As the U.S. stock market wraps up a strong week with major indexes like the S&P 500 and Dow Jones Industrial Average extending their monthly winning streaks, small-cap stocks are garnering attention amidst this positive momentum. In this environment, identifying small-cap companies with potential for growth can be particularly appealing, especially when they exhibit signs of being undervalued and have insider action signaling confidence from those within the company.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Merchants Bancorp | 7.5x | 2.5x | 49.72% | ★★★★★★ |

| Business First Bancshares | 10.1x | 2.5x | 49.60% | ★★★★★☆ |

| Wolverine World Wide | 15.2x | 0.7x | 42.87% | ★★★★★☆ |

| First United | 10.0x | 3.0x | 44.97% | ★★★★★☆ |

| Peoples Bancorp | 10.3x | 1.9x | 45.08% | ★★★★★☆ |

| S&T Bancorp | 11.3x | 3.9x | 37.96% | ★★★★☆☆ |

| Farmland Partners | 6.4x | 7.9x | -87.28% | ★★★★☆☆ |

| Citizens & Northern | 13.3x | 3.3x | 32.47% | ★★★☆☆☆ |

| CNB Financial | 17.7x | 3.3x | 46.68% | ★★★☆☆☆ |

| Omega Flex | 17.0x | 2.7x | 7.70% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Innospec (IOSP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Innospec is a company engaged in the development and supply of specialty chemicals, with operations spanning fuel specialties, oilfield services, and performance chemicals, and has a market cap of approximately $2.61 billion.

Operations: Fuel Specialties, Oilfield Services, and Performance Chemicals contribute significantly to revenue streams. The gross profit margin has shown fluctuations, reaching 30.88% in the most recent period. Operating expenses have consistently impacted profitability with notable allocations towards general and administrative costs.

PE: -1543.6x

Innospec, a smaller U.S. company, has shown insider confidence with recent share buybacks totaling 246,528 shares for US$22.2 million by September 30, 2025. Despite a drop in net income to US$12.9 million for Q3 2025 from US$33.4 million the previous year, they maintain growth potential with earnings forecasted to rise by nearly 60% annually. A semi-annual dividend of $0.87 per share was declared for late November payout, indicating steady shareholder returns amidst financial challenges.

- Click here to discover the nuances of Innospec with our detailed analytical valuation report.

Review our historical performance report to gain insights into Innospec's's past performance.

Wendy's (WEN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wendy's operates a global fast-food restaurant chain known for its hamburgers, with operations primarily in the U.S. and internationally, along with a significant focus on real estate and development, and has a market capitalization of approximately $4.58 billion.

Operations: The company's revenue streams are primarily driven by its U.S. operations, with additional contributions from international markets and real estate development. Over recent periods, the gross profit margin has shown a notable trend of improvement, reaching 49.14% at the end of 2017 before adjusting to around 35% in subsequent years. Operating expenses consistently include costs related to general and administrative functions, depreciation, and amortization.

