- ATI Inc. has announced that longtime executive James Robert "Rob" Foster will become Senior Vice President, Finance and Chief Financial Officer on January 1, 2026, succeeding current CFO Don Newman, who will move into a Strategic Advisor role before retiring on March 1, 2026.

- The choice of an internal leader with both deep operational experience and prior finance leadership signals ATI’s emphasis on tying capital decisions closely to manufacturing performance and long-term contract execution.

- We’ll now examine how Foster’s blend of operational and finance expertise could influence ATI’s investment narrative and longer-term earnings trajectory.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

ATI Investment Narrative Recap

To own ATI, you need to believe in its position as a high value alloys supplier to aerospace and defense, and its ability to earn attractive returns on large, ongoing capital investments. The CFO transition to Rob Foster does not appear to change the near term focus on executing long term Boeing and Airbus contracts, nor does it materially reduce key risks such as heavy capex needs and exposure to weaker industrial and medical demand.

Among recent announcements, ATI’s expanded long term titanium products agreement with Boeing stands out as most relevant, because Foster has managed both the Specialty Alloys & Components business and ATI’s capital deployment processes that support these contracts. His background ties directly into the main catalyst of reliably supplying next generation aerospace programs while trying to protect margins and cash generation in the face of high ongoing investment requirements.

But investors should still pay close attention to ATI’s heavy capital spending needs and what that could mean for...

Read the full narrative on ATI (it's free!)

ATI's narrative projects $5.5 billion revenue and $635.6 million earnings by 2028. This requires 6.7% yearly revenue growth and a $218.1 million earnings increase from $417.5 million today.

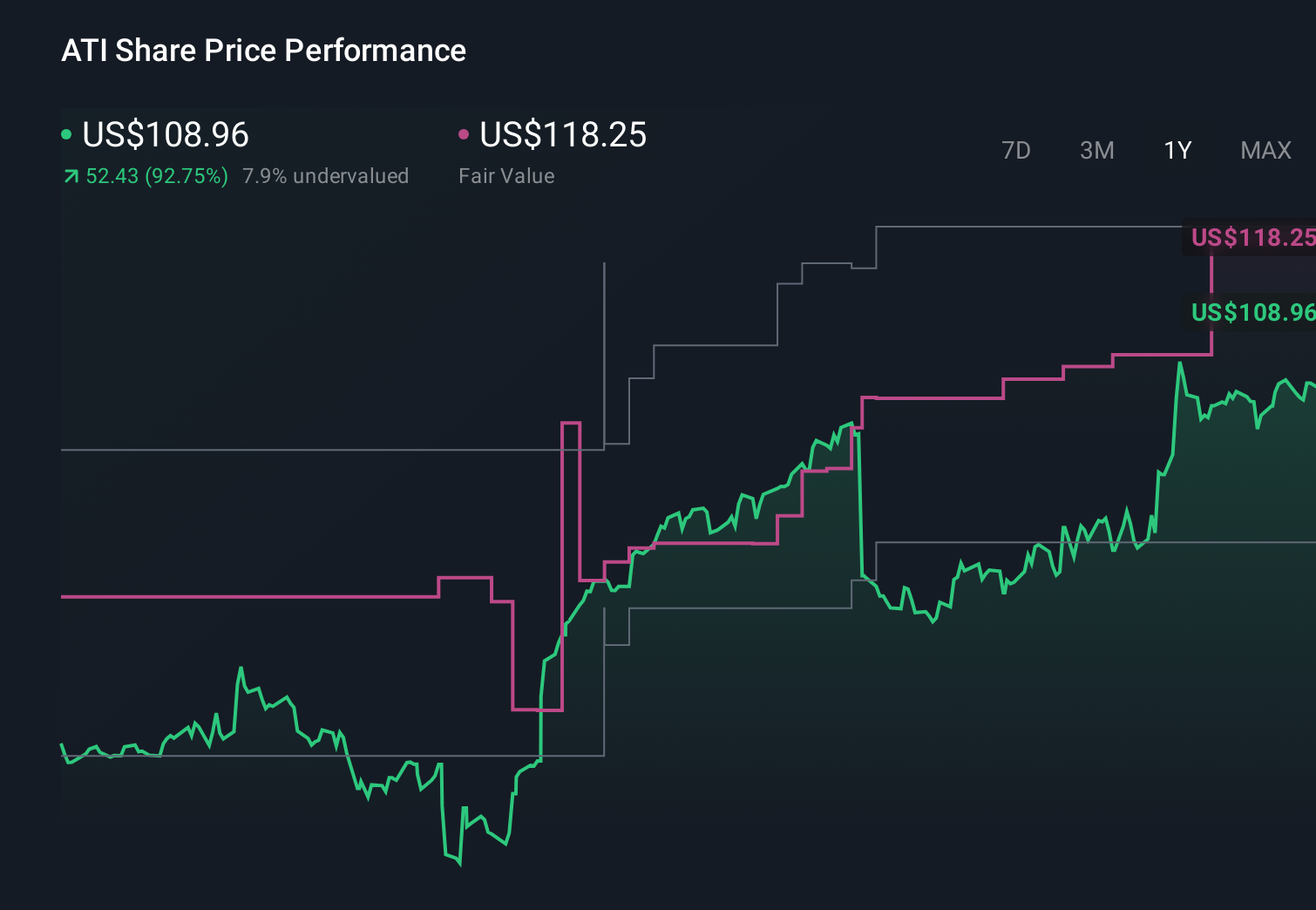

Uncover how ATI's forecasts yield a $118.25 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community value ATI between US$62.68 and US$118.25 per share, highlighting very different expectations. Against this, ATI’s dependence on significant capex for capacity and upgrades could influence how sustainable any perceived upside really is, so it is worth comparing several of these viewpoints side by side.

Explore 5 other fair value estimates on ATI - why the stock might be worth 40% less than the current price!

Build Your Own ATI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ATI research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ATI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ATI's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com