Everest Group (NYSE:EG) has announced that Elias Habayeb, who brings decades of experience at Corebridge Financial and American International Group, will become its new Chief Financial Officer in May 2026. The transition follows the retirement of current CFO Mark Kociancic, and investors are now watching to see how this move could influence Everest Group’s financial strategy in the future.

See our latest analysis for Everest Group.

Despite a flurry of leadership changes and the strategic divestment of its commercial retail insurance business, Everest Group’s share price return has struggled recently. The stock has slipped 14.7% year-to-date, resulting in a one-year total shareholder return of -18.7%. Momentum has faded compared to its strong long-term record. However, ongoing shifts in the executive team suggest the company is actively positioning itself for future growth and operational discipline.

If you’re keeping an eye out for standout opportunities across the market, now is a practical time to broaden your watchlist and see what you find among fast growing stocks with high insider ownership.

After a year of underperformance and a leadership shakeup, does Everest Group’s depressed share price point to an undervalued insurer with upside ahead, or is the market already accounting for potential growth from new management?

Most Popular Narrative: 17.2% Undervalued

Everest Group’s latest fair value estimate stands well above the last close price, suggesting room for upside if narrative projections play out as expected. This estimate is grounded in forward-looking assumptions and factors impacting future profitability, not just the company’s recent challenges.

The hard reinsurance and specialty insurance market, characterized by disciplined terms, attractive risk-adjusted returns, and high entry barriers, positions Everest Group, given its capital strength and capability, to capture above-market premium growth and maintain resilient net margins and earnings, even as industry cycles evolve.

What’s the secret behind this fair value? Tighter margins, bold profit forecasts, and a profit multiple that could rival any sector out there. Want to know exactly which assumptions and which numbers are moving the needle in this valuation? Click through to see the key reasons driving this bullish estimate.

Result: Fair Value of $374.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Everest’s deepening exposure to natural catastrophes and lingering reserve volatility could quickly undermine bullish outlooks if sector headwinds become more pronounced.

Find out about the key risks to this Everest Group narrative.

Another View: Market Ratios Challenge the Undervaluation Case

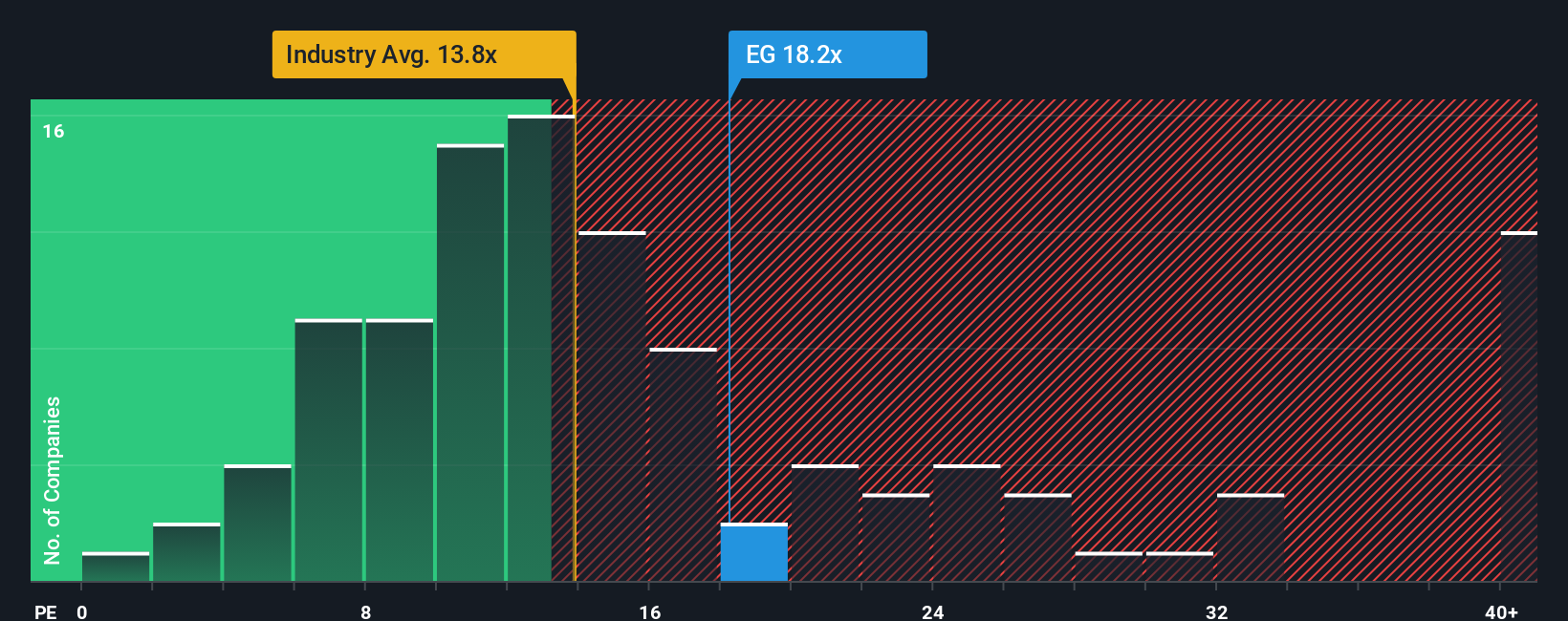

Taking a different approach, Everest Group trades at 23.8 times earnings, which is notably higher than both the US Insurance industry average of 13.2x and the peer average of 11.7x. While its fair ratio is estimated at 33.2x, this premium over competitors could signal valuation risk if growth falters. Is the company truly undervalued, or does the current price reflect cautious optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Everest Group Narrative

If you’d rather dig into the numbers yourself or want to weigh in with your analysis, it’s easy to craft your own story about Everest Group in just a few minutes, so Do it your way.

A great starting point for your Everest Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Supercharge your portfolio now by finding dynamic growth sectors and hidden gems you might otherwise overlook.

- Unleash the full potential of passive income and check out these 14 dividend stocks with yields > 3% with yields above 3%.

- Target untapped value and scoop up bargains among these 924 undervalued stocks based on cash flows fueled by real, cash flow-based fundamentals.

- Ride the cutting edge of healthcare innovation and pursue gains with these 30 healthcare AI stocks leading medical breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com