- Wondering if Select Medical Holdings is fairly priced, overlooked, or potentially a hidden value? You are not alone, as many investors are eyeing the stock for hints of opportunity.

- Over the past week, Select Medical has jumped 13.4%, building on an 8.4% gain over the last month, even as it remains down 17.6% year to date.

- Recent market excitement has been driven by industry-wide discussions about evolving healthcare regulations and strategic partnerships across the sector. These headlines have nudged sentiment and may explain why Select Medical’s shares have reacted with sharp moves in both directions.

- Right now, the company scores just 2 out of 6 on our core valuation checks. Next, we will break down what that really means using different approaches. Make sure to stick around, because there is a more complete way to understand value that we will reveal at the end of the article.

Select Medical Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Select Medical Holdings Discounted Cash Flow (DCF) Analysis

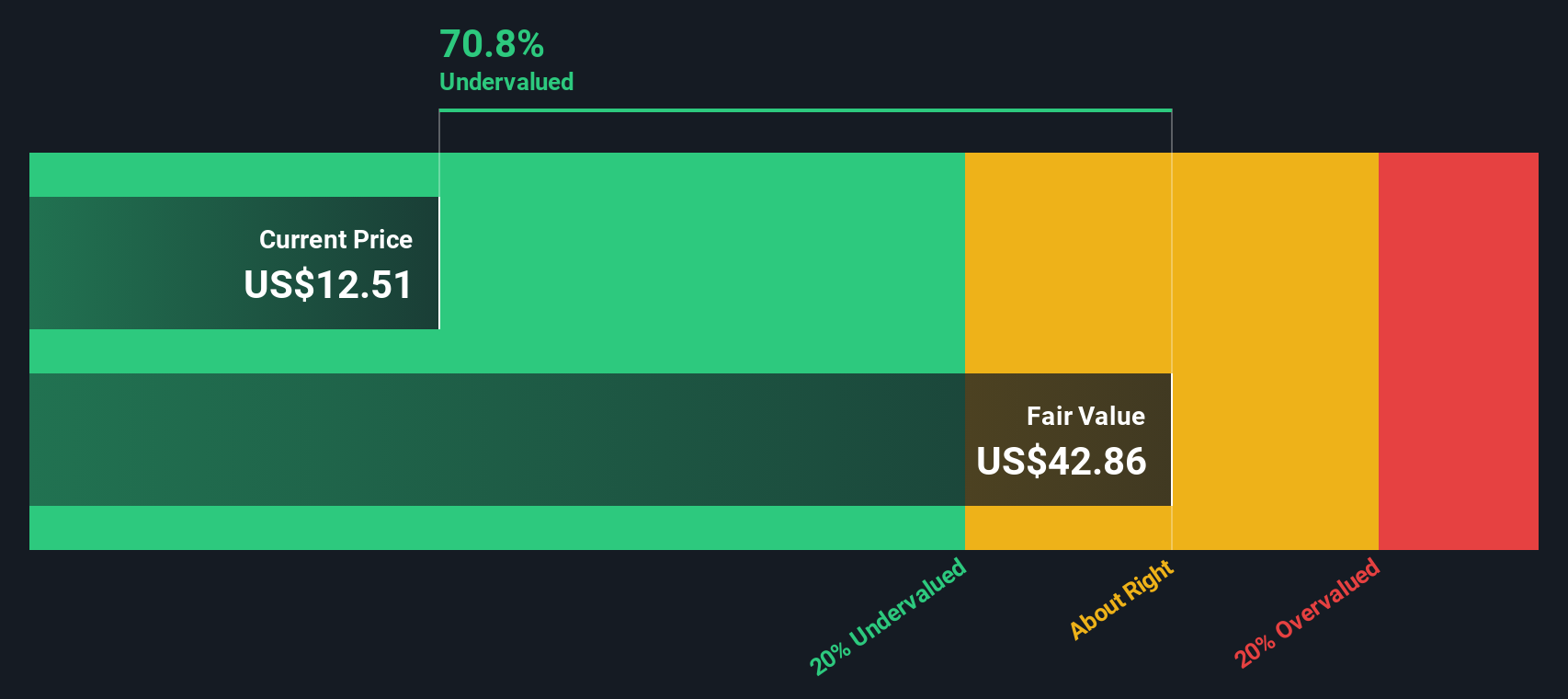

The Discounted Cash Flow (DCF) model evaluates a company's value based on estimates of future cash flows, which are projected over a period of time and then discounted back to today's value using a set rate. For Select Medical Holdings, this approach takes into account both near-term analyst estimates as well as longer-range forecasts extrapolated from available data.

