Element Solutions (NYSE:ESI) revealed two major moves this week: announcing a new quarterly cash dividend and reaching an agreement in principle for a $450 million add-on to its senior secured term loan due 2030. Together, these updates have investors’ attention.

See our latest analysis for Element Solutions.

Element Solutions has seen momentum shifting gears this year. The 7-day share price return was over 7%, reflecting enthusiasm around recent updates. Its total shareholder return over the past year remains negative at -7.8%. Over three and five years, long-term holders have enjoyed total returns of 37.7% and 92.1%, respectively. This points to the company’s history of positive long-term performance, even as short-term results fluctuate.

If you’re interested in seeing which other companies are showing strong growth alongside insider confidence, now’s a great time to discover fast growing stocks with high insider ownership

With Element Solutions posting accelerating growth and trading at a substantial discount to both analyst targets and intrinsic value, is there a buying opportunity here, or has the market already priced in the company’s future momentum?

Most Popular Narrative: 19.3% Undervalued

Element Solutions’ most widely-followed valuation puts fair value at $32.10, well above the last close of $25.91. This sets up a valuation thesis that hinges on the company's ability to drive margin expansion and recurring profitability.

Continued portfolio optimization, evidenced by divestitures of lower-margin businesses, strategic acquisition activity, and a shift toward B2B and high-growth end markets, should structurally shift sales mix toward value-added products. This supports margin expansion and stronger recurring profitability.

Curious what’s behind this bullish view? There is a precise growth plan, aggressive margin targets, and an earnings leap at the center of this calculation. The secrets to this fair value are in the narrative. Read on to discover the bold financial drivers analysts are betting on.

Result: Fair Value of $32.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro uncertainty or a slowdown in key markets like electronics and autos could quickly challenge Element Solutions' positive growth narrative.

Find out about the key risks to this Element Solutions narrative.

Another View: Relative Value Raises Caution

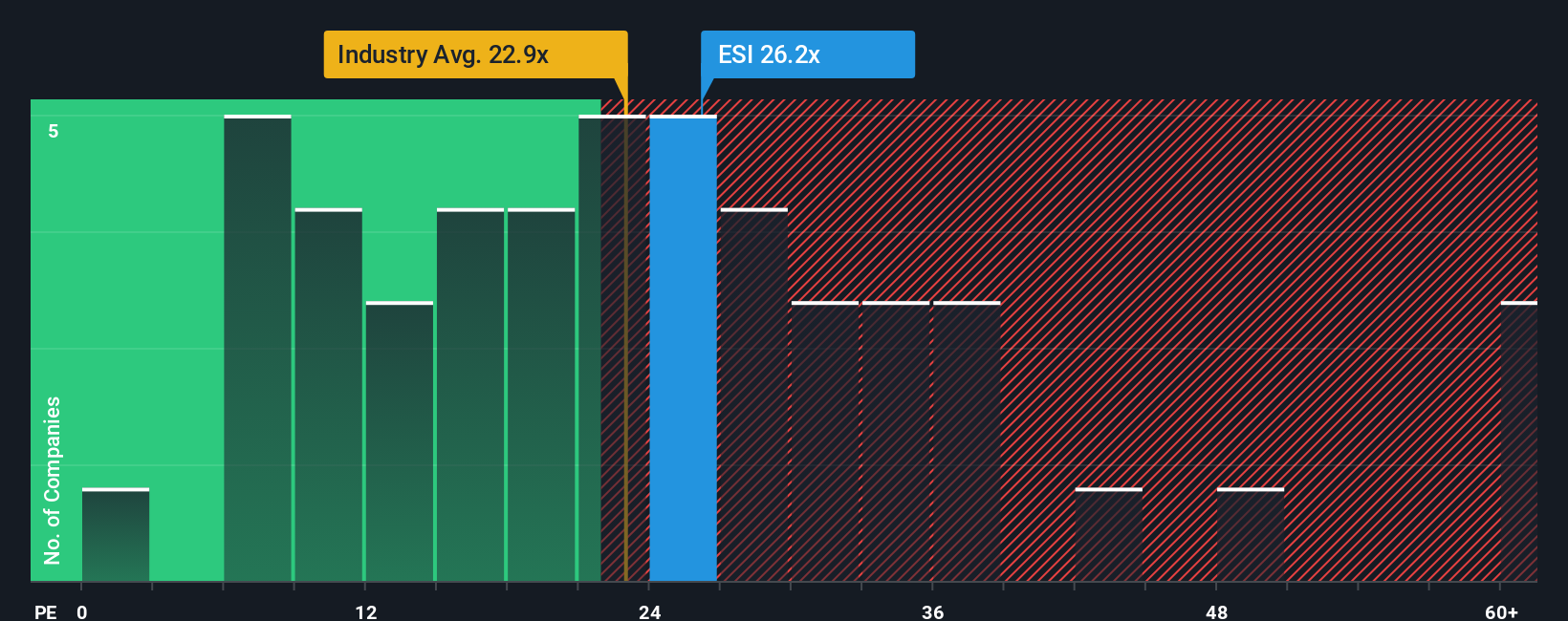

While some see Element Solutions as undervalued based on future growth, its price-to-earnings ratio paints a different picture. The company trades at 26.2x earnings, much higher than the US Chemicals industry average of 22.7x and above its fair ratio of 22x. This suggests the market may be pricing in elevated expectations, adding risk if growth does not deliver. Will the premium prove justified, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Element Solutions Narrative

If you want to see the numbers for yourself or prefer to draw your own conclusions, you can easily craft your own research-based narrative in just a few minutes, and Do it your way

A great starting point for your Element Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your strategy to a single opportunity when smart money is moving across multiple market frontiers. Take action with these powerful screeners before major trends leave you behind.

- Uncover hidden, high-growth opportunities by scanning these 3579 penny stocks with strong financials that bring financial muscle to market at bargain entry points.

- Catch game-changing breakthroughs with these 25 AI penny stocks as artificial intelligence reshapes industries and profits for the bold can emerge rapidly.

- Secure stable passive income by targeting these 15 dividend stocks with yields > 3% with healthy yields and a proven record of rewarding their investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com