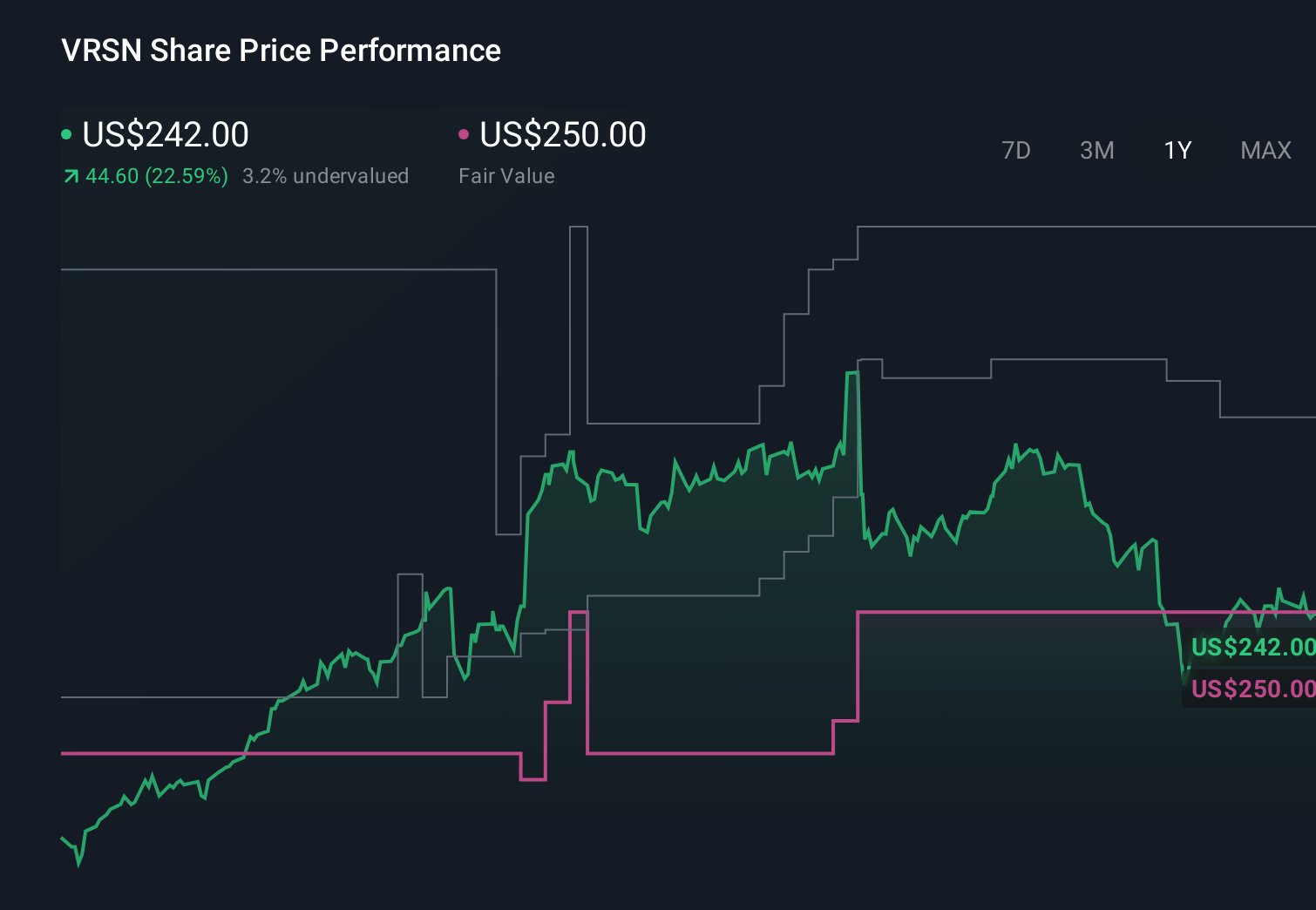

- If you are wondering whether VeriSign at around $242 a share is still worth considering, or if the big gains are already behind it, this breakdown is for you.

- Despite being down 3.0% over the last week and 2.2% over the past month, the stock is still up 18.1% year to date and 22.2% over the last year, which quietly signals resilient long term momentum.

- Recently, investors have been refocusing on VeriSign's core role in internet infrastructure and its long term, contract based revenue. This has helped support sentiment even through bouts of volatility. At the same time, ongoing discussions around internet governance and the strategic importance of domain name services have kept the stock on the radar of long term, quality focused investors.

- On our valuation framework, VeriSign scores a solid 5/6 for being undervalued across multiple checks. Next, we will unpack how different valuation approaches look at that score, before finishing with a more holistic way to judge whether the market is really getting this stock right.