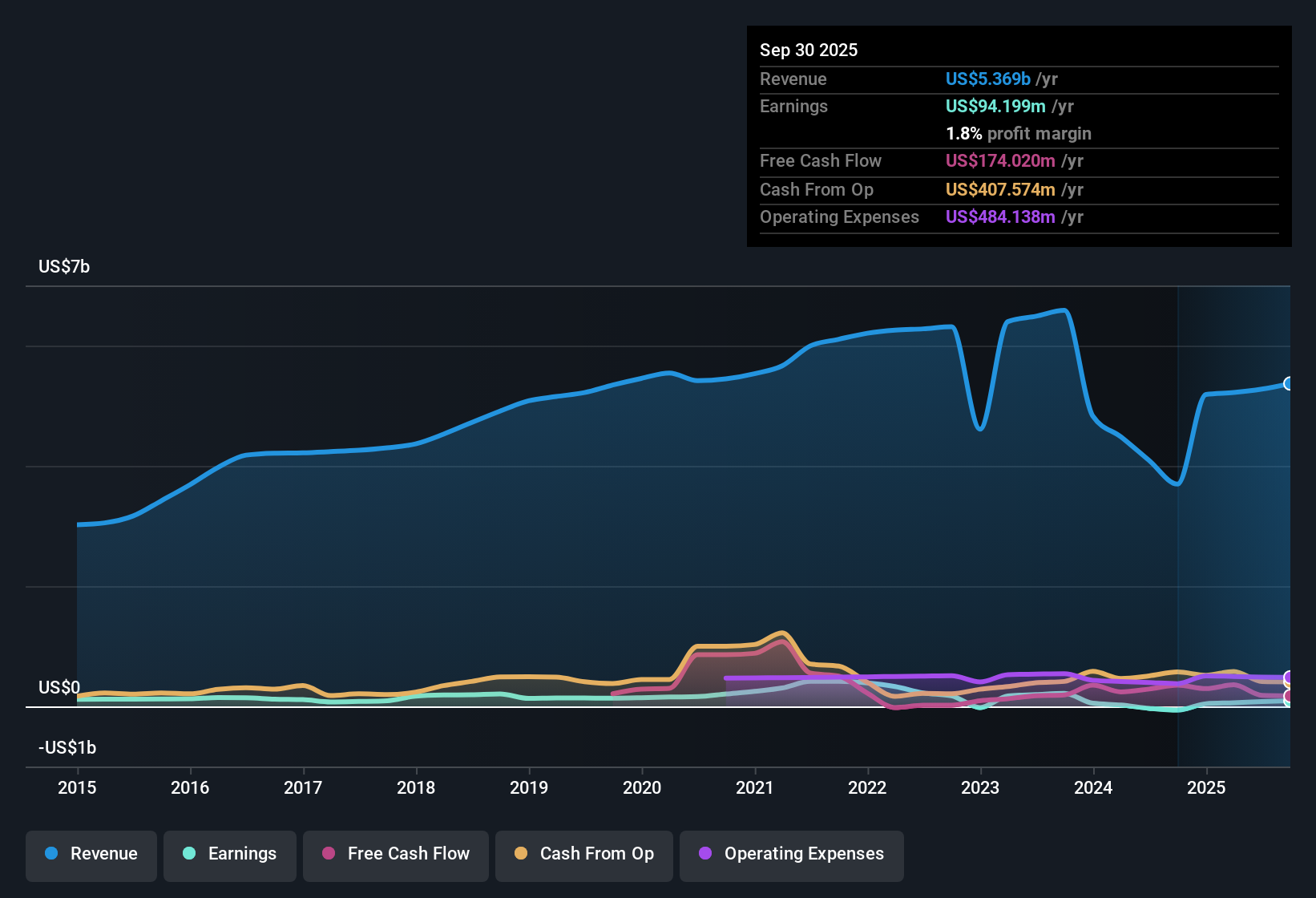

Currently, Select Medical Holdings generates approximately $175 million in free cash flow, all reported in US dollars. The DCF projection suggests future free cash flows may decline significantly over the coming years, with a forecast of about $86 million by 2026 and further decreases in subsequent years, ultimately reaching just under $30 million by 2035.

Based on this model, the estimated intrinsic value of Select Medical Holdings stock is $4.87 per share, which is 218.1% less than its current trading price. This steep discount implies that, according to cash flow forecasts, the stock is overvalued by a substantial margin.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Select Medical Holdings may be overvalued by 218.1%. Discover 920 undervalued stocks or create your own screener to find better value opportunities.

