- Ever wondered if Kinsale Capital Group is a bargain in today’s market? You’re not alone. Let’s see if there’s value hiding beneath the surface.

- Kinsale’s stock dropped 2.4% in the past week, is down 5.6% this month, and has slid 17.0% year-to-date, which may signal shifting market sentiment or a chance for patient investors.

- Recently, media coverage has focused on Kinsale’s strategic expansion into specialty insurance lines and its prudent risk management approach. These developments are shaping investor expectations and could help explain why the stock’s recent moves have caught attention.

- Right now, Kinsale scores a 3 out of 6 on our value checks, which means the story isn’t straightforward. Before settling on a verdict, we’ll break down all the valuation methods that matter, plus an even better way to judge a company’s true worth at the end.

Find out why Kinsale Capital Group's -24.5% return over the last year is lagging behind its peers.

Approach 1: Kinsale Capital Group Excess Returns Analysis

The Excess Returns model evaluates how well a company reinvests shareholders' capital above its basic cost of equity. Essentially, it focuses on the rate at which Kinsale Capital Group turns its book equity into profits beyond what investors demand, shedding light on both current financial strength and sustainable future value.

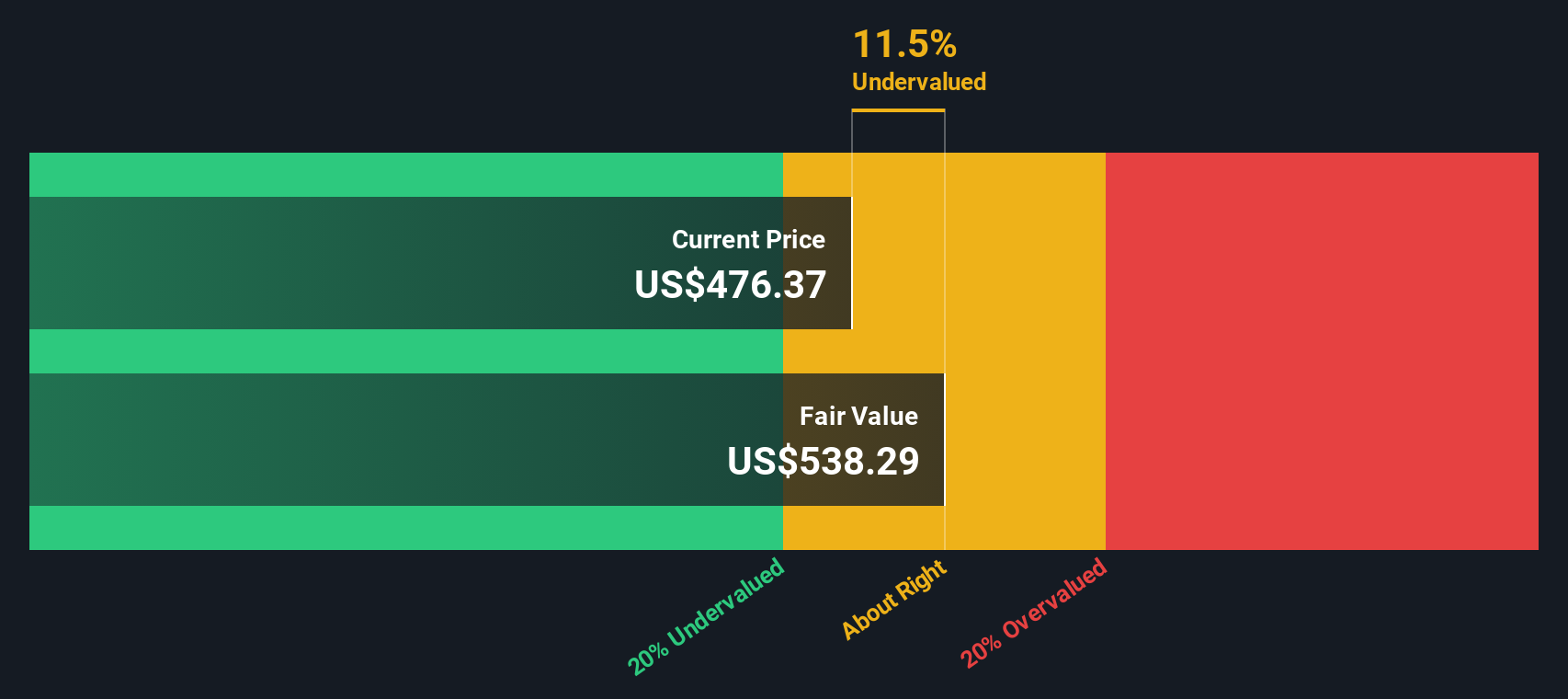

For Kinsale, the latest analysis shows a Book Value of $80.19 per share and a Stable EPS of $23.39, based on weighted future Return on Equity estimates from 9 analysts. The company’s Cost of Equity stands at $6.97 per share, which means each share is generating an Excess Return of $16.42 over what it costs to fund its equity base. Kinsale’s Average Return on Equity of 23.34% is notably high, and projections call for further growth, with the Stable Book Value expected to reach $100.19, as sourced from 8 analyst forecasts.

