Aspen Insurance Holdings (AHL) stock has seen modest moves lately as investors weigh steady revenue growth of 3% and an annual net income uptick near 10%. Shares recently closed at $36.97.

See our latest analysis for Aspen Insurance Holdings.

After steadily climbing since the start of the year, Aspen Insurance Holdings now trades at $36.97, reflecting a year-to-date share price return of 13.75%. This upward momentum suggests investors are warming to its earnings growth and stable outlook.

If you’re interested in what else might be gathering momentum, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

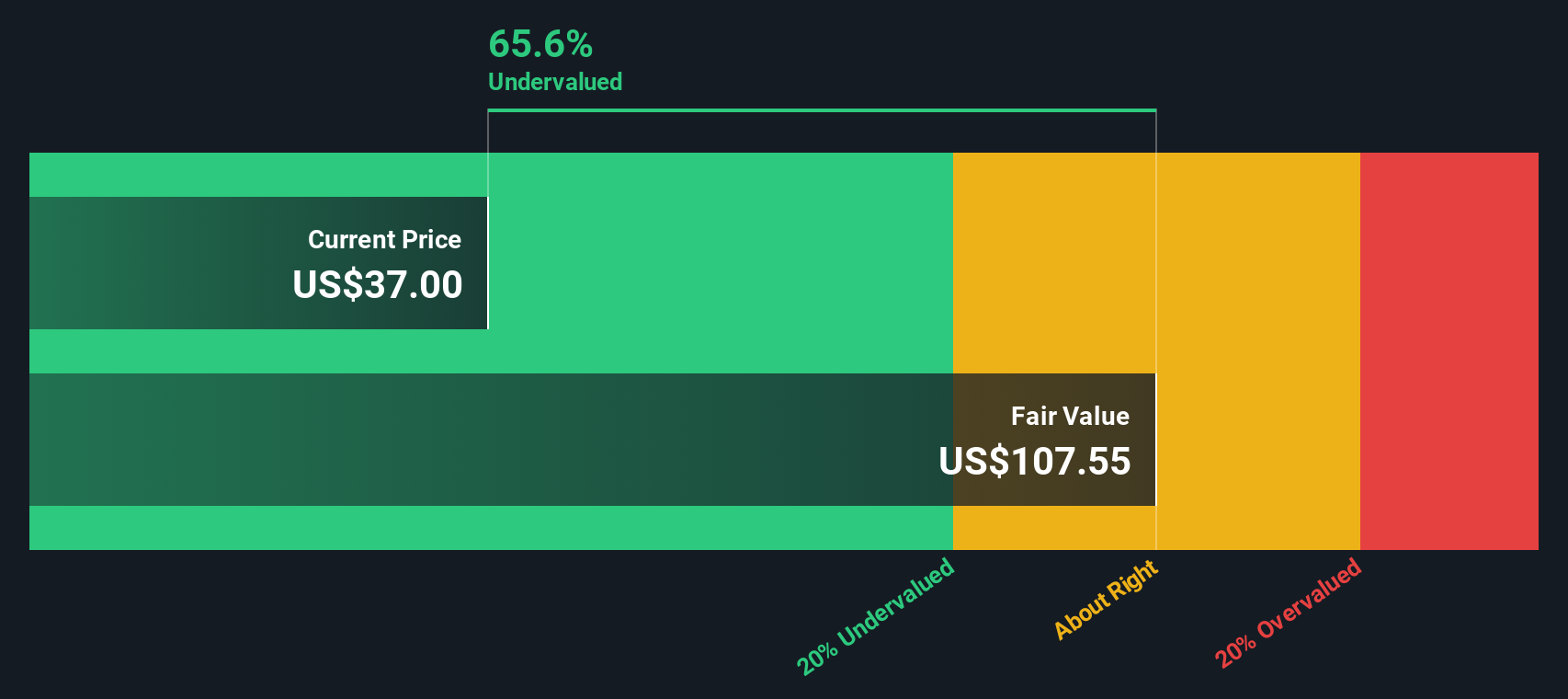

With recent gains fueled by steady results, some investors are asking whether Aspen Insurance Holdings remains undervalued or if its latest rally simply reflects markets catching up to the company's potential. Is there still a buying opportunity, or has future growth already been priced in?

Price-to-Earnings of 8.5x: Is it justified?

Aspen Insurance Holdings is trading at a price-to-earnings ratio of 8.5x, well below both its peers and the broader industry. At a recent close of $36.97, this suggests the stock may be flying under the market’s radar.

The price-to-earnings ratio compares a company’s share price to its per-share earnings, providing a quick gauge of how the market values its profitability. For insurers, this metric is a go-to barometer for investors seeking value among established businesses.

At 8.5x, Aspen Insurance Holdings has a lower price-to-earnings ratio than the industry’s 13.2x average and the peer group’s 11.2x. This signals that the market may not be fully factoring in the company’s recent growth in profits and high-quality earnings. In addition, the company’s own fair price-to-earnings ratio estimate stands at 12.8x, which may indicate potential for re-rating if fundamentals continue to hold up.

Explore the SWS fair ratio for Aspen Insurance Holdings

Result: Price-to-Earnings of 8.5x (UNDERVALUED)

However, risks remain, such as potential shifts in global insurance markets and unforeseen underwriting losses. These factors could impact future earnings momentum for Aspen Insurance Holdings.

Find out about the key risks to this Aspen Insurance Holdings narrative.

Another View: What Does the SWS DCF Model Say?

While Aspen Insurance Holdings’ price-to-earnings ratio points to undervaluation, the SWS DCF model offers a strikingly different perspective. According to this cash flow-based approach, AHL’s fair value is estimated to be much higher than its current share price. This suggests there may be room for a significant re-rating. The key question is whether the market believes these future cash flows can be realized.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aspen Insurance Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 932 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aspen Insurance Holdings Narrative

If you have a different perspective or want to dig deeper into the numbers, you can easily craft your own view on Aspen Insurance Holdings in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Aspen Insurance Holdings.

Looking for more investment ideas?

Don’t limit your opportunities to just one company. Act now and use the Simply Wall Street Screener to unlock hidden gems and promising performers in today’s market.

- Uncover the next wave of medical breakthroughs by checking out these 30 healthcare AI stocks, making strides in healthcare innovation and artificial intelligence.

- Boost your passive income by selecting from these 15 dividend stocks with yields > 3%, with consistently attractive yields and strong fundamentals.

- Ride the growth of digital assets with these 82 cryptocurrency and blockchain stocks, capitalizing on advances in decentralized finance and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com