As the U.S. stock market enjoys a robust week following Black Friday, with major indices like the S&P 500 and Dow Jones Industrial Average extending their winning streaks, investors are eyeing opportunities beyond the tech-heavy Nasdaq, which has just concluded its first losing month since March. In this vibrant yet cautious landscape, identifying stocks with solid fundamentals is essential for those looking to uncover hidden gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

John B. Sanfilippo & Son (JBSS)

Simply Wall St Value Rating: ★★★★★★

Overview: John B. Sanfilippo & Son, Inc., operating through its subsidiary JBSS Ventures, LLC, is engaged in processing and distributing tree nuts and peanuts across the United States with a market cap of approximately $845.72 million.

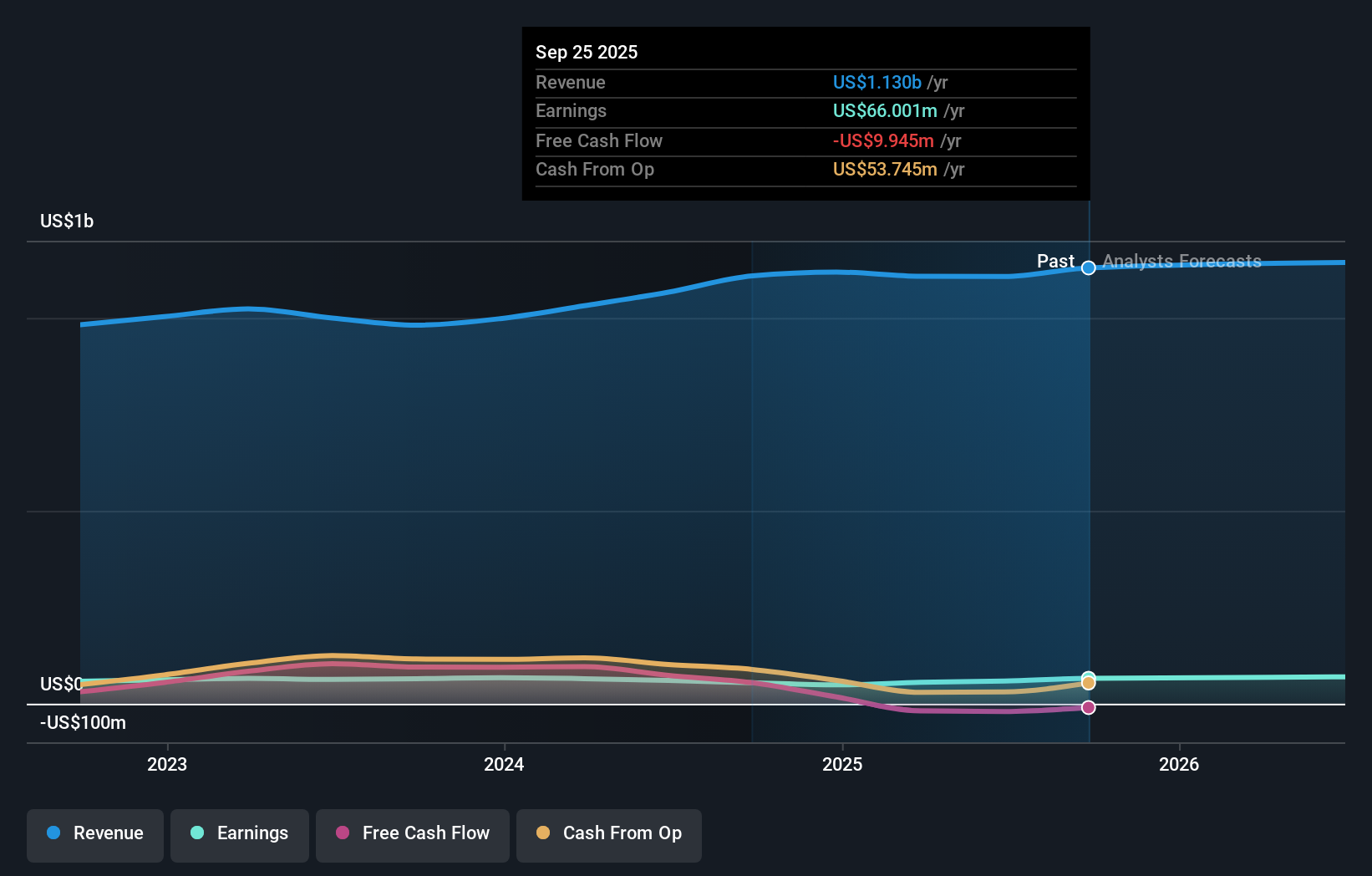

Operations: JBSS generates revenue of approximately $1.13 billion from selling various nut and nut-related products and bars. The company's financial performance can be analyzed through its net profit margin, which provides insight into profitability after accounting for all expenses.

John B. Sanfilippo & Son, a nimble player in the food industry, recently reported first-quarter sales of US$298.68 million, up from US$276.2 million last year, with net income rising to US$18.73 million from US$11.66 million. The company's earnings growth of 21% outpaced the industry's 4.6%, and its price-to-earnings ratio of 12.8x suggests it trades at a favorable value compared to peers and the broader market (18.7x). With interest payments well covered by EBIT at 22 times and a satisfactory net debt to equity ratio of 22%, JBSS appears financially robust despite not being free cash flow positive currently.

- Take a closer look at John B. Sanfilippo & Son's potential here in our health report.

Gain insights into John B. Sanfilippo & Son's past trends and performance with our Past report.

Karat Packaging (KRT)

Simply Wall St Value Rating: ★★★★★★

Overview: Karat Packaging Inc. manufactures and distributes a range of single-use disposable products for restaurant and foodservice settings, with a market cap of approximately $442.99 million.

