Gold.com (GOLD) just completed a straightforward rebrand, changing its name from A-Mark Precious Metals and adopting the GOLD ticker on the NYSE, a move that naturally has investors taking a closer look.

See our latest analysis for Gold.com.

The rebrand comes after Gold.com was dropped from the Nasdaq Composite Index and shifted to the GOLD ticker on the NYSE, with a roughly 20 percent 1 month share price return suggesting fresh momentum despite a modest 1 year total shareholder return.

If this kind of repositioning has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership as you hunt for the next potential standout.

With earnings growing faster than revenue, but the stock still trading at a steep discount to analyst targets, investors now face a key question: is Gold.com quietly undervalued, or is the market already pricing in its next chapter of growth?

Most Popular Narrative Narrative: 27.4% Undervalued

With shares last closing at $30.33 against a narrative fair value of $41.75, the current setup suggests a sizable upside gap if the thesis holds.

The recent string of strategic acquisitions (SGI, Pinehurst, AMS, SGB, LPM) and their ongoing integration are creating operational synergies, broadening distribution channels, and driving efficiencies, positioning A-Mark to capture greater operating leverage and expand net margins as integration matures.

Want to see the math behind this upside story? The narrative leans on faster earnings, improving margins, and a richer future multiple. Curious how those pieces fit together? Dig into the full narrative to unpack the specific growth and profitability assumptions driving that fair value.

Result: Fair Value of $41.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent demand weakness and rising operating costs could offset acquisition gains, squeezing margins and undermining the optimistic upside case around Gold.com.

Find out about the key risks to this Gold.com narrative.

Another View: Expensive on Earnings

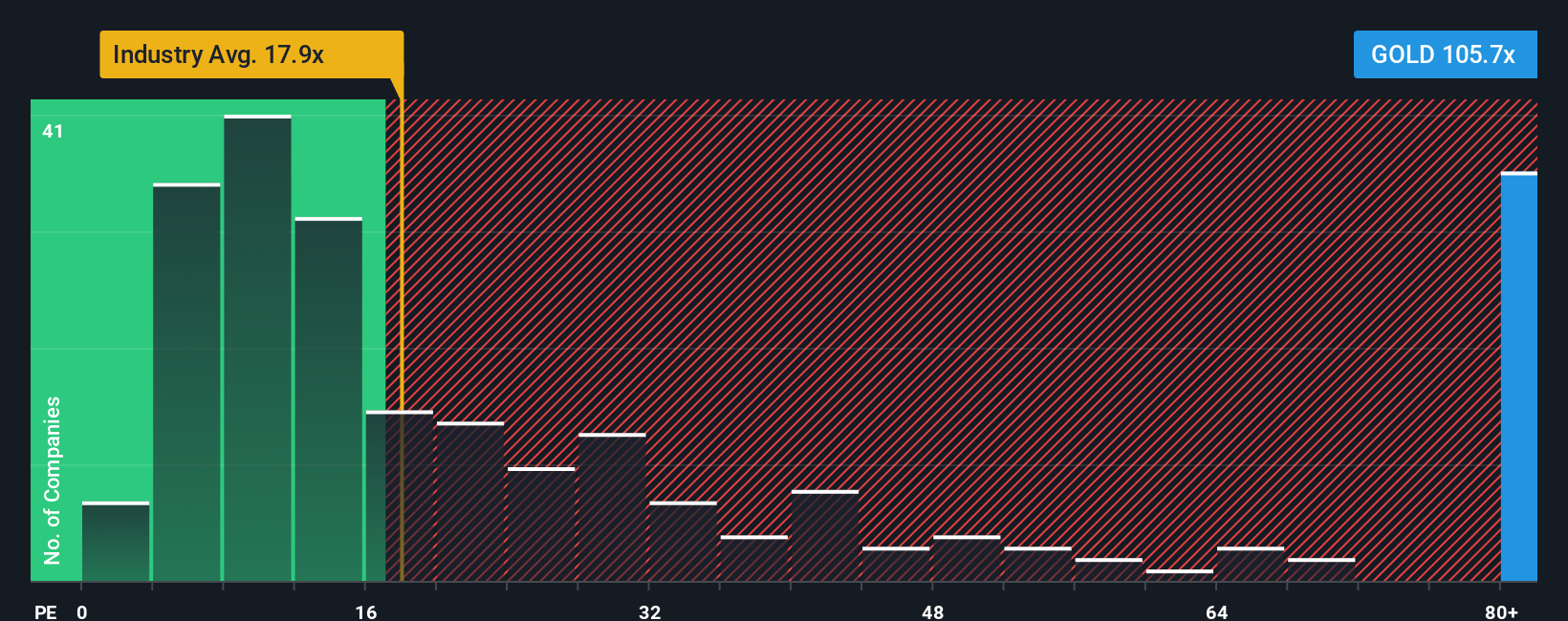

That bullish upside story runs into a snag when you look at the earnings multiple. Gold.com trades on about 101 times earnings, versus 17.7 times for global retail distributors and a fair ratio of 23.8 times. This points to stretched expectations rather than a clear bargain.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gold.com Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom take in just a few minutes: Do it your way.

A great starting point for your Gold.com research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one story. Broaden your opportunity set now with focused stock ideas that match your goals and sharpen your edge.

- Target reliable income by reviewing these 15 dividend stocks with yields > 3% that may offer steadier cash returns through thicker, more sustainable payouts.

- Explore transformational innovation by scanning these 27 AI penny stocks that may be positioned to benefit as artificial intelligence adoption evolves across industries.

- Prepare for potential sentiment shifts by analyzing these 81 cryptocurrency and blockchain stocks that may participate in future waves of digital asset activity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com