- Recently, Jim Cramer publicly voiced support for Super Group (SGHC), highlighting the company's global online sports betting and gaming operations, shortly after the company raised its full-year revenue and adjusted EBITDA guidance.

- This combination of favorable analyst commentary and upgraded financial projections underscores growing management confidence and increased visibility for Super Group’s business outlook.

- We’ll explore how the company’s raised outlook may influence analyst assumptions around long-term earnings growth and market expansion.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Super Group (SGHC) Investment Narrative Recap

To be a shareholder in Super Group (SGHC), you need confidence in the long-term growth of global online sports betting and gaming, as well as the company’s ability to adapt amid shifting regulatory and competitive challenges. While Jim Cramer’s public support and Super Group’s upgraded guidance have increased short-term visibility, this doesn’t materially alter the primary catalyst, which remains the company’s push into new markets, or the main risk tied to regulatory tightening in major regions.

The company’s recent upward revision of its full-year revenue and adjusted EBITDA guidance on November 3, 2025, is especially relevant. This announcement supports management’s growing confidence and was followed by earnings results showing increased revenue and profitability, signals that near-term financial momentum may be improving, even as the business continues to manage regional risks.

In contrast, investors should also pay attention to the ongoing risk of tightening marketing and regulatory restrictions in certain geographies that could...

Read the full narrative on Super Group (SGHC) (it's free!)

Super Group (SGHC)'s outlook suggests revenues will reach $2.6 billion and earnings will grow to $453.0 million by 2028. This is based on a projected annual revenue growth rate of 10.3% and an earnings increase of $316.8 million from current earnings of $136.2 million.

Uncover how Super Group (SGHC)'s forecasts yield a $18.00 fair value, a 65% upside to its current price.

Exploring Other Perspectives

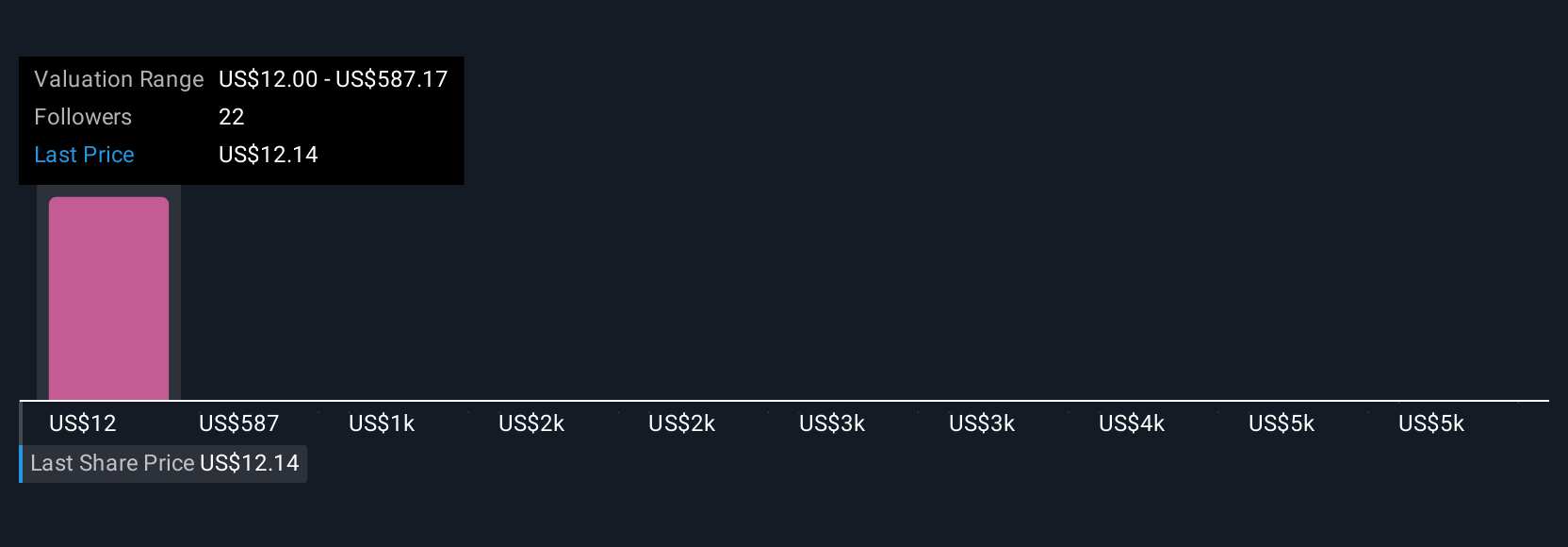

Four distinct fair value estimates from the Simply Wall St Community range from US$12 to US$5,763.67. The current focus on expanding into new, high-growth regions highlights why market participants evaluate Super Group’s potential so differently.

Explore 4 other fair value estimates on Super Group (SGHC) - why the stock might be worth just $12.00!

Build Your Own Super Group (SGHC) Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Super Group (SGHC) research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Super Group (SGHC) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Super Group (SGHC)'s overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com