (NYSE:EDU) has just been dropped from the Hang Seng China Enterprises Index, a move that could reshape how index-tracking funds and institutional investors position around the stock.

See our latest analysis for New Oriental Education & Technology Group.

The index removal lands at a delicate moment, with New Oriental’s 7 day share price return of 5.01 percent standing against a year to date share price return of negative 12.82 percent. At the same time, its 3 year total shareholder return of 68.07 percent still hints at meaningful long term recovery momentum.

If this shake up has you rethinking where growth could come from next, it might be worth exploring fast growing stocks with high insider ownership as a way to spot other compelling stories on your radar.

With earnings still growing and the share price trading at a steep discount to analyst targets and intrinsic value estimates, is New Oriental quietly undervalued here, or is the market already discounting all of its future growth potential?

Most Popular Narrative: 16.8% Undervalued

With the narrative fair value set well above the last close at $53.67, the stage is set for a growth and margins driven debate.

Continued investment and rollout of omnichannel online merge offline and AI driven systems are enabling operating leverage, cost reductions, and higher efficiency in delivery, which is already resulting in improved operating margins 410bps YoY in core business, supporting future earnings growth through both topline expansion and margin expansion.

To see the engine behind that premium valuation, and why future earnings, margins, and share count all pull in the same direction, explore the full narrative.

Result: Fair Value of $64.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer overseas study demand and intensifying non academic competition could still pressure margins and slow growth, challenging assumptions behind that undervalued narrative.

Find out about the key risks to this New Oriental Education & Technology Group narrative.

Another Lens on Valuation

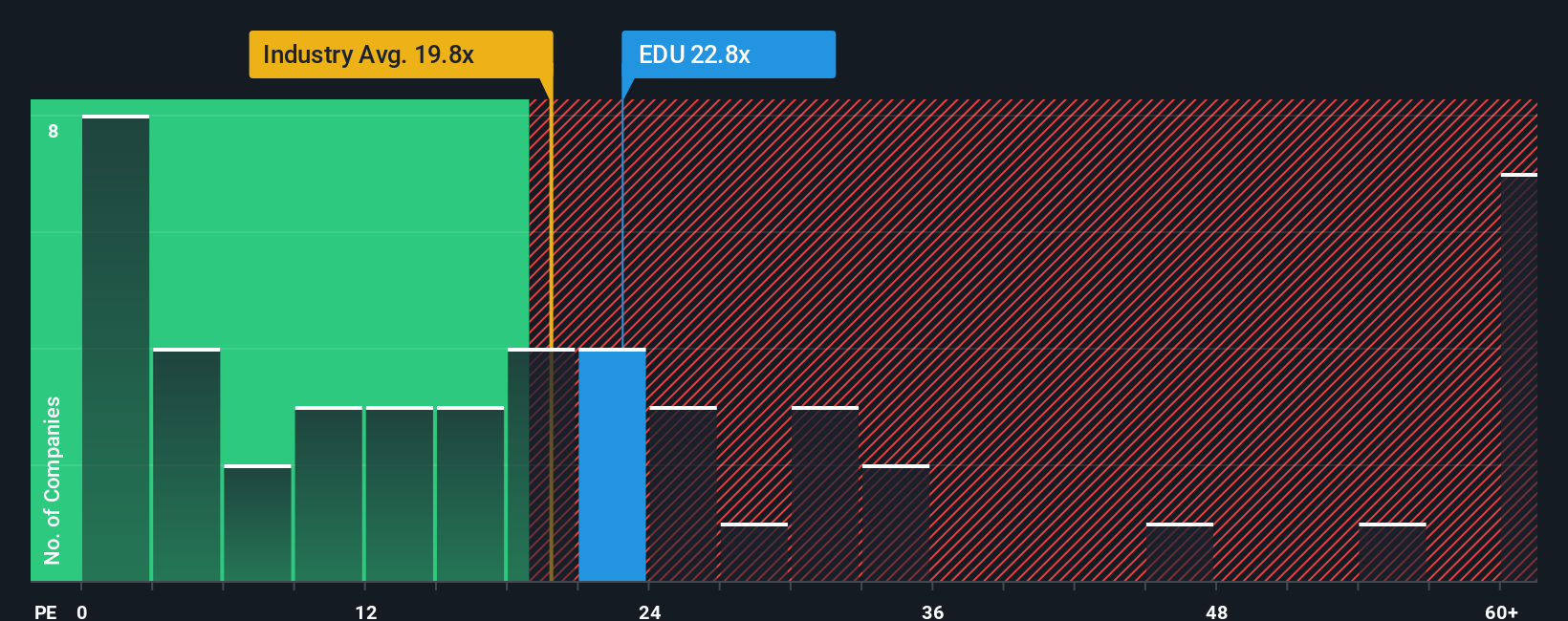

Analysts see New Oriental as undervalued, but its price to earnings ratio of 23.3 times is notably richer than the US Consumer Services average of 15.9 times, only slightly below peers at 24.6 times and close to a fair ratio of 23.6 times. This suggests less obvious upside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own New Oriental Education & Technology Group Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalised view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding New Oriental Education & Technology Group.

Ready for your next investing move?

Before you move on, lock in fresh opportunities with targeted ideas from the Simply Wall Street Screener, so you are not chasing the market after it moves.

- Capture potential multi-baggers early by scanning these 3607 penny stocks with strong financials where strong balance sheets meet tiny market caps.

- Supercharge your growth focus with these 25 AI penny stocks tapping into companies building the infrastructure and applications behind artificial intelligence.

- Lock in value opportunities ahead of the crowd by tracking these 908 undervalued stocks based on cash flows that still trade below what their cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com