Zebra Technologies (ZBRA) shares have seen notable swings over the past month, losing nearly 19%. Investors are closely watching company fundamentals and broader tech trends to gauge where the stock could move next.

See our latest analysis for Zebra Technologies.

Zooming out, Zebra Technologies’ 1-year total shareholder return stands at -38.3%, reflecting persistent pressure despite occasional short-term rebounds such as last week’s 8.5% share price recovery. Recent momentum has faded after a steep drop this month, which suggests investors remain cautious about the company’s outlook and valuation.

If you’re on the hunt for potential growth stories beyond tech hardware, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

The key question facing investors now is whether Zebra Technologies’ recent valuation slide makes for an attractive entry point or if the current share price already reflects future growth potential, leaving little room for upside.

Most Popular Narrative: 30.1% Undervalued

The most widely followed narrative places Zebra Technologies’ fair value at $358.47, which is significantly above the recent closing price of $250.50. This notable gap has drawn both scrutiny and optimism as investors debate whether such a valuation is justified by expected growth and operational improvements.

The accelerating shift toward automation, digital transformation, and real-time workflow optimization, driven by ongoing labor shortages, e-commerce expansion, and increased supply chain demands, continues to fuel robust demand for Zebra's portfolio (hardware, software, RFID, machine vision). This supports sustained revenue growth and long-term earnings visibility.

What is the math behind this bold fair value? The heart of the narrative is a profit and growth forecast that relies on revenue expansion, rising margins, and ambitious future earnings multiples. Want the specific quantitative leaps analysts are betting on? See which projections drive the biggest valuation upside in the full narrative.

Result: Fair Value of $358.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering concerns around tariffs and slow software growth could challenge the bullish outlook if cost pressures continue or recurring revenue does not accelerate.

Find out about the key risks to this Zebra Technologies narrative.

Another View: What Do Market Ratios Suggest?

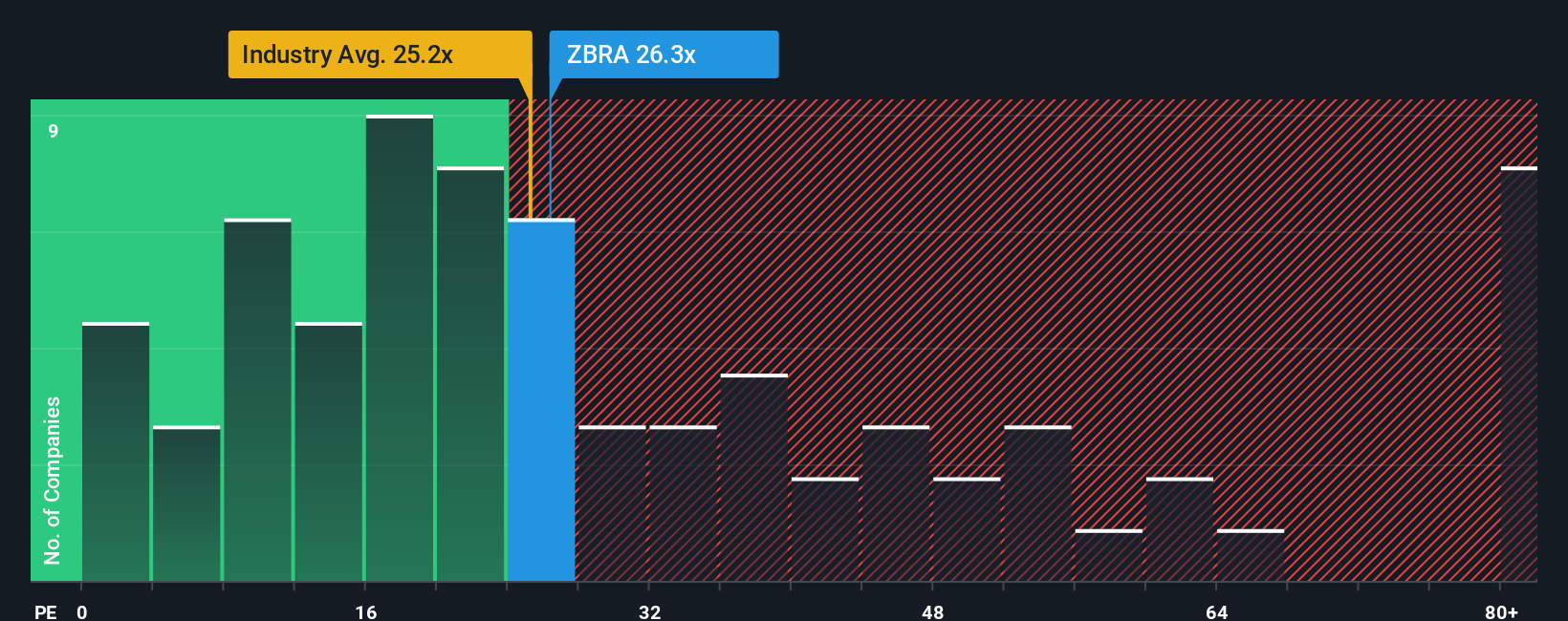

Taking a closer look at the price-to-earnings ratio, Zebra Technologies trades at 24.8x, just above the US Electronic industry average of 24.6x but far below the peer average of 48.8x. At the same time, it sits well beneath its fair ratio of 32.1x, indicating solid comparative value. Could a shift toward this fair ratio unlock greater upside, or does the current gap signal possible risks still ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zebra Technologies Narrative

If you want to dig deeper or see the story from a new perspective, you can quickly craft your own valuation view in minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Zebra Technologies.

Looking for More Investment Ideas?

Don’t let the next market leader pass you by. Supercharge your portfolio by branching out to new sectors and smart investment opportunities with these top picks from our screener:

- Maximize your search for potential bargains by scanning these 927 undervalued stocks based on cash flows with strong fundamentals and attractive cash flow potential.

- Tap into game-changing technologies and explore the AI trend by uncovering these 25 AI penny stocks that are driving innovations across industries.

- Grow your passive income streams with these 15 dividend stocks with yields > 3%, featuring companies with yields above 3% and the financial strength to support consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com