- Wondering whether Chemours is a value play or a value trap? You are not alone, especially when volatility brings its price back into the spotlight.

- After a challenging year with the stock dropping 38.4%, Chemours has rebounded 11.7% in just the last week. This highlights both renewed growth interest and shifting risk perceptions.

- Recent news of leadership changes and ongoing environmental lawsuits have fueled volatility. Many investors are reassessing where Chemours stands in a changing regulatory landscape. This mix of headlines is shaping both sentiment and expectations for the future.

- On our comprehensive valuation check, Chemours scores 6 out of 6 for undervaluation, which is rare. Let us break down what this means using traditional valuation methods, and stick around for a smarter approach you will not want to miss at the end of the article.

Find out why Chemours's -38.4% return over the last year is lagging behind its peers.

Approach 1: Chemours Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them to reflect their value in today's dollars. This approach provides a way to see what a business could be worth based on its ability to generate cash over the long term.

For Chemours, the current Free Cash Flow (FCF) stands at -$54 million, reflecting a recent period of volatility. However, analysts forecast a significant improvement in the coming years, with FCF expected to climb to $275 million by 2027. Looking even further ahead, long-term projections suggest FCF could reach about $371 million by 2035, though estimates that far out are based on simply extrapolating recent trends. All calculations use $ as the reporting currency.

Using a two-stage free cash flow to equity model, Chemours’ DCF fair value is estimated at $21.10 per share. With the stock currently trading at a 39.1% discount to this intrinsic value, the DCF analysis suggests Chemours is notably undervalued at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Chemours is undervalued by 39.1%. Track this in your watchlist or portfolio, or discover 932 more undervalued stocks based on cash flows.

Approach 2: Chemours Price vs Sales

The price-to-sales (P/S) ratio is a preferred valuation metric for Chemours because it provides a useful way to assess the company’s worth when profitability is inconsistent or negative, as is currently the case. The P/S ratio measures what investors are willing to pay for each dollar of revenue, which can be especially meaningful for companies facing earnings pressure but maintaining solid revenue streams.

Typically, growth potential and risk profile influence what a “normal” or “fair” P/S ratio should be. Higher expected revenue growth or lower risk generally justifies a higher P/S multiple, while more volatile or declining sales would warrant a lower one.

Chemours currently trades at a P/S ratio of 0.33x, which is well below the Chemicals industry average of 1.18x and the peer average of 0.95x. At first glance, this discount could suggest undervaluation. However, Simply Wall St's proprietary Fair Ratio model, which factors in Chemours’ earnings growth prospects, profit margins, risk profile, and company size, sets Chemours’ Fair Ratio at 0.81x. This customized benchmark provides a more tailored context than a basic peer comparison because it integrates critical fundamentals alongside sector dynamics.

With Chemours’ actual P/S ratio meaningfully below its Fair Ratio, the stock appears undervalued based on this metric and this is consistent with the findings from the DCF analysis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Chemours Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. Narratives are Simply Wall St’s innovative approach that makes investment decisions more powerful by allowing users to tie their own story or perspective about a company directly to financial forecasts and fair value estimates. Instead of just relying on static numbers or consensus, a Narrative lets you outline your view on Chemours' future revenue, earnings, and margins, and then instantly see how that outlook translates into a Fair Value. This makes your investing decision both personal and data-driven.

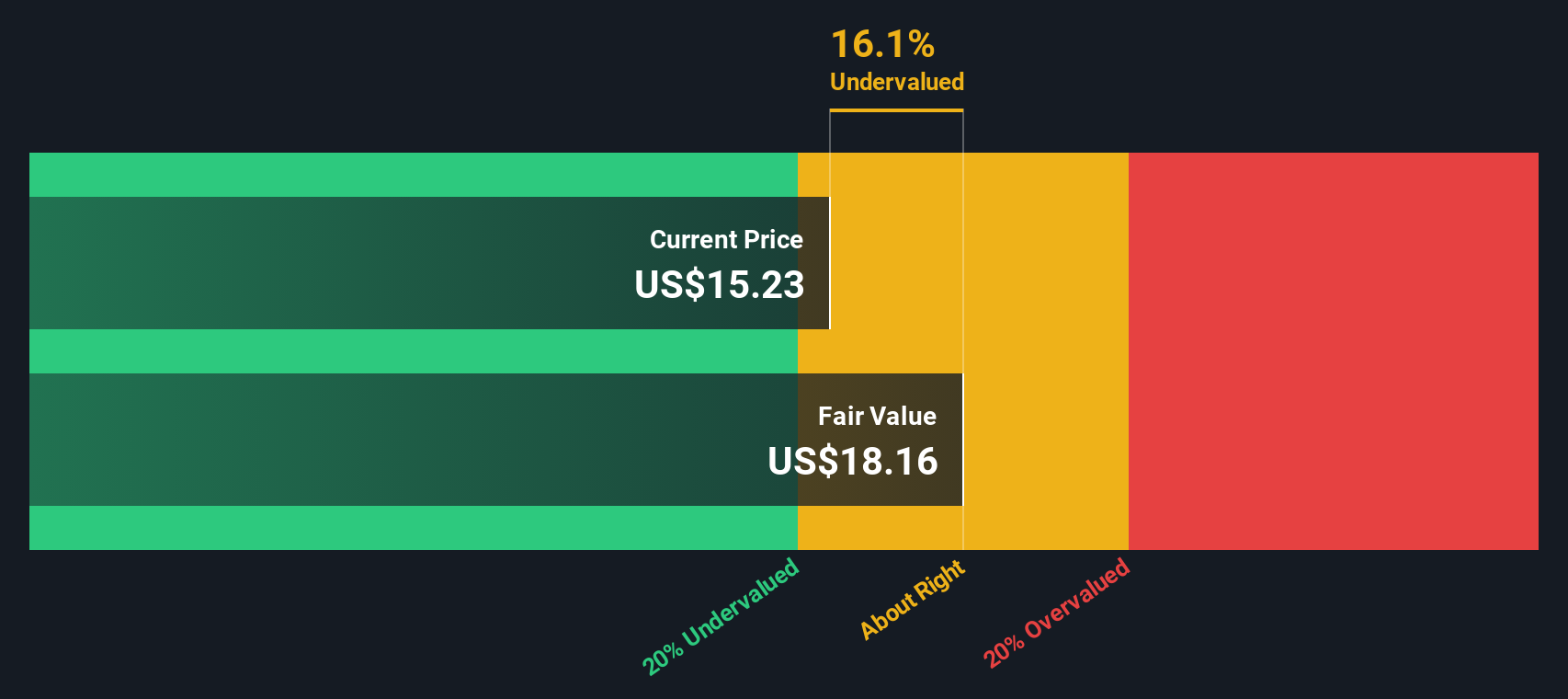

On the Simply Wall St Community page, Narratives are easy to access and update, giving millions of investors the tools to visualize how the company’s story, estimates, and news events all connect. Each Narrative dynamically updates when fresh news, earnings, or market developments arise, allowing your valuation to be as current as the latest information. Narratives help you decide when to buy or sell by comparing your calculated Fair Value against the current market Price. For example, one investor might build a bullish Narrative for Chemours based on regulatory wins and margin expansion, resulting in a Fair Value of $18.00 per share. Another may take a more cautious view due to litigation risks, arriving at just $11.00. This proves that the story behind the numbers can make all the difference.

Do you think there's more to the story for Chemours? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com