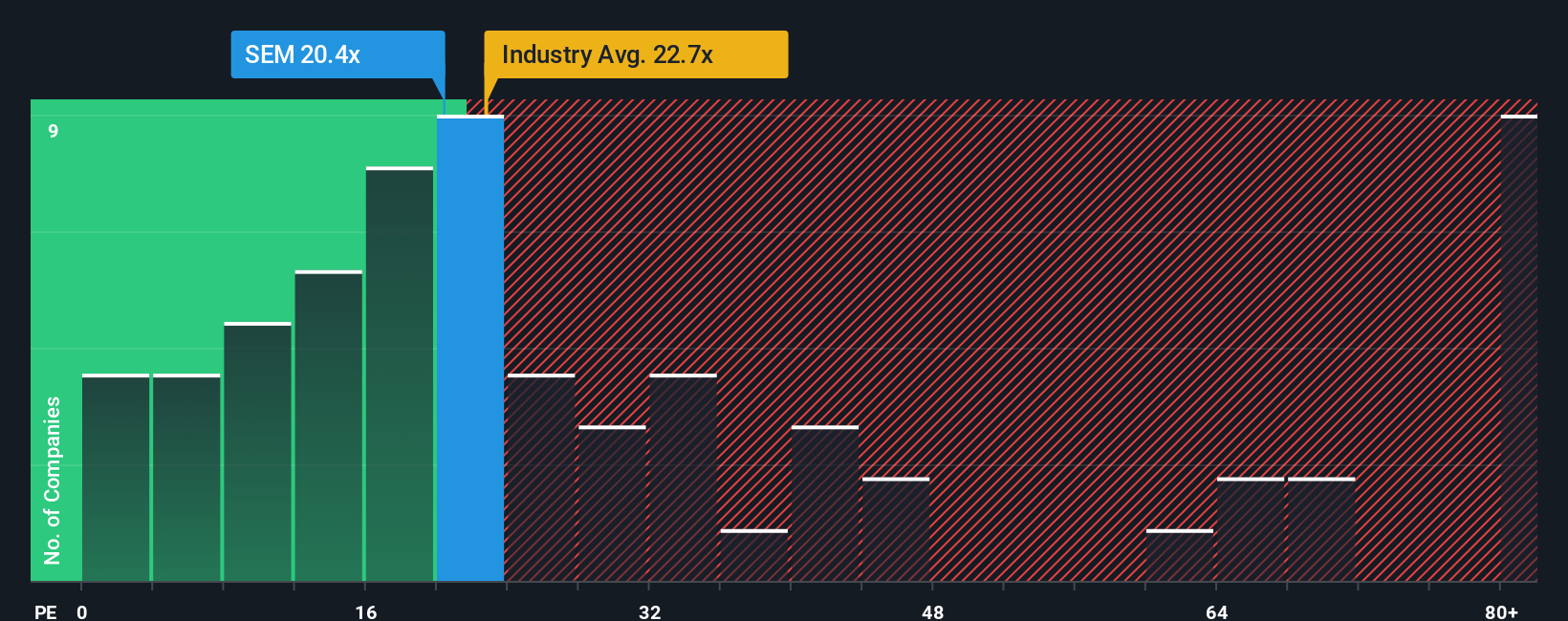

Approach 2: Select Medical Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies because it compares a company’s share price to its earnings, offering a straightforward view of how much investors are willing to pay for each dollar of profit. It is especially meaningful for businesses like Select Medical Holdings that are consistently generating earnings.

Growth expectations and risk play a critical role in determining what a “normal” PE ratio should be. Companies with higher growth prospects or lower risks often attract a premium, reflected in higher multiples. In contrast, lower growth or elevated uncertainty usually results in a discount.

Currently, Select Medical Holdings trades at a PE ratio of 20.3x. When benchmarked, this is lower than the Healthcare industry average of 22.8x and also below the average of its direct peers at 14.8x. However, benchmarks like peers and industry groups do not always consider a company’s specific growth, risk, profit margins, and market cap nuances.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio for Select Medical Holdings stands at 27.4x, representing the multiple appropriate for the company’s unique business profile including its growth outlook, financial strength, industry position, and specific risks. This proprietary figure provides a sharper, more tailored perspective than broad comparisons alone.

Comparing the Fair Ratio against the actual current PE shows that Select Medical Holdings is trading well below its fair value by this measure. This indicates there could be greater upside potential given the current price.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Select Medical Holdings Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story and perspective about a company, a way to link your view of Select Medical Holdings' future revenue, earnings, and margins to a financial forecast, which leads directly to a fair value tailored to your outlook.

This approach makes investing more dynamic and personal by connecting the “why” behind your numbers, so you can clearly lay out whether you think Select Medical Holdings is poised to grow through expansion, faces risks from policy shifts, or sits somewhere in between. Narratives are easy to create and track using the Simply Wall St platform’s Community page, where millions of investors regularly share and update their perspectives.

What makes Narratives especially powerful is that they update automatically as new information arrives. For example, when news breaks or earnings are released, your fair value and forecast-based story are updated in real time, helping you make better investment decisions by always comparing your own Fair Value to the company’s latest Price.

For Select Medical Holdings, one investor might believe its patient volume expansion and operational improvements justify a bullish fair value of $21.0 per share, while another might focus on regulatory and margin pressures and adopt a more cautious $14.0 per share. Narratives make both views transparent and actionable for smarter investing.

Do you think there's more to the story for Select Medical Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com