Approach 1: VeriSign Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes the cash a business is expected to generate in the future, then discounts those cash flows back into today’s dollars to estimate what the company is worth now.

For VeriSign, the latest twelve month Free Cash Flow sits at roughly $998 million. Using a 2 Stage Free Cash Flow to Equity approach, cash flows are projected to grow steadily, reaching about $1.82 billion by 2035, based on a mix of analyst estimates through 2026 and longer term extrapolations by Simply Wall St. These future cash flows are then discounted back to today using an appropriate rate of return, reflecting the risk of owning the stock.

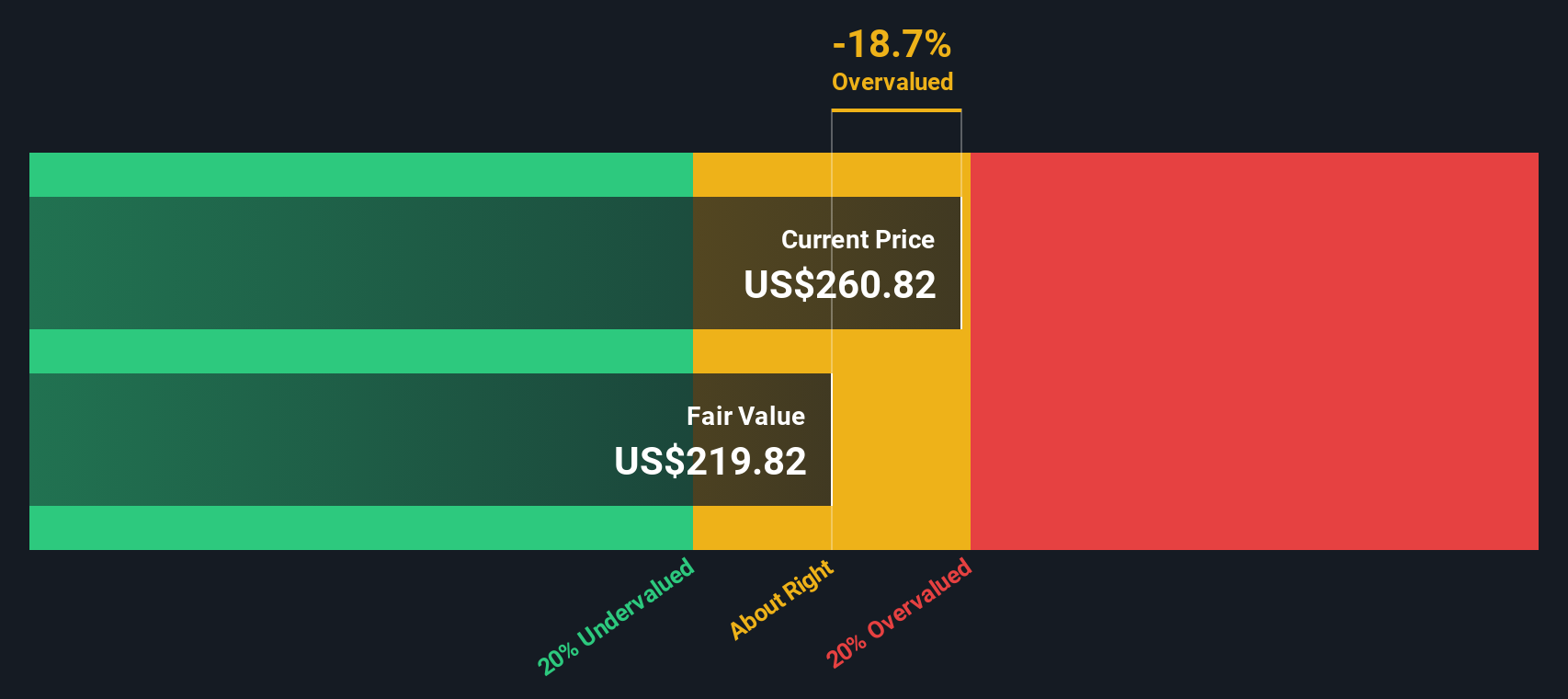

On this basis, the model estimates an intrinsic value of about $243.75 per share, compared with a current price near $242. This implies the stock is roughly 0.6% undervalued, effectively suggesting that the market is pricing VeriSign very close to its calculated fair value.