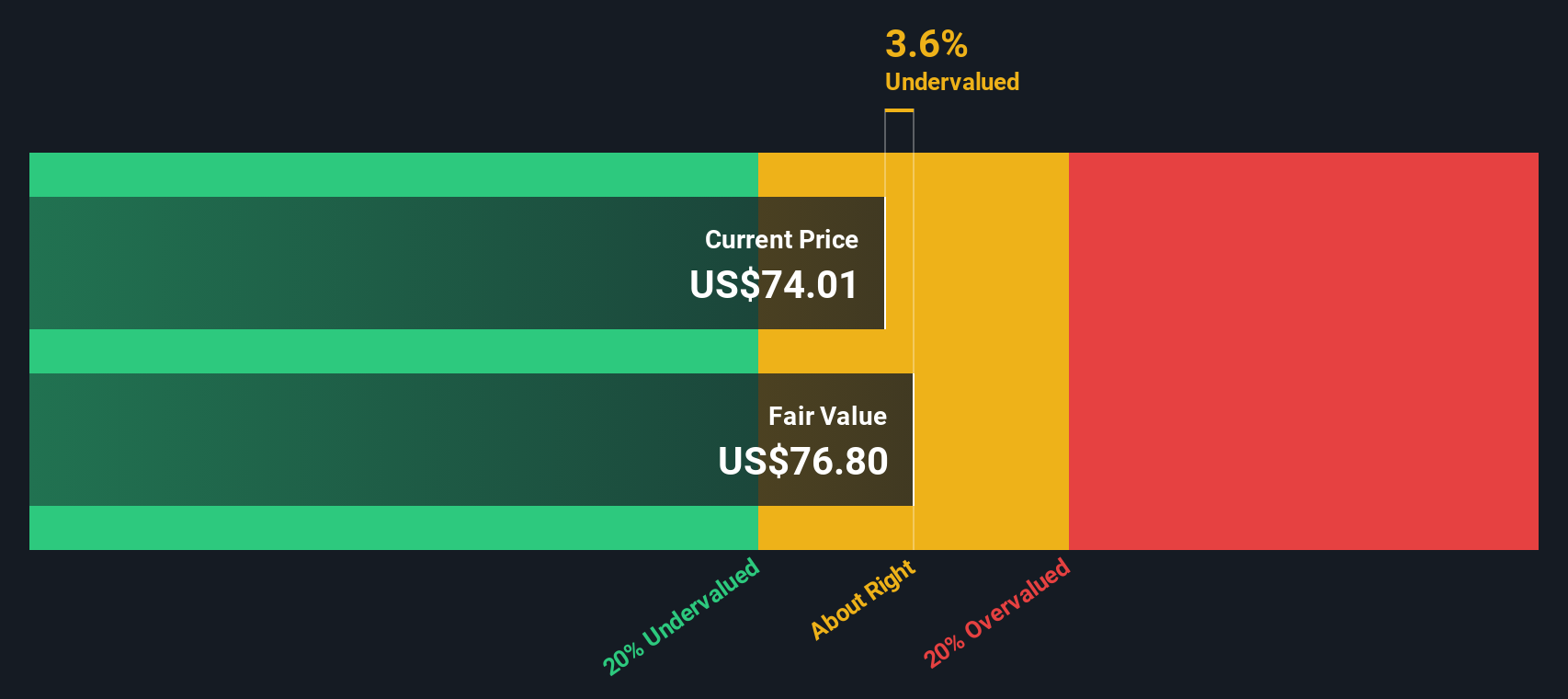

PE: 8.6x

Wendy's, a notable player in the small-cap segment, has shown resilience despite facing financial challenges. Recent earnings revealed a slight dip in revenue to US$549.52 million for Q3 2025, down from US$566.74 million the previous year. The company is actively managing its debt by issuing US$400 million in new notes to refinance existing obligations and support growth initiatives. With insider confidence evident through recent share purchases, Wendy's continues to focus on innovative product offerings and market expansion strategies while navigating funding risks associated with external borrowing sources.

- Click to explore a detailed breakdown of our findings in Wendy's valuation report.

Understand Wendy's track record by examining our Past report.

Wolverine World Wide (WWW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wolverine World Wide is a company that designs, manufactures, and markets a range of footwear and apparel products, with operations segmented into the Active Group, Work Group, and Other categories; it has a market capitalization of approximately $1.44 billion.

Operations: The Active Group is the largest revenue contributor, generating $1.37 billion, followed by the Work Group at $439.3 million. The company's gross profit margin has shown a notable upward trend, reaching 46.58% in late 2025 from 39.38% in early 2015. Operating expenses are substantial and have fluctuated over time, with general and administrative expenses consistently being a significant component of these costs.