Operations: Karat Packaging generates revenue primarily from the manufacturing and supply of a broad portfolio of single-use products, totaling approximately $453.78 million.

Karat Packaging, a dynamic player in the sustainable packaging sector, showcases its potential through strategic moves and financial resilience. The company reported third-quarter sales of US$124.52 million, up from US$112.77 million last year, though net income dipped to US$7.33 million from US$9.09 million. Its price-to-earnings ratio of 14.6x is appealing compared to the broader market's 18.7x, signaling good value for investors eyeing growth opportunities in eco-friendly products amid rising environmental standards and consumer demand shifts. Despite challenges like tariff exposure and stiff competition, Karat's focus on innovation and operational efficiency aims to bolster future profitability with projected annual revenue growth of 7.6%.

ASA Gold and Precious Metals (ASA)

Simply Wall St Value Rating: ★★★★★☆

Overview: ASA Gold and Precious Metals Limited is a publicly owned investment manager with a market capitalization of approximately $994.95 million.

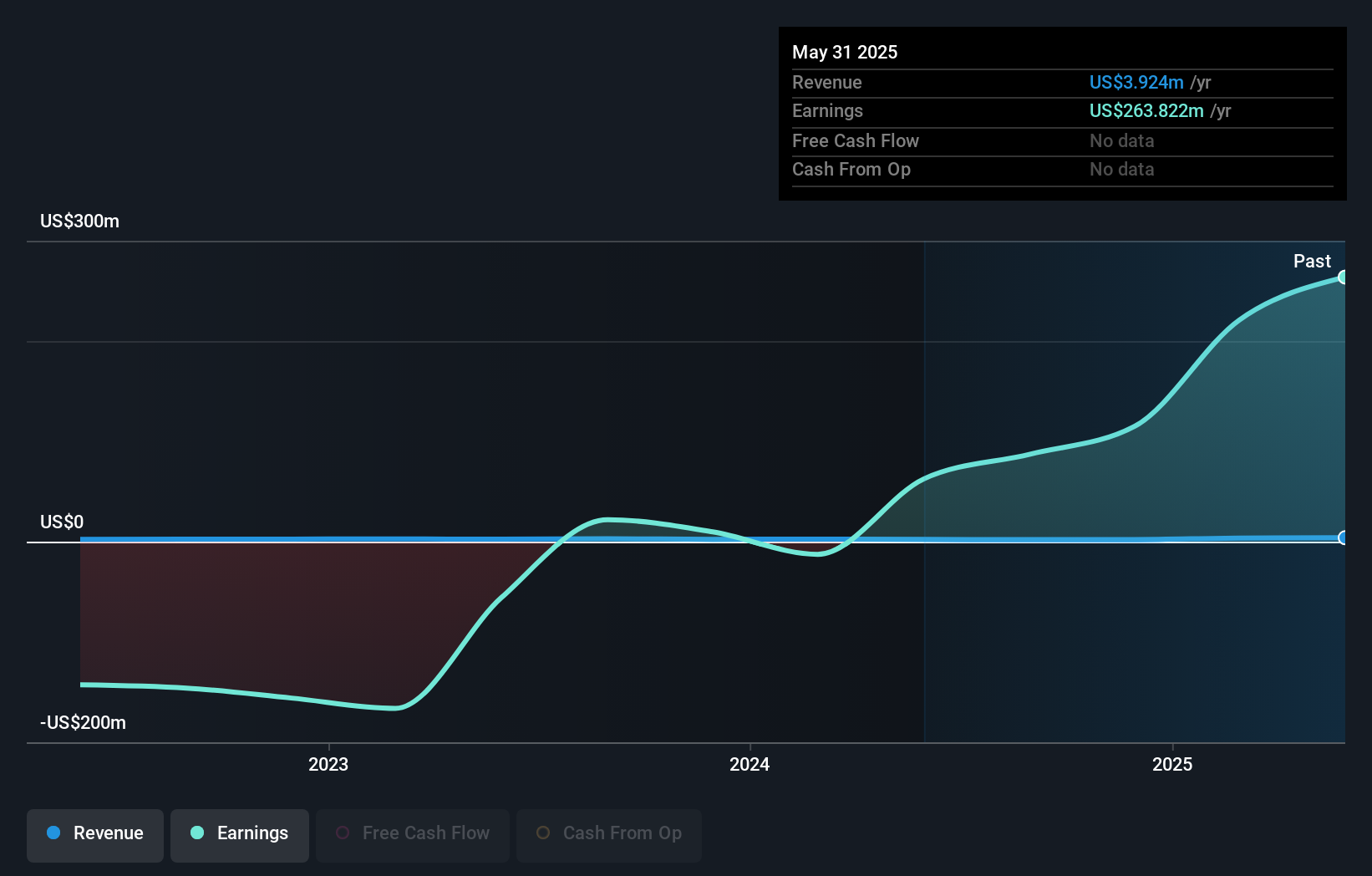

Operations: The primary revenue stream for ASA Gold and Precious Metals Limited comes from its financial services segment, specifically closed-end funds, generating approximately $3.98 million. The company's net profit margin is a key indicator to consider when evaluating its financial performance.

ASA Gold and Precious Metals, a niche player in the precious metals investment space, has shown impressive earnings growth of 330.7% over the past year, significantly outpacing the industry average of 15.6%. With no debt on its books for five years, ASA seems to be managing its financial health prudently. However, a substantial one-off gain of US$377 million has skewed recent results. Despite reporting revenue of just US$3.34 million for nine months ending August 2025, net income reached US$351.41 million due to this unusual item. Its price-to-earnings ratio stands at an attractive 2.6x compared to the broader market's 18.7x.

Seize The Opportunity

- Gain an insight into the universe of 294 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com