Result: ABOUT RIGHT

VeriSign is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: VeriSign Price vs Earnings

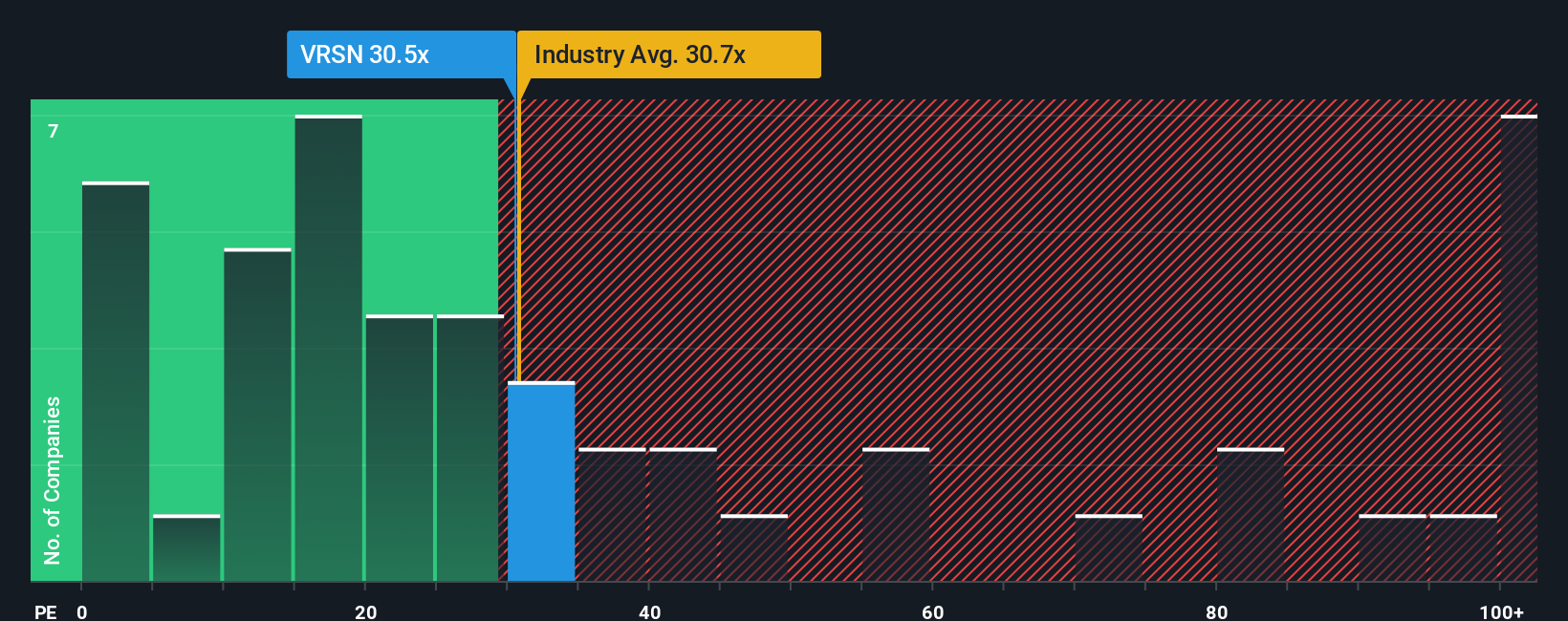

For a consistently profitable company like VeriSign, the Price to Earnings ratio is a useful way to judge how much investors are willing to pay for each dollar of current earnings. In general, faster growing, lower risk businesses tend to justify a higher PE, while slower growth or higher uncertainty usually warrant a lower multiple.

VeriSign currently trades on a PE of about 27.7x. That sits below the broader IT industry average of roughly 31.1x and well under the peer group average near 42.8x, suggesting the market is applying a relative discount despite the company’s solid fundamentals.

Simply Wall St’s proprietary Fair Ratio for VeriSign comes in at about 29.0x. This Fair Ratio estimates the PE that would be appropriate given VeriSign’s specific earnings growth outlook, profitability, industry positioning, market cap and risk profile. Because it is tailored to the company, it is more informative than simple comparisons with industry or peers, which can be skewed by very high growth or more speculative names. With the current PE only slightly below the Fair Ratio, the multiple based view indicates the stock is priced very close to what would be considered fundamentally reasonable.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your VeriSign Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simple stories investors create on Simply Wall St’s Community page that link their view of VeriSign’s business to a set of revenue, earnings and margin forecasts. They then roll those into a Fair Value and compare that Fair Value to today’s share price to decide whether to buy, hold or sell. The whole Narrative updates dynamically as new news or earnings arrive. For example, one investor might build a bullish VeriSign Narrative anchored on improving domain trends, .web upside and a Fair Value near the high analyst target of about $340. Another might take a more cautious view around parked domain risks and advertising exposure, landing closer to the low target near $250. Yet both are using the same easy, visual tool to turn their story into numbers and make clearer, more consistent decisions.

Do you think there's more to the story for VeriSign? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com