According to this model, Kinsale’s calculated intrinsic value stands at $544.36 per share. Based on current market prices, this suggests the stock is trading at roughly a 30.7% discount, which may indicate a significant margin of undervaluation by this measure.

Result: UNDERVALUED

Our Excess Returns analysis suggests Kinsale Capital Group is undervalued by 30.7%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Kinsale Capital Group Price vs Earnings

Price-to-Earnings (PE) is the preferred valuation metric for profitable companies like Kinsale Capital Group, as it directly links the price investors pay with the company's underlying earnings power. A well-used PE ratio offers investors a convenient shorthand for how much confidence the market has in the company’s ability to continue delivering profits.

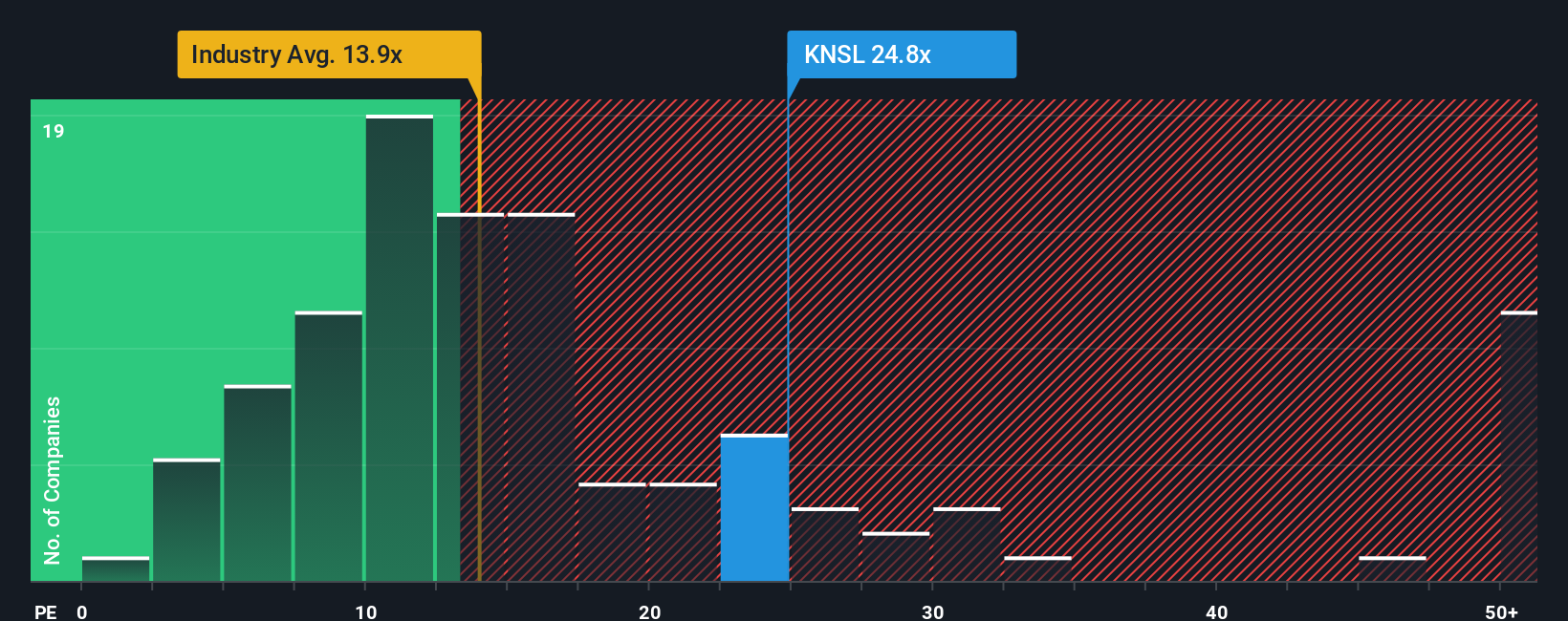

Growth expectations and perceived risks significantly influence what is considered a fair or "normal" PE ratio. Faster-growing or less risky companies often have higher PE multiples, while slower growth or higher risk can reduce these multiples. For context, Kinsale Capital Group currently trades at a PE of 18.5x. This figure is slightly above the average for its insurance industry peers at 18.0x, and considerably above the broader industry average of 13.3x.

