- Universal Technical Institute, Inc. recently announced robust full-year financial results, new campus expansion plans across both technical and healthcare divisions, and provided earnings guidance through fiscal year 2029, expecting revenue to surpass US$1.2 billion by then.

- A key insight is that management is pursuing a multi-year strategy of growth and diversification, with new campuses and programs launching annually to broaden its geographic reach and educational offerings.

- We'll explore how Universal Technical Institute’s planned campus expansions and long-term earnings guidance may reshape its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Universal Technical Institute Investment Narrative Recap

To be a shareholder in Universal Technical Institute, you need to believe in the company’s ability to successfully expand and diversify its campus footprint while sustaining enrollment growth across both technical and healthcare divisions. The recent announcements of multi-year campus rollouts and long-term earnings guidance may support anticipated revenue gains, but do not materially alter the biggest immediate risk: managing heavy expansion investments to achieve proportional student demand and regulatory approvals. The announcement of three new campuses set to open in 2027, including major new locations in Salt Lake City, Houston, and Atlanta, stands out as the most relevant development. These planned launches are aligned with UTI’s strategy to broaden program offerings and accelerate market penetration, supporting its short-term catalyst of increased enrollment opportunities. However, it’s important for investors to recognize the contrast: if enrollment or regulatory approvals fall short of expectations, aggressive expansion could result in...

Read the full narrative on Universal Technical Institute (it's free!)

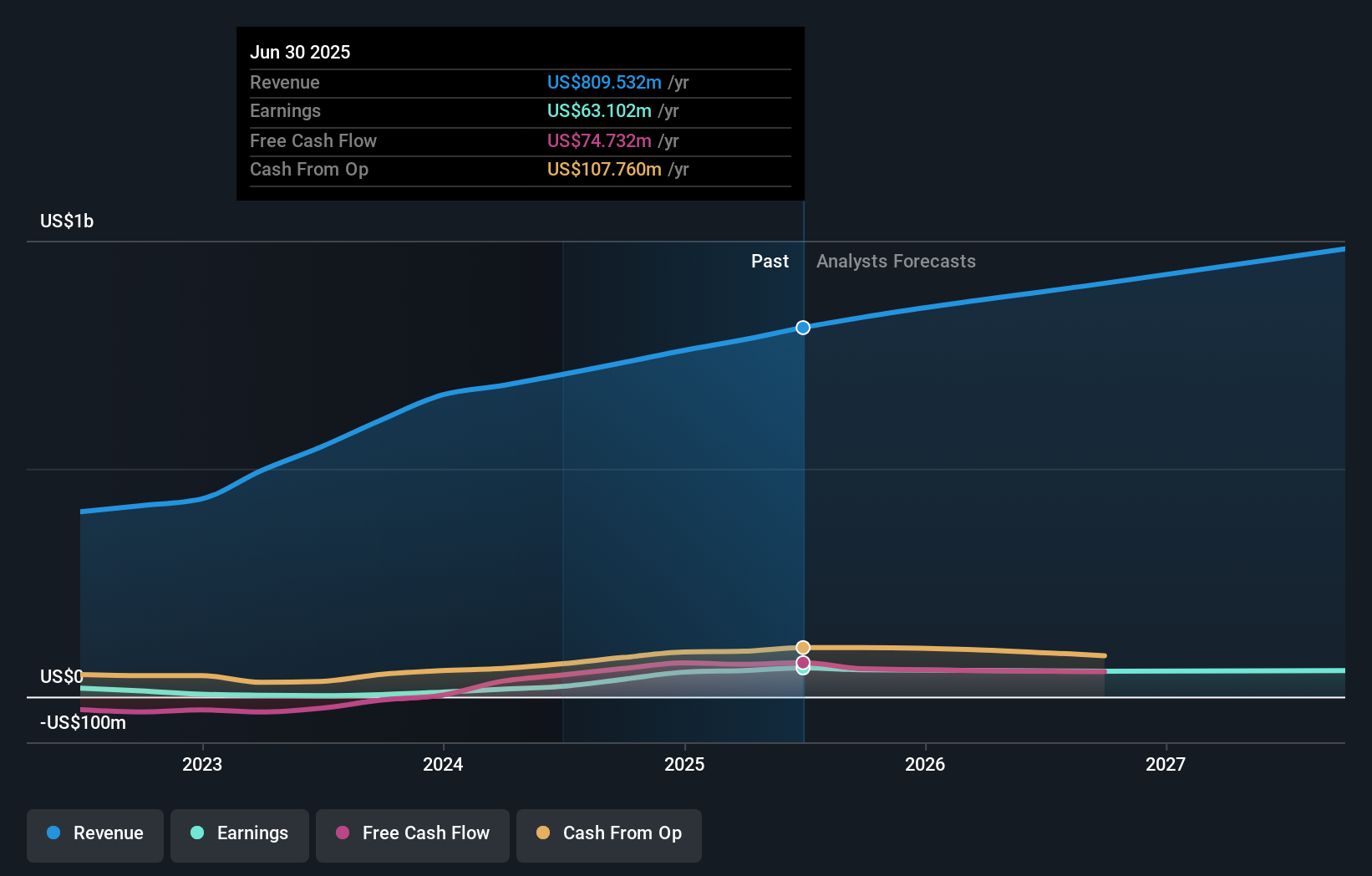

Universal Technical Institute's outlook forecasts $1.0 billion in revenue and $54.0 million in earnings by 2028. This scenario assumes an 8.9% annual revenue growth rate and a $9.1 million decrease in earnings from the current level of $63.1 million.

Uncover how Universal Technical Institute's forecasts yield a $37.60 fair value, a 63% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate UTI’s fair value between US$8.89 and US$37.60, with two diverse viewpoints represented. With ongoing campus expansion efforts, opinions on future returns and risks can differ widely, review a range of these perspectives to deepen your own analysis.

Explore 2 other fair value estimates on Universal Technical Institute - why the stock might be worth less than half the current price!

Build Your Own Universal Technical Institute Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Universal Technical Institute research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Universal Technical Institute research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Universal Technical Institute's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com