Marzetti (MZTI) just announced its 63rd consecutive year of raising its quarterly cash dividend. Shareholders are set to receive $1.00 per share next month. The company also filed a $255 million shelf registration related to an ESOP stock offering.

See our latest analysis for Marzetti.

Marzetti’s streak of dividend hikes comes as its share price has seen moderate ups and downs over the year, with a recent dip following news of the shelf registration and ESOP offering. Over the past year, total shareholder return stands at -8.3%, while the longer-term five-year total return remains positive. This suggests that recent momentum has faded even as the company continues to prioritize both investors and growth initiatives.

If Marzetti’s renewed focus on rewarding shareholders has you thinking about broader opportunities, it could be the perfect time to discover fast growing stocks with high insider ownership

With the stock now trading nearly 18% below analyst targets and a recent history of mixed total returns, the question is whether Marzetti’s current price leaves room for upside or if future growth is already reflected in the market.

Most Popular Narrative: 16% Undervalued

Marzetti’s most followed narrative sees the company’s fair value far ahead of its latest closing price, hinting at a possible disconnect between expectations and reality. The crowd is watching accelerating profit margins and strategic moves as key drivers, and there is plenty more beneath the surface.

“Strategic focus on optimizing the supply chain, through the closure of higher-cost facilities, ramp-up of the new Atlanta plant, and ongoing productivity initiatives, is set to provide meaningful cost savings, driving operating margin improvement and supporting higher overall profitability.”

Want to know what’s powering this optimistic view? The narrative hinges on ambitious projections for higher earnings and stronger margins, a scenario that is becoming increasingly rare in this sector. How does Marzetti plan to deliver these results, and what aggressive financial assumptions are shaping its fair value? Unlock the full picture and see which numbers are tipping the scale.

Result: Fair Value of $199 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising input costs and shifting consumer demand toward fresh, clean-label foods could challenge Marzetti’s ability to deliver on these optimistic projections.

Find out about the key risks to this Marzetti narrative.

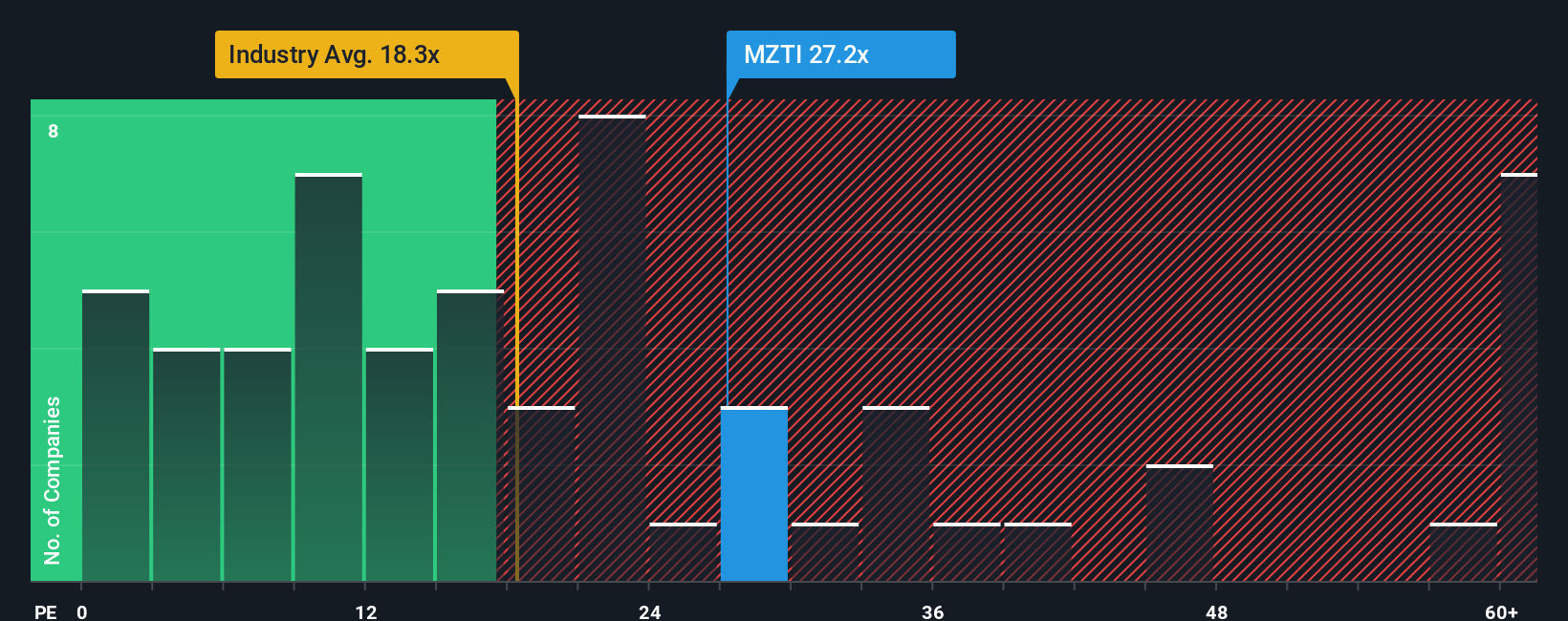

Another View: Market Multiples Raise Valuation Questions

Looking beyond the optimistic fair value, Marzetti’s current price-to-earnings ratio of 27.1 is notably higher than both its industry peers at 15.1 and the broader US Food sector at 20.7. This suggests a premium and places the ratio above the fair value of 15.4, leaving less margin for error if growth falters. Is the market pricing in too much optimism, or is there still value to be found here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marzetti Narrative

If you want to look deeper, compare the facts for yourself, or even chart a different course, making your own Marzetti narrative is quick and easy: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Marzetti.

Looking for More Investment Ideas?

Take charge of your portfolio. Don’t let unique opportunities pass you by when you can uncover fresh themes and strong growth across different sectors right now.

- Reimagine your returns with these 15 dividend stocks with yields > 3% for reliable income streams from companies boasting yields above 3%.

- Get ahead of the curve and ride the innovation wave by analyzing these 25 AI penny stocks powering breakthroughs in artificial intelligence.

- Secure potential bargains with these 927 undervalued stocks based on cash flows based on robust cash flow analysis, offering hidden value others might miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com