Simply Wall St's proprietary "Fair Ratio" is designed to reflect the PE multiple a company deserves based on its unique mix of earnings growth, profit margins, risk profile, industry trends, and market cap. Unlike simple peer or industry comparisons, this tailored benchmark provides a more accurate picture, especially for companies that stand out, such as Kinsale, with higher growth or unique advantages that raw averages cannot capture.

In Kinsale’s case, the Fair Ratio comes in at 13.2x compared to the current 18.5x. This difference suggests the stock is priced meaningfully above what its fundamentals would indicate on this model, which may signal that the stock is trading at a premium to its intrinsic value.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kinsale Capital Group Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative helps you go beyond the numbers by connecting your perspective on a company, such as how you think it will perform in the real world, with future estimates for things like revenue, earnings, margins, and ultimately its fair value.

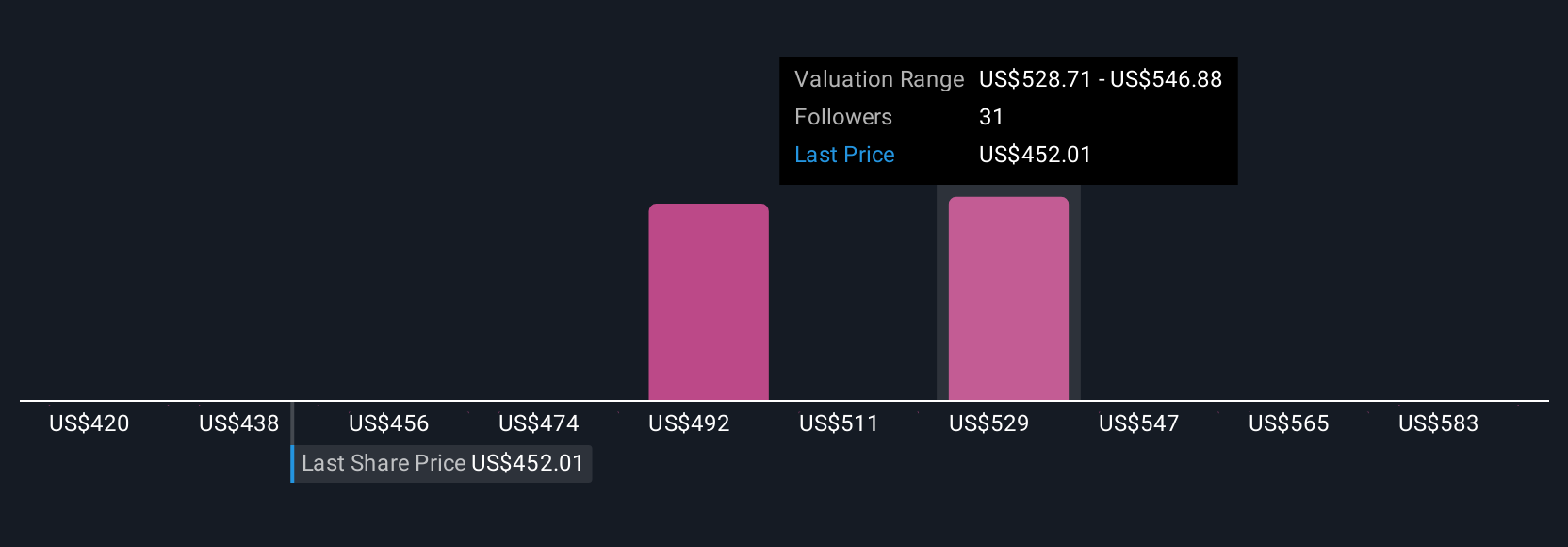

Narratives give context to the numbers. You start by describing your view of the company’s story or potential. This perspective then connects to a dynamic financial model that calculates a fair value based on your assumptions. This approach is simple and accessible. On Simply Wall St’s Community page, millions of investors are already using Narratives to define and share their outlooks on companies like Kinsale Capital Group.

With Narratives, you can immediately see how your expected fair value compares to the current share price, which can help inform your decision making. Best of all, your Narrative stays updated as new earnings or news is released, so your valuation evolves alongside the business.

For example, with Kinsale Capital Group, one investor’s optimistic Narrative, expecting strong expansion and margin resilience, might put fair value at $560. A more cautious view, emphasizing slowing growth and increased competition, might only justify $448. The narrative you choose makes all the difference in your investment decision.

Do you think there's more to the story for Kinsale Capital Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com