- Arm Holdings and South Korea's industry ministry previously signed a memorandum of understanding to open an "Arm School" chip design facility from 2026 to 2030, aiming to train around 1,400 advanced semiconductor and AI design specialists and deepen technology exchange with local universities and researchers.

- This education-focused partnership strengthens Arm's role at the center of the AI semiconductor ecosystem, potentially deepening adoption of its architectures across South Korea's system-semiconductor and fabless sectors.

- Next, we’ll examine how this South Korean chip design school initiative, centered on training 1,400 specialists, could influence Arm’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Arm Holdings Investment Narrative Recap

To own Arm, you have to believe its CPU and AI IP will keep pulling in higher royalties across data centers, smartphones, and edge devices, while R&D spending and expansion into subsystems do not erode profitability. The South Korea “Arm School” announcement looks supportive for the long term, but it does not materially change the near term catalyst around AI data center adoption or the key risks of high R&D intensity and customer concentration.

Among recent developments, the Astera Labs partnership under the Arm Total Design program stands out, because it directly targets custom AI infrastructure silicon built on Arm Neoverse CSS. That initiative is tightly linked to one of Arm’s main catalysts: deeper penetration into hyperscaler and AI data center workloads, where higher royalty rates on v9 and CSS designs are central to the investment case.

Yet while these growth drivers are exciting, investors still need to be aware of how rising customer self sufficiency and in house chip design could...

Read the full narrative on Arm Holdings (it's free!)

Arm Holdings’ narrative projects $7.4 billion in revenue and $2.3 billion in earnings by 2028.

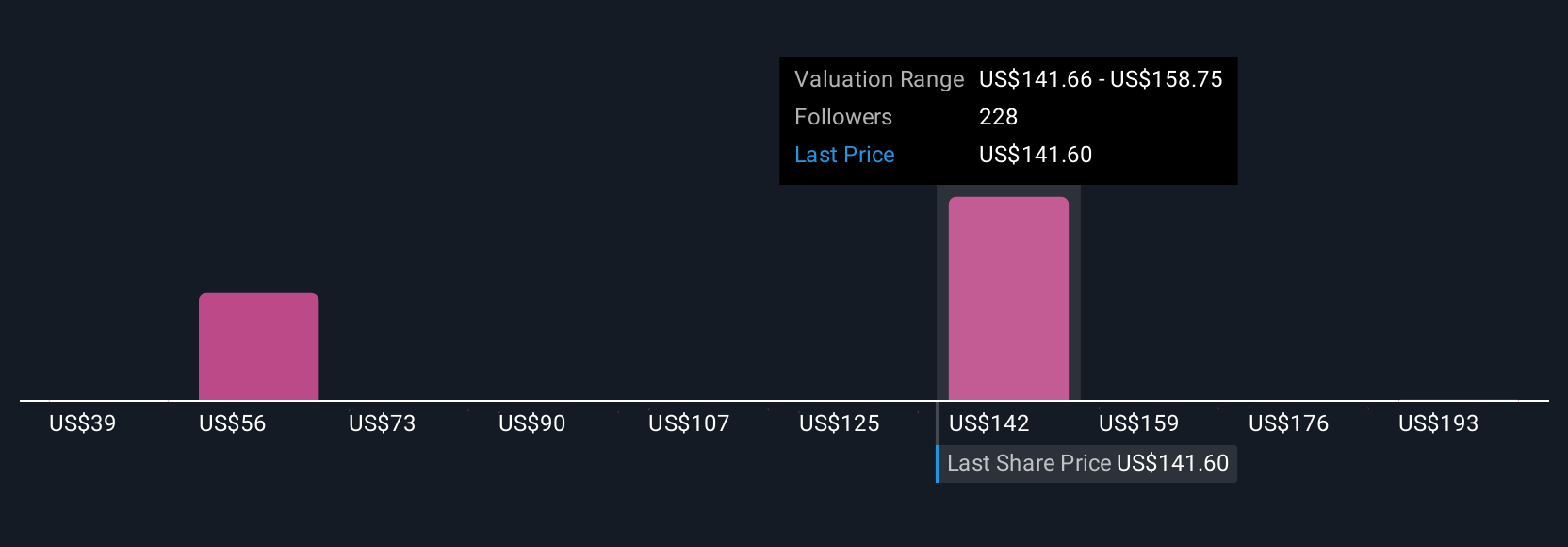

Uncover how Arm Holdings' forecasts yield a $167.97 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Bullish analysts were already projecting Arm’s revenue to reach about US$8.6 billion and earnings US$2.8 billion by 2028, so this talent focused Korea news could either reinforce or challenge that far more optimistic view compared with consensus, depending on how you weigh the long term payoff against rising open standard and alternative architecture risks.

Explore 19 other fair value estimates on Arm Holdings - why the stock might be worth less than half the current price!

Build Your Own Arm Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arm Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Arm Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arm Holdings' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com