- White Mountains Insurance Group, Ltd. recently announced a share repurchase program to buy back up to US$300 million of its shares at prices between US$1,850 and US$2,050 per share, with the offer set to expire on December 19, 2025.

- This initiative will be funded from available cash resources, including proceeds from asset sales, and is aimed at deploying unallocated capital while offering shareholders increased liquidity.

- We'll explore how the allocation of un-deployed capital toward this buyback program shapes White Mountains Insurance Group's current investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is White Mountains Insurance Group's Investment Narrative?

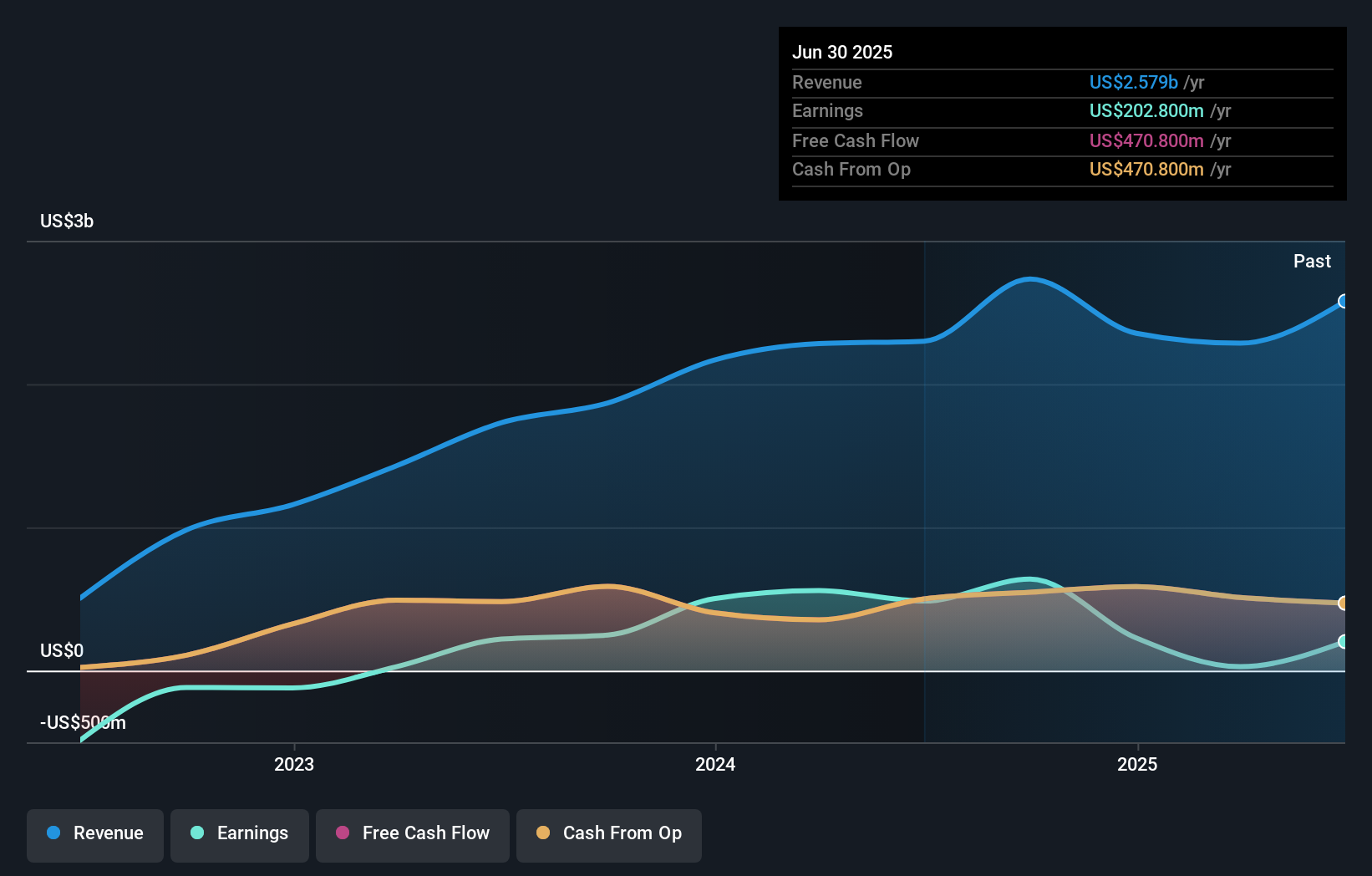

Being a shareholder in White Mountains Insurance Group often comes down to believing in disciplined capital allocation and a board willing to act decisively, even amid uneven recent earnings and leadership shifts. The new US$300 million share repurchase program meaningfully addresses one of the short-term catalysts, how the company deploys unallocated capital especially after recent asset sales. By returning capital to shareholders at set price ranges, the buyback could support near-term share value and boost liquidity. However, it also means less cash flexibility for other opportunities or buffer if underwriting profits remain under pressure. The most important risks, such as high relative valuation, declining profit margins and ongoing executive transitions, remain front of mind, though the buyback itself doesn't fundamentally shift these factors. The real test for investors is whether this use of capital offers the confidence needed given WTM's earnings volatility and low return on equity. On the other hand, shareholders should be aware of the recent sharp drop in profit margins and how that might influence future decisions.

White Mountains Insurance Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on White Mountains Insurance Group - why the stock might be worth 42% less than the current price!

Build Your Own White Mountains Insurance Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your White Mountains Insurance Group research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free White Mountains Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate White Mountains Insurance Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com