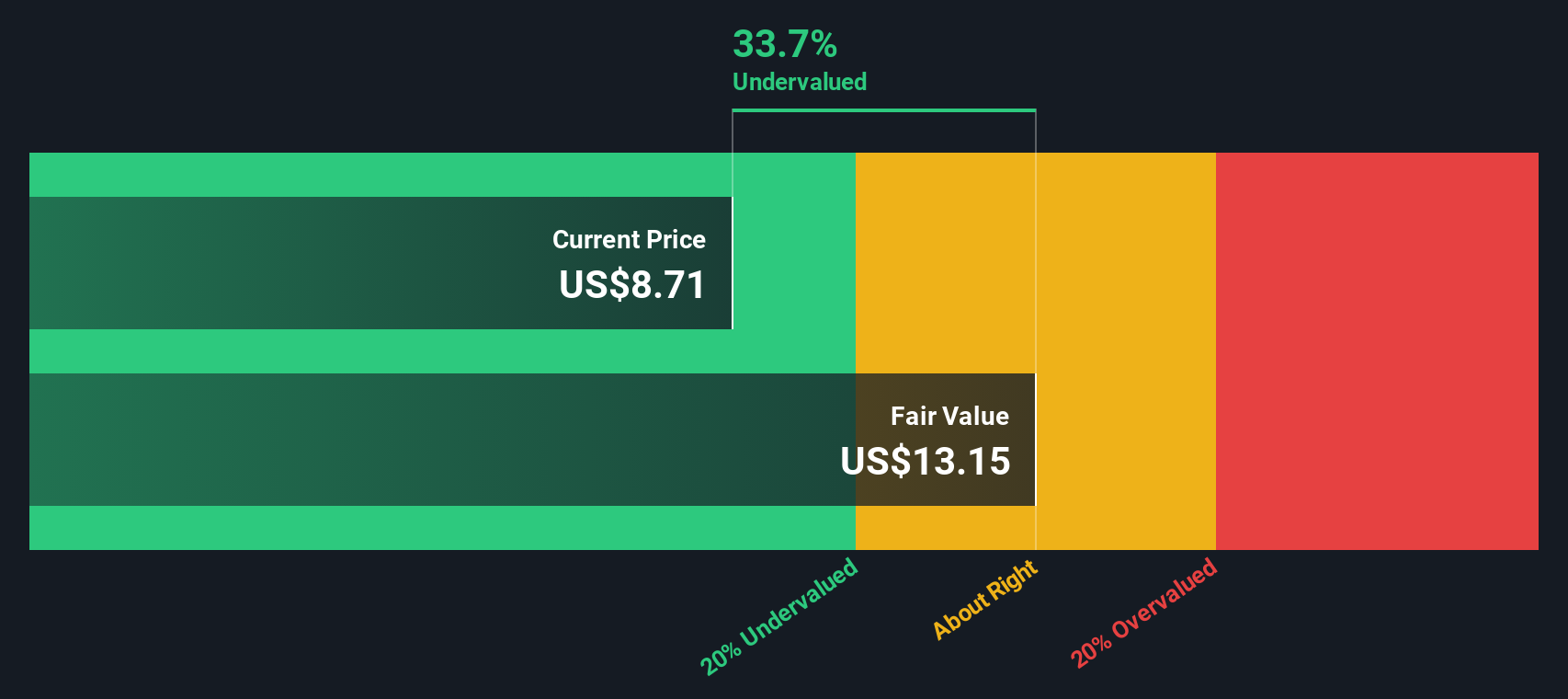

PE: 15.2x

Wolverine World Wide, a company with a diverse portfolio of footwear brands, has been making strategic moves to enhance its market position. Recent insider confidence is evident as an independent director acquired 35,000 shares valued at US$535,500. The company anticipates revenue growth for 2025 and has appointed Justin Cupps as President of its Work Group to drive innovation. Despite challenges in debt coverage by operating cash flow, Wolverine's focus on brand collaborations and product diversification signals potential for future growth in the competitive footwear industry.

Make It Happen

- Click this link to deep-dive into the 78 companies within our Undervalued US Small Caps With Insider Buying screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com