- In the past week, Avnet reported a quarterly revenue result and forward guidance that exceeded analyst expectations, powered by double-digit growth at Farnell and in Asia, even as short interest remained above peers.

- The combination of strong operational performance and still-elevated short interest highlights a disconnect between Avnet’s improving fundamentals and lingering market skepticism about its outlook.

- We’ll now examine how Avnet’s better-than-expected quarter, alongside still-high though easing short interest, reshapes the company’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Avnet Investment Narrative Recap

To own Avnet, you have to believe its global distribution scale, especially in higher growth regions like Asia and at Farnell, can offset pressure on margins and uneven regional demand. The latest quarter’s revenue beat and stronger guidance support that view near term, but do not remove the key risk that faster Asian growth and weak EMEA could keep squeezing gross margins and earnings.

The most relevant recent announcement is Avnet’s Q3 FY2025 result, where sales topped expectations by about 3% and guidance also came in ahead of consensus, helped by double digit growth at Farnell and in Asia. That strength underpins the current catalyst of improving fundamentals, yet the stock’s post earnings decline and still elevated, though easing, short interest show that many investors remain focused on the risk of structurally lower margins as the business mix shifts.

However, investors should be aware that rising Asian sales could pressure Avnet’s blended margins if regional demand imbalances persist and ...

Read the full narrative on Avnet (it's free!)

Avnet’s narrative projects $25.5 billion revenue and $680.5 million earnings by 2028. This requires 4.8% yearly revenue growth and about a $440 million earnings increase from $240.2 million today.

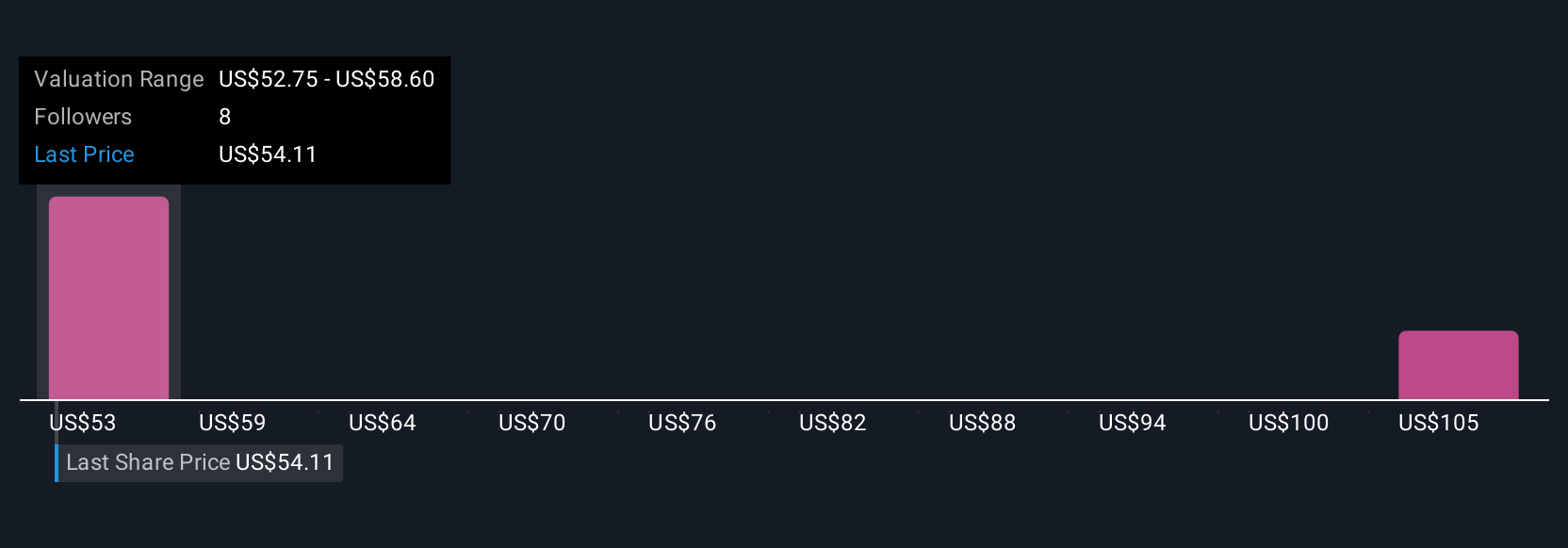

Uncover how Avnet's forecasts yield a $53.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$9.96 to US$64 per share, showing how far opinions can stretch. When you set those views against the risk of ongoing margin compression from mix shifts, it underlines why you may want to compare several different takes on Avnet’s potential.

Explore 4 other fair value estimates on Avnet - why the stock might be worth less than half the current price!

Build Your Own Avnet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avnet research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Avnet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avnet's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com